Chinese EV battery nickel consumption is declining

Globally, 103.1 kilotonnes of nickel were deployed onto roads in electrified passenger vehicles sold January through April 2025, representing a 14% increase over the same four months in 2024.

The relatively modest growth in nickel consumption compares to over 30% expansion of the combined lithium contained in the batteries of newly sold EVs over the same period and is primarily a function of increasing adoption of nickel-free cathode chemistries.

Global penetration of EVs powered by lithium iron phosphate batteries sped to a new monthly record of 46% on a capacity deployed basis in April this year. That’s up from less than 1% in January 2020.

Despite a healthy rebound in Europe this year and steady growth in the Americas, regions where high-nickel batteries dominate, the outsize role of China on global EV market trends continues to dent battery nickel’s prospects.

Indeed, on an absolute basis nickel consumption in China is shrinking despite a 39% jump in overall battery metal demand (graphite, lithium, iron, phosphorous, manganese, cobalt, aluminum and rare earth).

LFP chemistries now represent 69% of Chinese battery metal consumption and mid-nickel packs a further 17% of the total 409.4 kt from January through April.

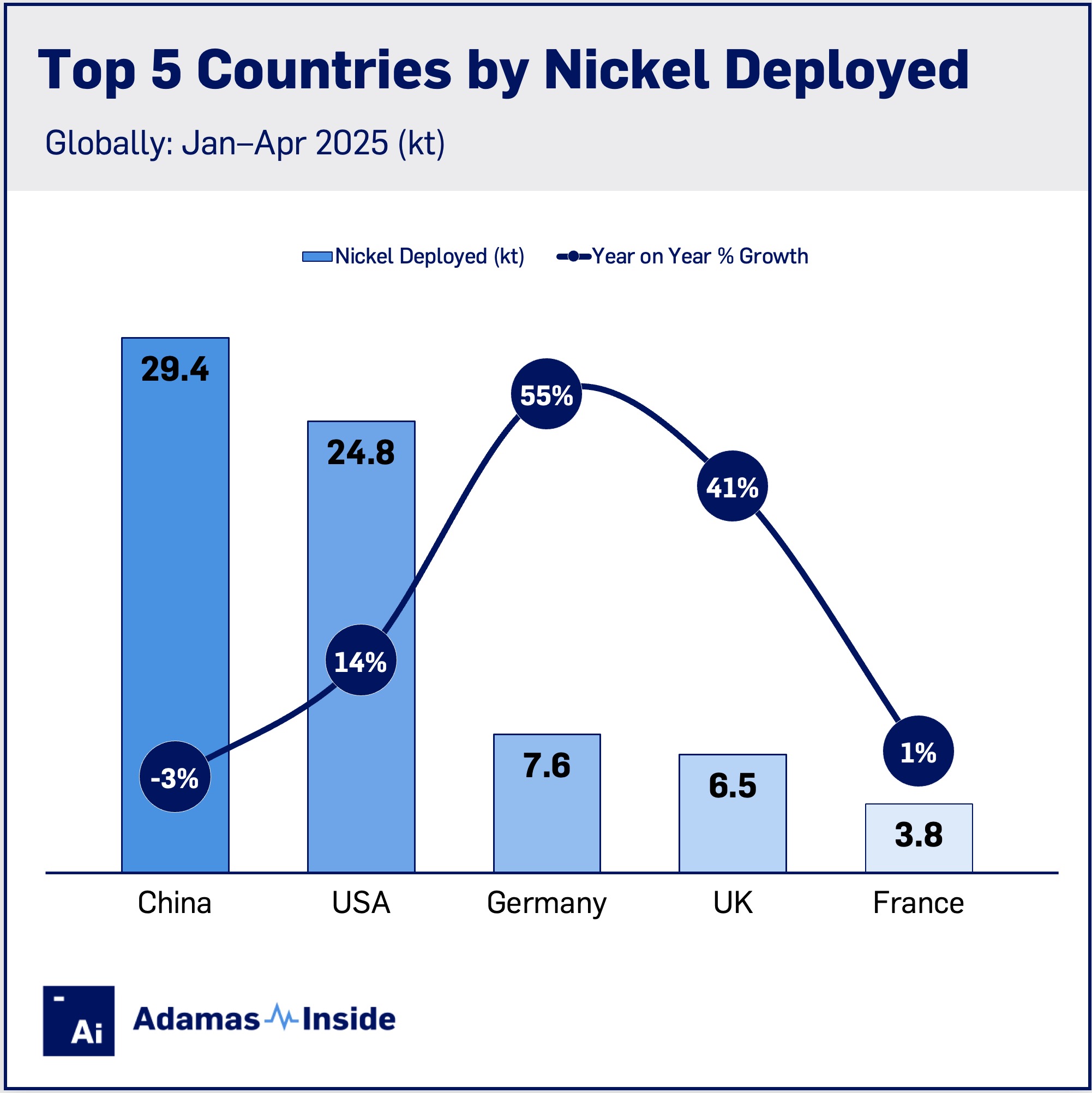

Over the first four months of 2025 nickel deployment in China reached 29.4 kt, down 3% from last year. In the US, nickel deployment increased by 14%, reaching 24.8 kt. In Germany, it surged by 54%, amounting to 7.6 kt.

The UK, currently the fourth-largest market for nickel deployment in 2025, exhibited robust growth with a 41% increase to 6.5 kt. In contrast, France, ranking fifth, has experienced a weak performance this year, recording a marginal increase of less than 1%, bringing its total to 3.8 kt.

The divergence in nickel demand between China and its four closest competitors (which collectively account for 42.7 kt) is particularly pronounced. This disparity is further underscored by the fact that China’s year-to-date battery capacity deployed, a good indicator of overall battery metals demand, surpasses twice the combined capacity of these competitors.

Contact the Adamas team to learn more or check out the intelligence services below.