After years lagging, full electric EV growth overtakes plug-ins

Over the first eight months of 2025, 648.5 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 28% more than the same period last year.

Full electric vehicles (BEVs) accounted for 82% of the total, or 529.0 GWh, while the share of plug-in hybrid electric vehicles (PHEVs) was 17%, at 113.2 GWh. The share of conventional hybrids or HEVs remained at 1% thanks to sales weighted average battery sizes that seldom exceed 2 kWh.

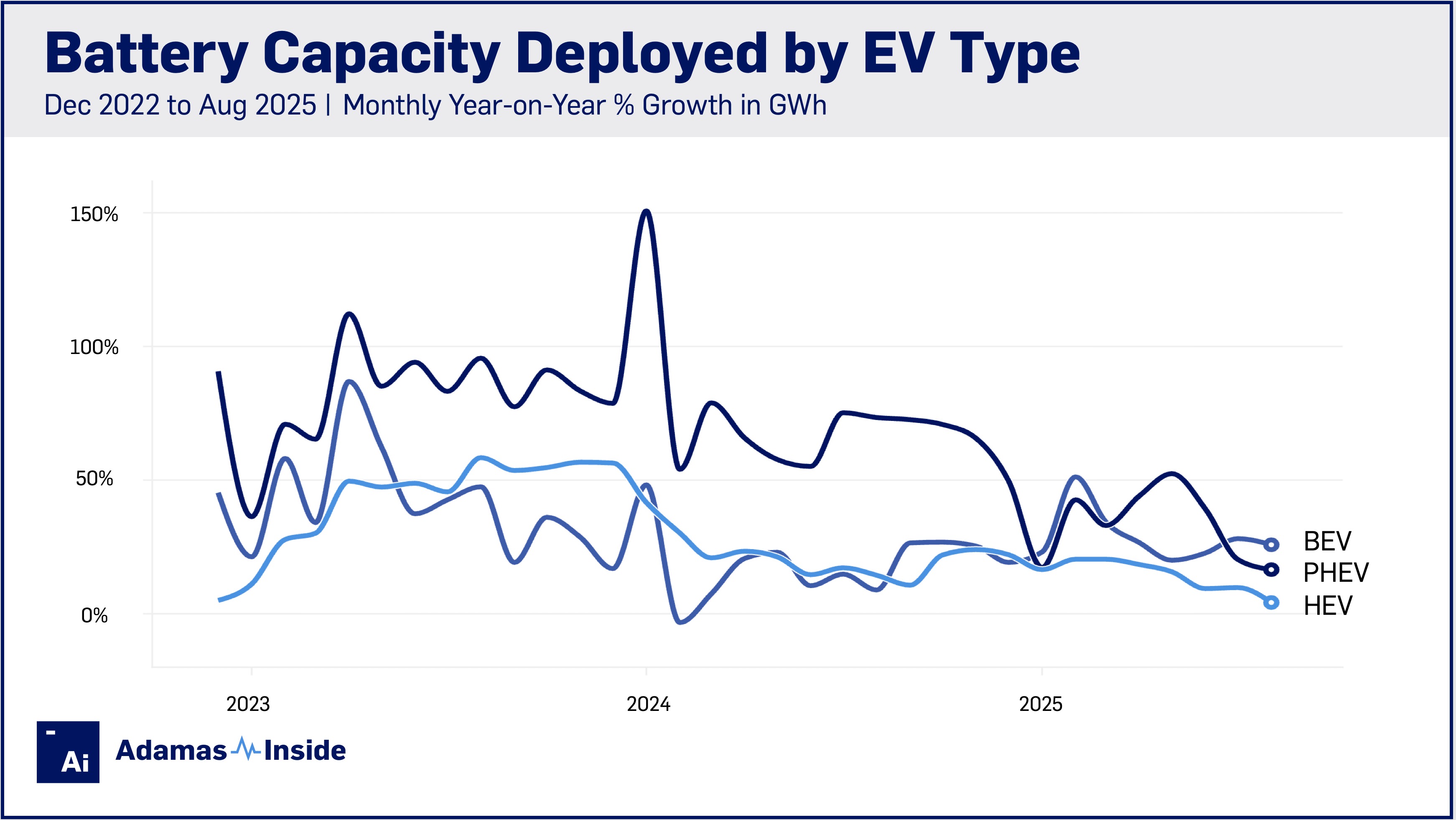

Since 2002, BEV global battery capacity deployment growth has lagged that of PHEVs. The latter started from a lower base and often expanded at more than double the rate, but now that trend is beginning to reverse. BEV battery capacity deployment growth first surpassed that of PHEVs in January and exceeded it for five of the last eight months.

Year to date BEV expansion of 28% on a GWh basis still came behind that of PHEVs (+32%), but BEV unit sales growth (up 31% to 8.5m units) from January through August has overtaken that of PHEVs (up 29% to 4.7m).

One of the reasons why the combined PHEV battery capacity deployed still has an edge over BEVs is that buyers are still opting for PHEVs with larger battery sizes, such as those found in EREVs (where the combustion engine serves only to recharge the battery).

For the first eight months of the year, the average BEV battery size was 62.4 kWh, down 2% while PHEV packs increased by 3% to a sales weighted average of 24.2 kWh. That said, the trend of bigger and bigger batteries for both BEVs and PHEVs is also leveling off.

Other factors, such as changing EV incentives (in Europe, PHEVs are mostly not eligible for retail-level subsidies) and the release of new EV models, also impact averages.

Xiaomi’s SU7 sports sedan has become a spectacular success story, and early signs indicate that the mobile phone maker’s YU7 SUV will also turn into a best-seller. While these beefy, high-end vehicles play a part in keeping average sizes afloat, naturally, the introduction of popular baby BEVs can have the opposite effect.

For instance, the base model Geely Xingyuan, which retails for under $10,000 sports a battery pack of just over 30 kWh. The urban runabout, available only in China, is now the second most sold BEV worldwide, wedging between Tesla Model Y and Model 3 in only its first year on the market.

The Xingjuan compares to the Li Auto L6 EREV launched in April last year which has become the number two selling PHEV of 2025 worldwide behind the BYD Song Pro plug-in. The L6 has a 36.8 kWh battery pack. The second most popular EREV, the Wenjie M8 in the Seres Group stable, takes it up another notch up at 52.0 kWh, doing its part to lift PHEV battery capacity deployment.

The rise of the EREVs is almost entirely a Chinese phenomenon, and 28% of plug-ins leaving the country’s showrooms so far in 2025 were range extenders. On a battery capacity deployed basis, EREVs now make up 42% of the PHEV total in China and a third worldwide, with 36.3 GWh hitting roads for the first time.

A handful of EREVs are going on sale outside China in the near future led by the Ramcharger pickup and the Jeep Grand Wagoneer in the US followed by BMW’s as yet unconfirmed iX5 REx. It a belated return to this EV type by the German automaker – the company launched its i3 EREV hatchback as long ago as 2013.

Contact the Adamas team to learn more or check out the intelligence services below.