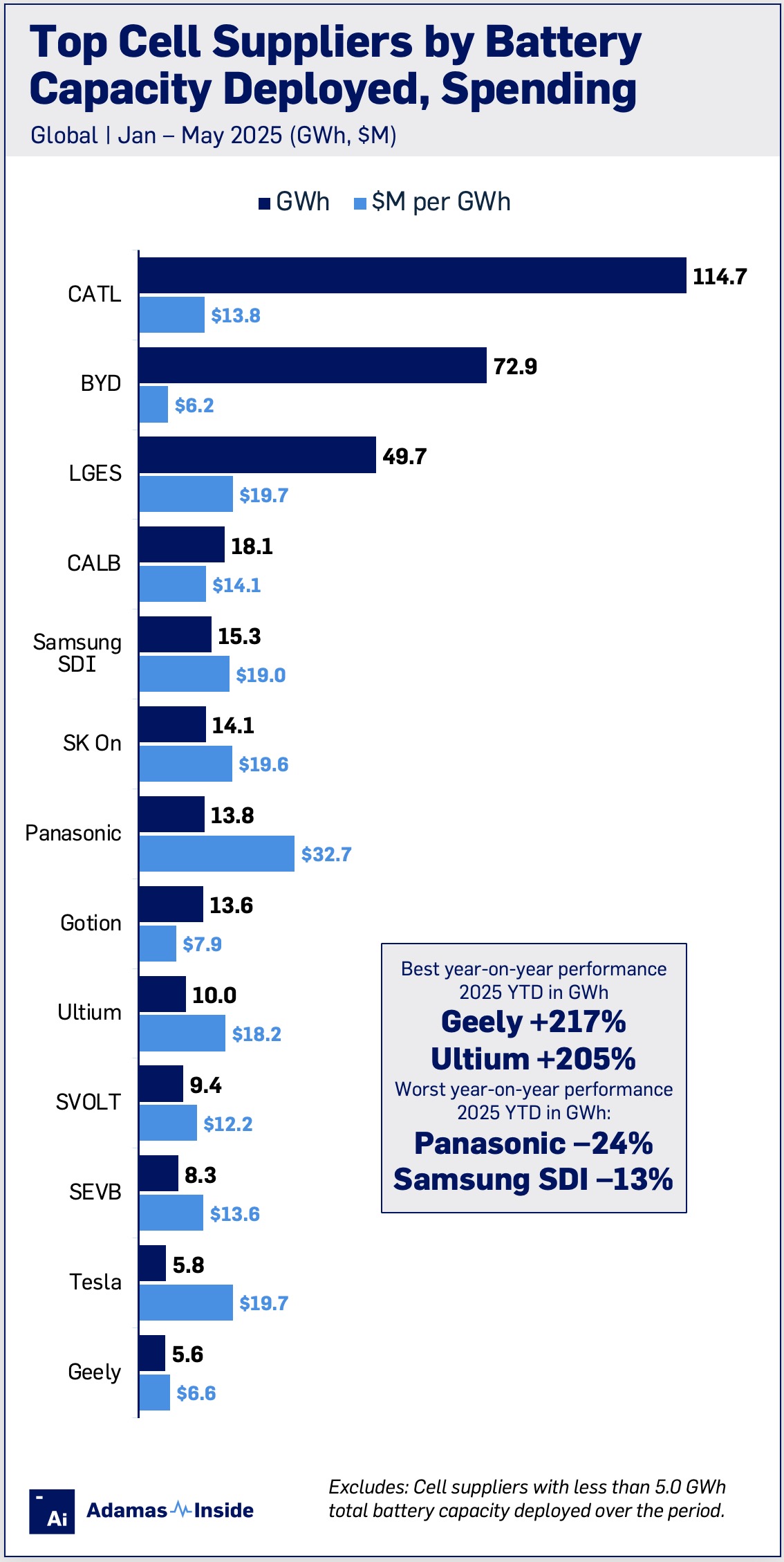

Top global cell suppliers by battery capacity deployed, battery metal spending

From January through May this year, 376.5 GWh of battery capacity were deployed onto roads globally in all newly sold passenger EVs combined (including plug-in, range extender and conventional hybrids), up 31% over the same period in 2024.

The 13 leading cell suppliers, each producing over 1 GWh per month in 2025 (the threshold for inclusion in the accompanying graph), accounted for 93% of the total market. This highlights the critical role of economies of scale, as over 50 EV cell manufacturers compete to supply the global electric vehicle industry.

CATL led the pack with 114.7 GWh of combined battery capacity deployed worldwide during the first five months of 2025, a 24% jump compared to last year. The Chinese battery giant cornered 31% of the global market in GWh terms last year, down a fraction compared to 2024.

CATL’s client base runs the gamut of automakers, including Tesla, Chinese brands like Changan, Chery, and Geely with their various sub-brands, as well as Western manufacturers such as BMW, Volkswagen, Mercedes-Benz, Stellantis, and many others.

BYD, the number one EV maker globally comes in second at 72.9 GWh after adding 46% more battery capacity to the world’s highways and byways last year. That robust performance increases the global share of BYD’s cell manufacturing arm, FinDreams Battery Co, from to 17% from 19%.

In 2025, the total battery capacity of electric vehicles equipped with LG Energy Solution batteries increased by 20% year-over-year, reaching 49.7 GWh.

The Big 3 – CATL, BYD, and LGES – combined cornered 63% of the global market, and in GWh terms, the competition quickly drops off from position four onwards.

CALB’s end users rolling 18.1 GWh onto roads year to date, a 46% jump compared to last year. Further down the ranking growth rates only increase for Chinese battery makers with Geely, which has gathered its cell manufacturing divisions under a single company called Jiyao Tongxing, leading the pack (+217% to 5.6 GWh).

Gotion, places eighth (+71% to 13.6 GWh) beating smaller rivals SVOLT (+60% to 8.3 GWh) and SEVB which lags its peers but still outperformed the overall market at a growth rate of 39% for 8.3 GWh so far this year.

The Korean and Japanese battery suppliers significantly underperformed the market. Panasonic saw the most significant decline, dropping 24% to 13.8 GWh. Samsung SDI also contracted, with a 13% decrease in GWh, while SK On, another Korean company, managed only a modest 4% year-on-year growth.

While Tesla underperformed the market with 22% growth to 5.8 GWh, Ultium Cells, a General Motors joint venture with LG Energy Solution, enters the top 10 on a global basis for the first time after more than tripling deployment to just under 10.0 GWh.

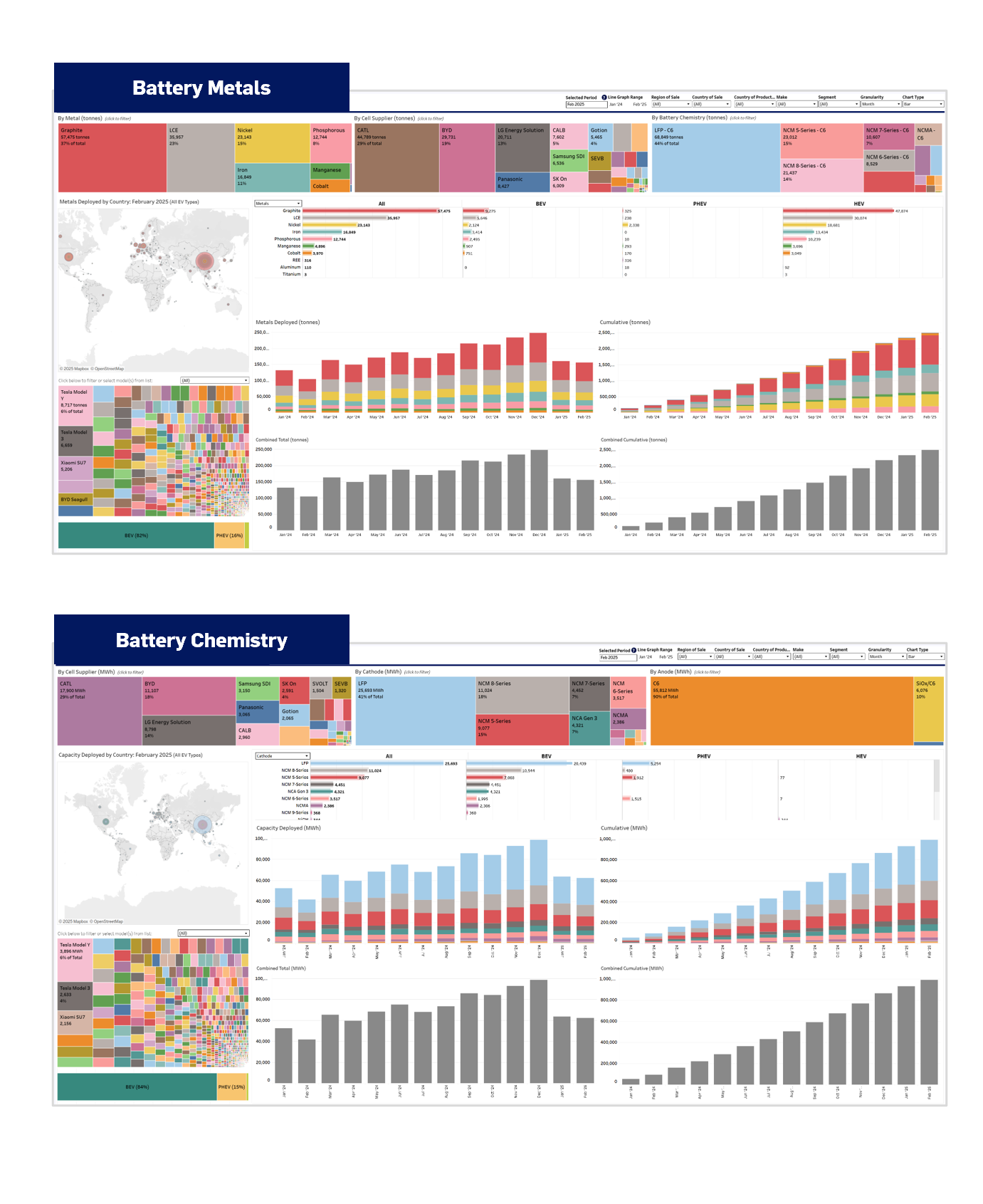

Paring GWh deployed with average pricing of battery metals – lithium, nickel, cobalt, manganese and graphite – offers clues to the outperformance of Chinese battery manufacturers.

Calculating the costs of installed tonnes, keeping in mind that these are terminal tonnes and do not consider losses during manufacturing, also provide further evidence (if any was needed) of the significant impact of nickel-free cathode chemistries on the economics of the sector.

Panasonic built its EV battery business through a long running partnership with Tesla in the US but as the automaker’s production shifted to China with CATL as supplier and its own cell business ramped up, the Japanese company struggled to keep momentum.

Nickel metal hydride batteries used in conventional hybrids now makes up 14% of Panasonic’s business on a GWh deployed basis, remarkable considering that HEV battery sizes seldom exceed 2 kWh.

EV Battery Intel Platform

The most detailed market data on EVs, batteries, metals and suppliers

The remainder of Panasonic’s battery capacity deployed comes in the form of high-nickel NCA and NCM cathodes, which helps explain why the Japanese conglomerate spends by far the most for every GWh hitting roads.

Panasonic’s $32.7 million for every fresh GWh steered onto roads from January through May compares to BYD’s $6.2 million. The Shenzhen-based company moved to an all-LFP model lineup in 2020 after the launch of its breakthrough blade battery.

Geely, and to a lesser extent Gotion, have also become heavily focused on LFP batteries which help keep their costs per GWh well below the $10 million-mark.

Last month GM and LGES announced that the automaker’s Tennessee plant will be retooled to produce LFP batteries by late 2027 with a nameplate capacity of 50 GWh.

For now, the Korean companies are all in on high-nickel cathodes which translates into per GWh raw material costs of $19 million-plus for all three.

Ultium, which exclusively produces NCMA cells currently operates on a similar cost basis as the Koreans, as does Tesla’s Texas plant output fitted to the performance Model Y and the Cybertruck.

On a battery capacity deployed basis, CATL’s cathode mix of no-, mid- and high-nickel, placing it neatly between the LFP and high-nickel NCM cell manufacturers. However, the significant revival in the cobalt price since February may start to show up in its per GWh costs later this year.

Contact the Adamas team to learn more or check out the intelligence services below.