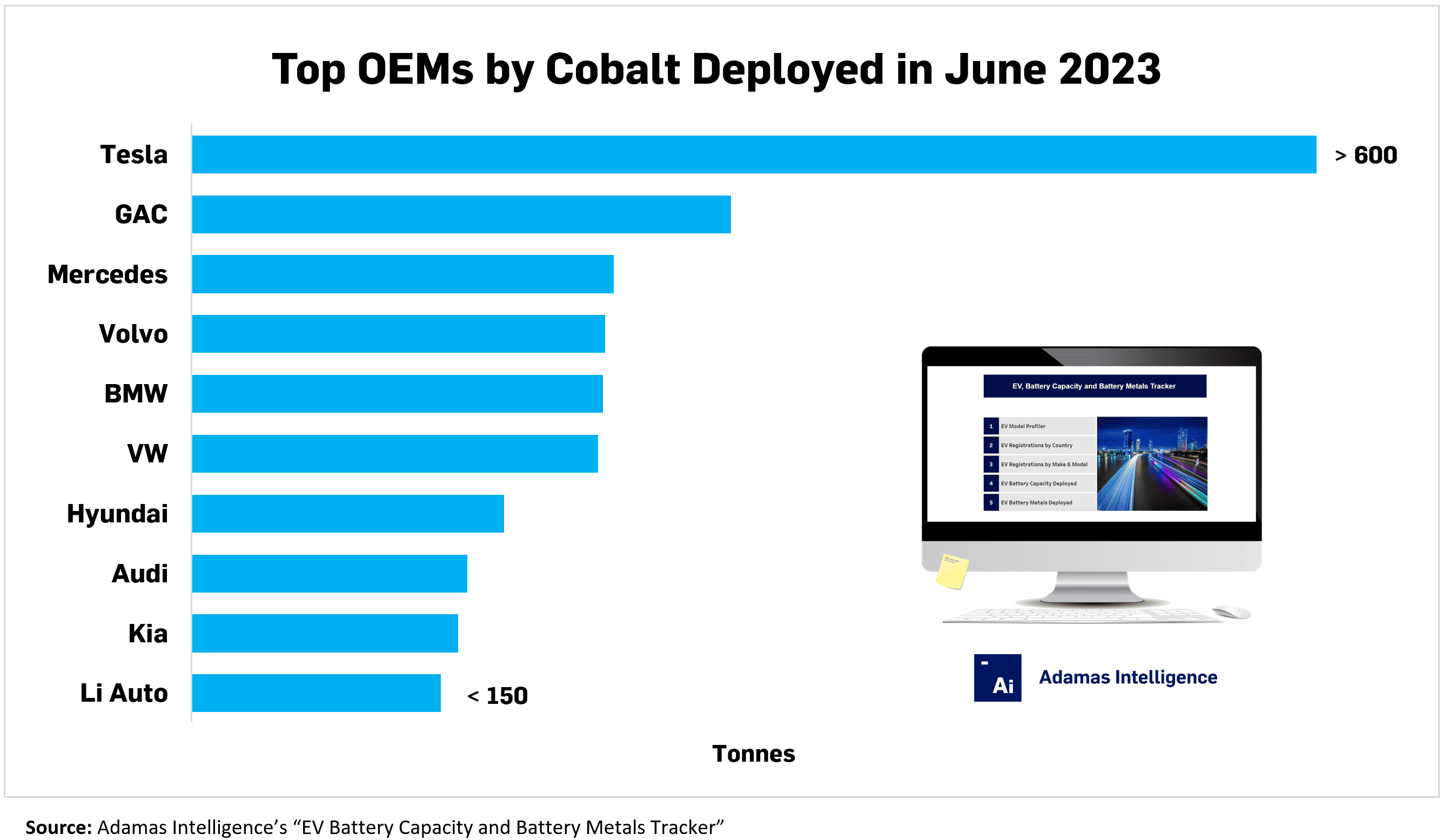

Top 3 OEMs by Cobalt Deployed in June 2023

Cobalt particularly vulnerable to evolving landscape of battery chemistries

Cobalt prices have been on a downward spiral since hitting near records in April of last year.

And news last week of a boost to output at the Tenke Fungurume copper-cobalt mine in the Congo will do little to allay fears of supply continuing to outstrip demand. The mine produced more than 20,000 tonnes of cobalt last year and its expansion plans for 2024 would catapult its Chinese owners, CMOC, past Glencore to become the world’s largest producer of the metal.

Adding insult to injury, the world’s largest EV battery maker by a country mile, CATL, recently announced the development of a new cobalt-free lithium iron phosphate (“LFP”) battery variant, called the Shenxing, that will slash sentiment even further. The company, based in Fujian province, claims its new LFP technology provides 400 kilometers of driving range on a 10-minute charge and 700 kilometers on a full charge.

This ability to rapidly charge overcomes a major drawback of legacy LFP batteries versus incumbents with nickel- and cobalt-containing NCM cathodes and will likely further erode demand for the latter, which is often used in high-end EV models and is especially popular in the U.S. and Europe where driving range often tops the list of consumer demands.

Cobalt’s traditional market is superalloys for the aerospace and other high-tech industries, but demand from the battery sector, including consumer electronics, now accounts for the bulk of global consumption making cobalt particularly vulnerable to the evolving landscape of battery chemistries in use.

In the face of LFP’s rise, cobalt consumption continues to grow

In June 2023, LFP commanded a 50% share of the passenger EV battery market in China by GWh deployed onto roads, data from the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows. Cars using a combination of NCM and LFP cells in the same pack are also increasing in popularity, the data shows.

Nevertheless, in the face of LFP’s rise, cobalt use continues to escalate and is projected to increase modestly in the years ahead as EV unit sales boom around the world. In June 2023, Adamas analysis shows that the top 10 OEMs by cobalt consumption worldwide upped their collective usage of the metal by 16% month-over-month and 54% year-over-year.

In total, nearly 5,250 tonnes of cobalt were deployed onto roads globally in June 2023, 19% more than the month prior and 35% more than the same month the year prior. Collectively, the top 10 OEMs by cobalt deployed were responsible for 50% of all usage in June 2023, up from a combined 44% in June 2022.

Despite switching to cobalt-free LFP for its standard range Model 3 and Y at the beginning of last year (the world’s two bestselling electric cars), the Texas-based EV pioneer Tesla still led the pack by cobalt consumption in June 2023 with over 650 tonnes deployed onto roads globally – more than double that of its closest competitor.

Following Tesla at a distance in second place with over 300 tonnes deployed was state-owned Guangzhou Automobile Group (“GAC”), which sells the rather unfortunately monikered Trumpchi brand and has notable joint ventures with Japanese marques Toyota, Honda and Mitsubishi.

Similarly, with nearly 250 tonnes of cobalt deployed onto roads globally, Mercedes Benz claimed third place in June, jumping slightly ahead of Volvo, BMW and VW. Notably, Mercedes sold less than half the number of EV units as GAC in June but consumed nearly as much cobalt, speaking to German brand’s inherently larger pack sizes and battery chemistry preferences.

Volvo, BMW, VW and Audi were also among the top 10 – evidence that having a cobalt-heavy high-end battery is becoming a distinguishing feature if you’re a sports and luxury carmaker. Perhaps it’s not inconceivable that one day energy-dense and thermal-runaway-protecting cobalt could be a selling feature of an EV, not dissimilar to sporting a V8 internal combustion engine or having twin-turbos.

Note: In order to produce the most accurate and granular data, battery capacity and metal deployed numbers in the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker do not include cars leaving assembly lines, those on dealership lots or in the wholesale supply chain; only end-user registered vehicles are considered.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.