Snapshot: Ford’s global EV progress as it announces ‘Model T moment’

Ford Motor Company came out fighting in Louisville, Kentucky earlier this month, announcing what CEO Jim Farley called a “Model T moment” harking back to the storied company’s 1908 car that not only transformed its fortunes but revolutionized the industry.

The automaker revealed its rather uninspiringly named “Ford Universal EV Platform” and “Ford Universal EV Production System” to bring affordable electric vehicles to market starting with a $30,000 midsize pickup set for a 2027 launch date.

Last week, Ford also kicked off production at a 43 GWh battery plant in Glendale, Kentucky. The joint venture with SK On focuses on NCM batteries and will sell output not taken up by Ford to other automakers or energy storage providers.

A second facility in Kentucky of equal size has been put on ice while Ford’s LFP facility in Michigan, in partnership with CATL, is now 60% complete after also being scaled down (from 35 GWh to 20 GWh).

At the halfway mark of 2025 it’s clear that while Ford’s ambitions are undiminished, the Dearborn-based company has a long way to go to catch up in the EV race.

The Ford group produced just over 2 million passenger vehicles during the first half of 2025, down slightly from last year, placing it at number seven for global combustion engine and EV output.

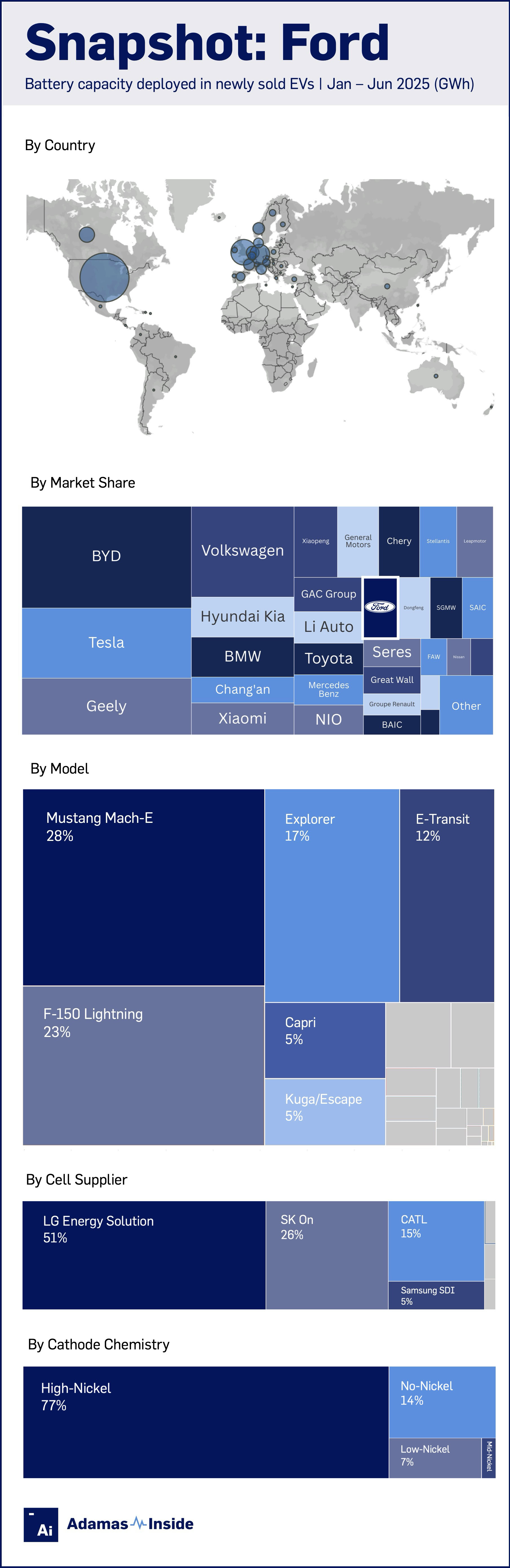

Ford falls out of the top 10 in EV sales. However, when measured by battery capacity deployed – a more accurate indicator of fleet electrification progress than unit sales alone – Ford ranks a lowly 19th globally.

New Ford EV owners rolled 8.9 GWh of battery capacity onto the world’s roads over the first six months of the year, 27% more than the same period in 2024.

That places the 122-year-old automaker behind Chinese start-ups like Xpeng (first vehicle produced November 2018), Nio (June 2018) and Leapmotor (June 2019). Not to mention Xiaomi which only launched its first model in 2024 and now ranks at number eight in terms of GWh deployed.

While Ford enjoyed a solid H1, the company still lags global growth rates and is heavily reliant on its ageing bestsellers, the Mustang Mach-E and F150 Lightning, responsible for more than half the automakers battery capacity deployed.

Ford’s Explorer built on a Volkswagen EV platform in Europe has been a great success on the continent, but there are currently no plans to bring the model to North America. Talk about an EREV version of the popular mid-size SUV for the domestic market has also gone quiet.

With little else in the pipeline before the switch to the new EV platform bar a confirmed electrified commercial van to be assembled at the company’s Ohio plant, Ford’s market position may not fundamentally improve before the end of the decade.

Ford is also heavily reliant on conventional hybrids to juice its fleet electrification efforts. HEVs made up 55% of the company’s EV sales from January through June, but at a sales-weighted average of only 1.2 kWh, they contribute little to GWh deployed.

The company’s plug-in hybrids (16% of EV sales) have an average battery capacity of 24.1 kWh, below the global average for the past six months. In contrast, Ford’s BEVs (29% of EV sales) have a significantly higher average battery capacity of 91.6 kWh compared to the global average of 62.4 kWh.

Globally, Ford’s tireprint is almost evenly split between North America and Europe. Like other Western carmakers, Ford has found the going tough in China, where it operates under a joint venture with the Chang’an Automotive Group. China now accounts for only a tiny fraction of Ford’s total battery capacity deployed.

Contact the Adamas team to learn more or check out the intelligence services below.