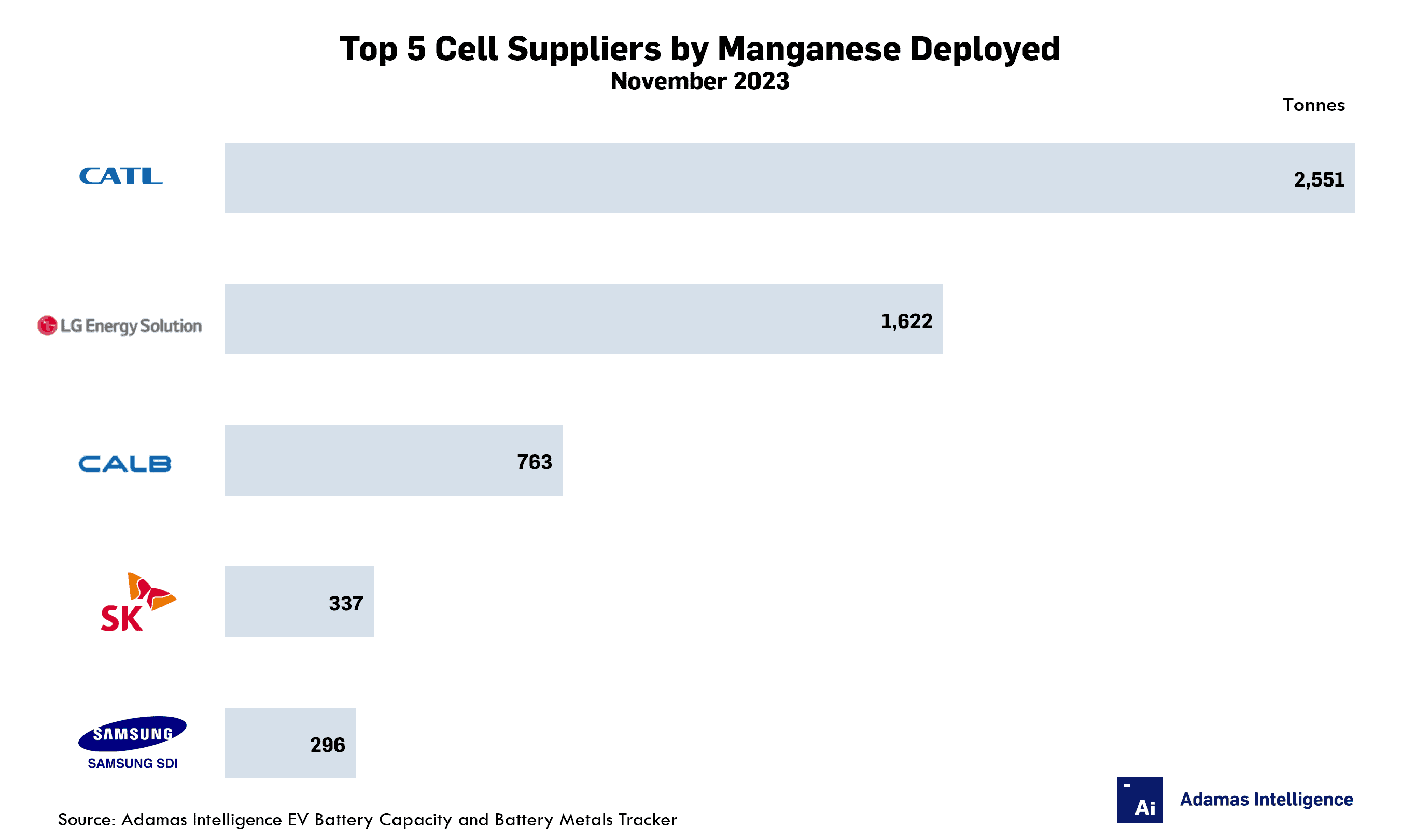

Global manganese deployment by cell supplier in November 2023

Samsung SDI pulls back, SVOLT surges

In November 2023, a total of 7,048 tonnes of manganese were deployed onto roads globally in the batteries of all newly sold passenger EVs (BEVs, PHEVs and HEVs) combined, 23% more than the same month the year prior and the second highest month on record after December 2022.

CATL led the pack globally with 2,551 tonnes of manganese deployed in November 2023, up 29% year-over-year. CATL cornered 32% of the global market by battery capacity (i.e., GWh) deployed during the month but enjoyed an even greater slice of the manganese pie at 36%.

Despite manganese-free LFP cells making up over one-third of CATL’s sales, the Chinese behemoth still took the manganese crown in November – a testament to the sheer volumes of nickel-cobalt-manganese (NCM) cells it moves.

In second spot, LG Energy Solution deployed 1,622 tonnes in November 2023, a mere 5% more than the same month the year prior. LGES captured 15% of the global market by battery capacity deployed during the month but, like CATL, cornered an even greater share of the manganese market at 23%.

In third, CALB deployed 763 tonnes of manganese onto roads globally in November 2023, up 62% year-over-year. With higher manganese loading per average EV supplied, CALB has been increasingly chipping away at the leads of the top two cell suppliers. In November 2023, the average passenger EV sold globally containing CALB cells housed 11.3 kilograms of manganese (up 10% year-over-year) while that of CATL and LGES contained 6.4 kilograms and 6.0 kilograms, respectively.

In fourth, SK On deployed 337 tonnes of manganese in November 2023, up 38% year-over-year, followed closely by Samsung SDI with 296 tonnes, down 10% over the same period.

in November 2023, Samsung SDI was the only cell supplier among the top 10 to record a drop in manganese deployment globally, while SVOLT (at number six) upped its manganese use by a whopping 344% year-over-year to 249 tonnes.

Adamas take:

Despite considerable growth in total global manganese deployment over the past 12 months, the global sales-weighted average amount of manganese deployed per EV fell 5% year-over-year in November 2023 to 3.7 kg.

The expanding use of LFP batteries in EVs, coupled with a preference for high-nickel variants on the ternary side of the market, will continue to put downward pressure on average EV manganese loadings in 2024.