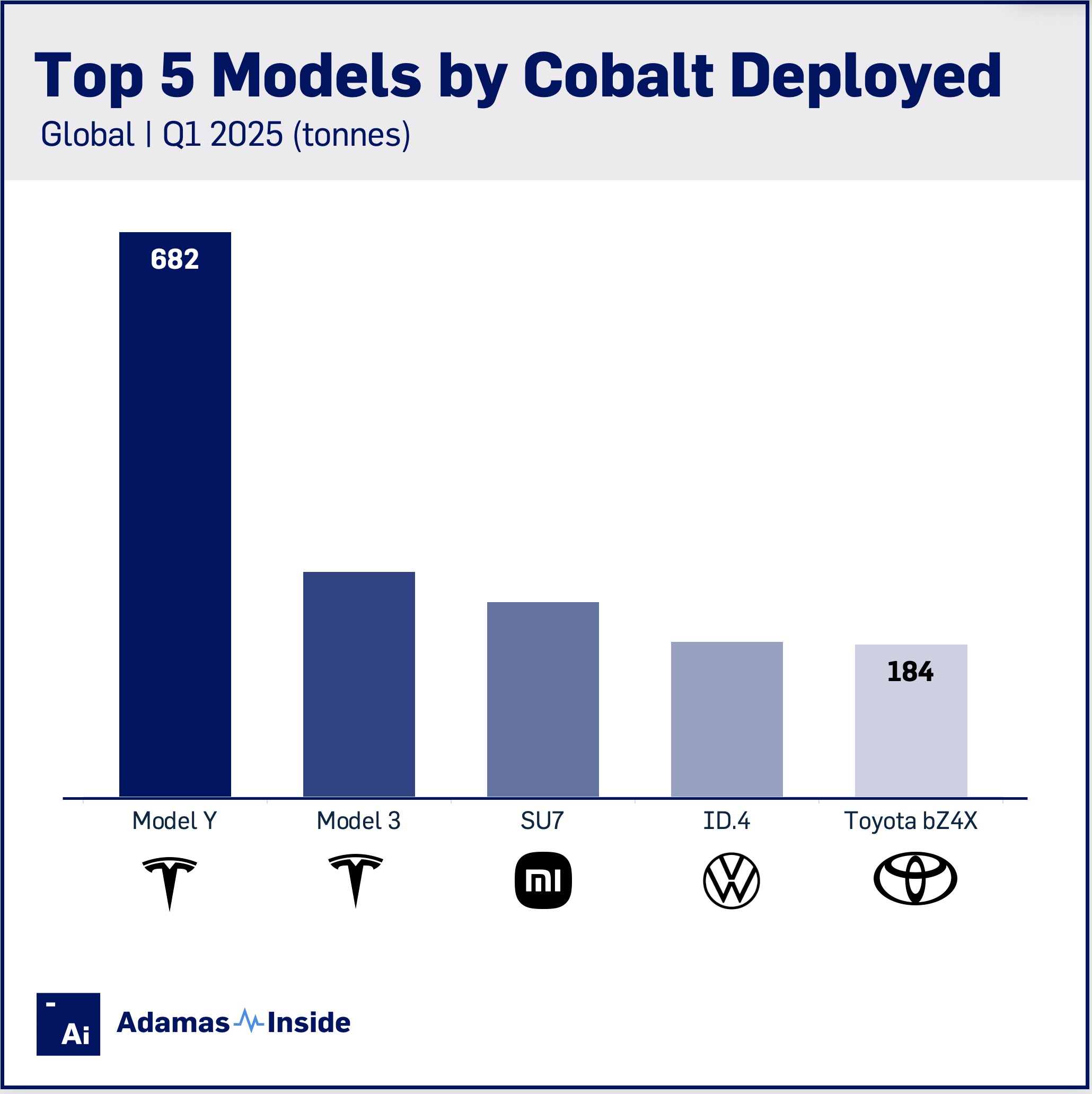

The world’s top 5 cobalt guzzlers

In the first quarter of 2025, a total of 13.4 kilotonnes of cobalt were deployed onto roads globally in the batteries of all newly sold passenger EVs combined, 4% more than the same quarter last year.

Cobalt underperformed its NCM cathode sister metals, with nickel and manganese deployment up 15% and 7%, respectively, year-over-year. The stronger growth in nickel demand underscores the sustained preference for high-nickel batteries in premium electric vehicle models, alongside consistent sales of conventional hybrid electric vehicles, which predominantly utilize NiMH batteries. In turn, manganese demand is being boosted by the small but rapidly growing uptake of alternative chemistries, including lithium-manganese-iron-phosphate (LMFP).

Despite a sharp 21% year-on-year drop in the combined cobalt contained in the batteries of Model Ys sold during Q1, Tesla’s bestseller held the lead by a large margin with 682 tonnes deployed onto roads worldwide.

The Model 3 came in second at 272 tonnes following a 44% jump compared to Q1 2024 when deployment was dampened by the switchover to the revamped model introduced to the Americas in January and elsewhere at the end of 2023.

The Xiaomi SU7, the Chinese mobile phone company’s first foray into EVs that went on sale in the second quarter of last year, debuts at number three with 235 tonnes. Xiaomi’s SUV, the YU7, is set to hit the roads in China next month, but it is expected to have a lesser impact on the battery cobalt market. YU7 sales would likely skew more towards the entry-level models, which are equipped with LFP batteries, than those of the sport sedan’s racing-oriented top-end variants, which come with hefty NCM batteries.

Deployment in the Volkswagen ID.4 at 187 tonnes cobalt (up 66% year on year) only just bested Toyota’s bZ4X (the revamped model, now just called the bZ, goes on sale in the second half of this year) at 184 tonnes deployed, a 21% improvement.

EV Battery Intel Platform

The most detailed market data on EVs, batteries, metals and suppliers

The continuing thrifting of cobalt in EVs has been a feature of the market since the turn of the decade, but suppliers to the industry can at least take heart from the revival of cobalt prices following the introduction of export restrictions by the Democratic Republic of Congo.

The DRC is responsible for more than three-quarters of global production, and the country’s efforts to shore up prices resulted in a dramatic spike at the beginning of March.

Pairing terminal tonnage deployed with the ruling price of cobalt sulfate entering the Chinese EV supply chain saw the total value of the installed cathode material increase by 6% in Q1 to $290 million.

Prices have since drifted sideways at these elevated levels, and the coming months could see quarterly values return to the $400 million-plus range, last seen in the second half of 2021 and calendar 2022.

Contact the Adamas team to learn more or check out the intelligence services below.