Top ten fastest growing EV markets in 2025

During the first quarter of 2025, 213.2 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 34% more than the same period last year.

China was responsible for more than half of the fresh GWh hitting the world’s roads during the first three months of the year, but the country nevertheless managed to outperform the global market, growing by a robust 38% year on year.

Last year EVs made up 41% of new passenger vehicles sales in China and despite its already substantial installed base China only just missed the cut-off to qualify for the top 10 fastest growing countries in GWh terms in Q1 2025.

Indonesia tops the charts with a 369% surge with a combined 1.2 GWh battery capacity deployed in EVs sold during the quarter. Second is Vietnam with 139% growth to just over 1.2 GWh.

Hot Turkey

The two Asian nations are following two very different paths for electrifying their car parc, however. More than 82% of the battery capacity deployed in Indonesia was in electric vehicles imported from China. In contrast, only 2% of the GWh added to Vietnam’s roads came from made-in-China EVs.

Vietnam’s national champion, Vinfast, which also has ambitious plans to expand overseas after moving its corporate headquarters to Singapore, sold nine out of every ten EVs in Vietnam so far this year, all of them BEVs.

EV penetration in Vietnam in Q1 was nearly 50% of units delivered. In Indonesia, that figure falls to 15%, and of those, minimally electrified conventional hybrids made up a third.

The third-fastest growing market in 2025, Turkey, increased total battery capacity by 119% year on year with made-in-China EVs responsible for 15% of the 2.2 GWh deployed.

Unlike Vinfast in Vietnam, homegrown automaker Togg has less of a grip on the Turkish vehicle market, although the Istanbul company’s sole model, the full electric T10X, does represent a fifth of the domestic market in GWh terms.

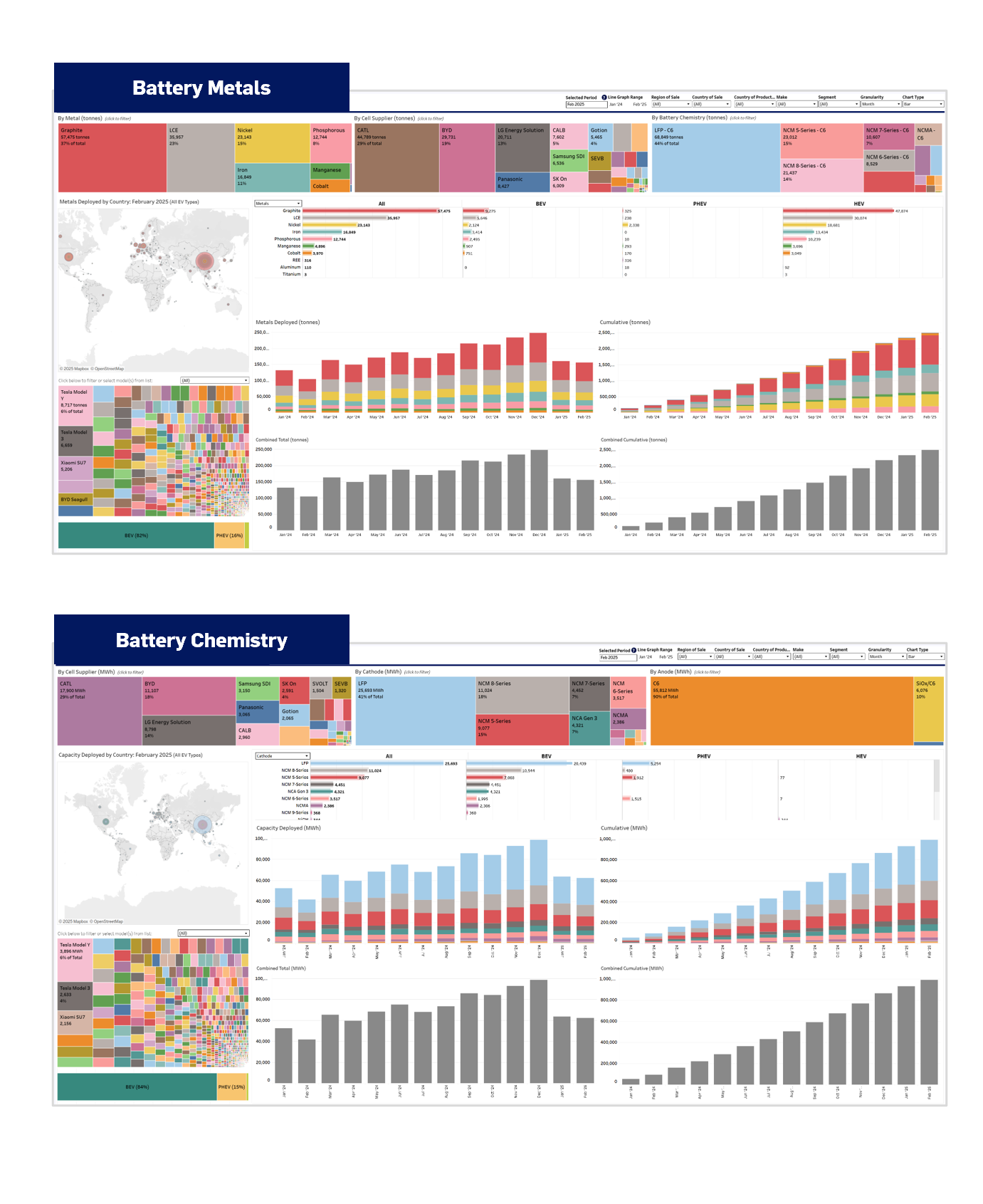

EV Battery Intel Platform

The most detailed market data on EVs, batteries, metals and suppliers

Europe ebullient

After India, which expanded battery capacity by 85% to 1.6 GWh in Q1, European countries fill the ranking. The world’s third and fourth largest EV markets, the UK and Germany, bounced back this year growing by 47% and 49% respectively.

The UK, which overtook Germany to become the third largest EV market in the world on a battery capacity deployed basis after a blockbuster March, added 10.1 GWh to the left side of roads during the first three months of 2025 while autobahns welcomed 9.7 GWh. A shade under 19% of the capacity deployed in the UK was imported from China while the continent’s top vehicle producer needed 10% of GWh deployed to come from China to meet quarterly demand.

Canada, the world’s sixth largest EV market after France at 3.2 GWh deployed in Q1 deserves an honorable mention after growing by 39% year on year, but the US underperformed with a 17% increase to 27.7 GWh.

Conversely, EV buyers in France deployed 6% less battery capacity on the country’s roads compared to the previous period. Among the 23 countries with more than 1 GWh of EV battery deployment in the past three months, Australia experienced the largest decline, dropping 22% to 1.4 GWh.

Contact the Adamas team to learn more or check out the intelligence services below.