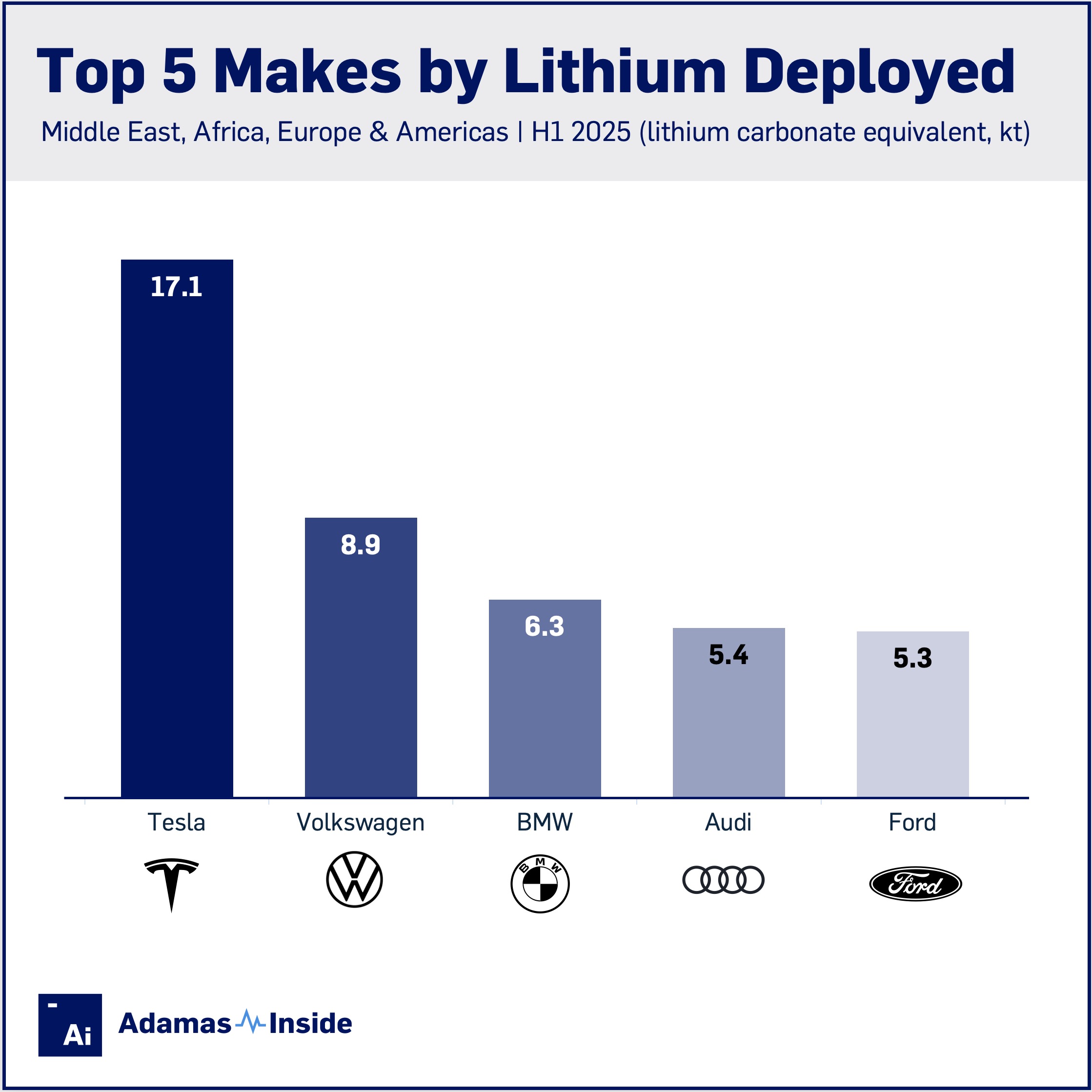

Top 5 EV makes by lithium deployed outside Asia Pacific

A combined total of 217.5 kilotonnes of lithium carbonate equivalent (LCE) were deployed onto roads globally from January through June this year in the batteries of all newly sold passenger EVs, including plug-in and conventional hybrids, combined, a 27% increase over 2024.

The Middle-East, Africa, Europe and the Americas made up 39% of the global total with LCE deployment over the first six months of 2025 rising by a combined 22% year on year to 106.7 kt across the four continents. That compares to much healthier growth of 31% in the Asia Pacific region.

Tesla retained its top spot with 17.1 kt of LCE deployed across its S,3,X,Y models and the Cybertruck, a decline of 16% compared to the first half of 2024.

Tesla’s bread and butter Model Y makes up 10% of global LCE deployment ex-Asia Pacific at 11.1 kt, but that is down 13% year on year as the prolonged switch-over to a new version, increased competition, and shift in consumer sentiment dent sales, particularly in Europe.

Runner up Volkswagen was the best performer among the top brands with an 85% leap year on year in LCE deployed to 8.9 kt, thanks in large part to the introduction of two newer models.

The ID.7 sedan, a rare success story for this body style amid a sea of SUVs and crossovers, made up 26% of Wolfsburg’s overall deployment across the regions during H1 after a 575% rise year over year. Despite its hefty batteries, the much-anticipated ID.Buzz arguably underperformed against expectations making up 10% of VW’s total for the period, 192% more than the same period last year.

BMW came in third in EMEA and the Americas, deploying 6.3 kt of LCE so far in 2025, up a modest 6% year on year followed by VW’s premium marque Audi which at 5.4 kt showed growth of 45% from January through June.

Ingolstadt’s Q6 e-tron full electric crossover SUV, introduced in the second quarter of last year, is the number four model overall in terms of LCE deployment (2.1 kt) during the period.

Rounding out the top 5 outside the Asia Pacific region is Ford at 5.3 kt, a 27% improvement over last year. The standout performer for Dearborn across the region was its new Ford Explorer, introduced mid-2024.

The popular SUV, only available as a BEV in Europe and the Middle-East, made up 17% of Ford’s overall LCE deployment.

On its current trajectory, BYD’s made-in-China EVs could soon crack the top five outside its home market in terms of LCE deployment after a 129% year-over-year expansion. The Shenzhen-based company deployed just over 5.0 kt during H1 2025 despite having no presence in the US and Canada.

Contact the Adamas team to learn more or check out the intelligence services below.