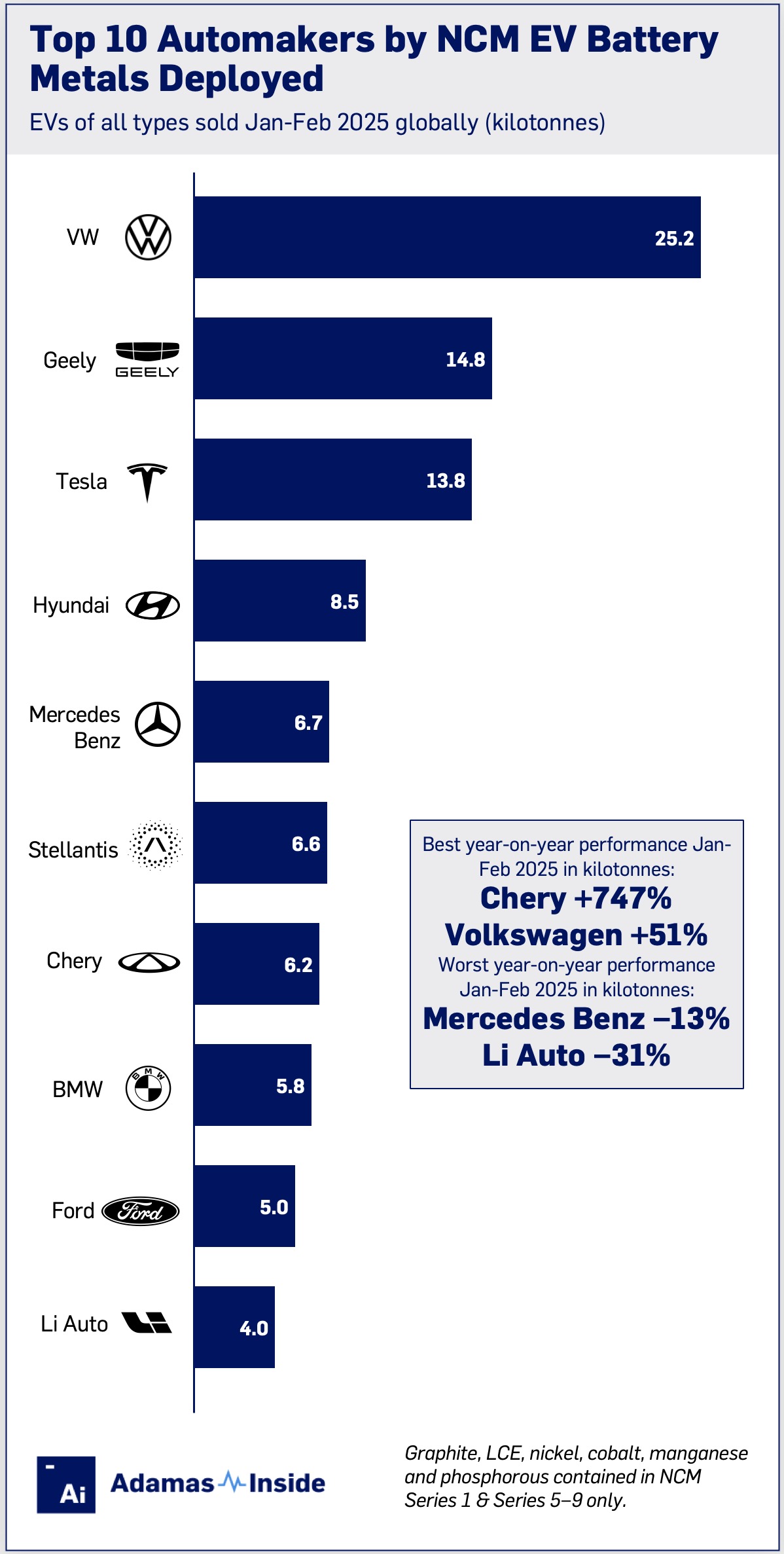

Top 10 EV manufacturers by NCM battery metals deployed

During the first two months of 2025, passenger EVs including plug-in and conventional hybrids equipped with nickel-cobalt-manganese (NCM) battery packs were responsible for 45% of total battery metals consumption globally.

In January-February this year (taken together to smooth out the impact of the Chinese lunar new year holiday) a total of 141.9 kilotonnes of graphite, LCE (lithium carbonate equivalent), nickel, cobalt, manganese and phosphorous were contained in NCM Series-1 to 9 packs powering newly sold EVs around the world.

While some EV batteries combine different cathode chemistries, and NCMA packs are increasingly finding their way onto the market, these types of batteries are excluded from the totals quoted here.

VW FTW

Following a 51% surge in its metal consumption in January and February this year, the Volkswagen Group has become the clear leader of the NCM pack.

Materials deployed in the German automaker’s many brands total 25.2 kt so far this year, followed at a distance by Geely, owner of, among others, Volvo, Polestar, and Zeekr, at 14.8 kt (up 18% year over year), and Tesla at 13.8 kt (up 20% year over year).

The mid-tier had a tougher opening to the year with Hyundai Motor Group, deploying 8.5 kt of battery metals after registering zero year-over-year growth, Mercedes-Benz 6.7 kt (–13%) and Stellantis 6.6 kt (–3%).

Chery, ranked seventh, was the fastest growing automaker among the top 10 OEMs after a 7-fold jump during the opening months of 2025. Buoyed by the success of its Luxeed marque, at 6.2 kt Chery, leapfrogged BMW, Ford and Li Auto to join the top tier despite healthy growth for the German and US automakers.

BMW increased deployment by 19% to 5.8 kt, Ford was up 27% to 5.0 kt, but Li Auto, an EREV specialist, lost momentum falling by 31% year on year to 4.0 kt, only just edging out trailblazer Xiaomi.

Straight to eight

The NCM 8-Series cathode chemistry with roughly 80% nickel, 10% cobalt and 10% manganese content, was the greatest contributor to deployment with 50.8 kilotonnes, closely followed by NCM 5-Series packs at 49.5 kt.

Mid-nickel cathodes remain popular in China but on a metals deployed basis showed no growth year on year compared to the high-nickel content chemistry which recorded a 22% jump.

While the vast majority of the batteries used in conventional hybrids are of the nickel metal hydride variety, an increasing number now sport NCM packs.

HEVs, despite a typical battery capacity of less than 2 kWh versus an average of 63 kWh for BEVs and 23 kWh for PHEVs, contributed nearly 1% to overall metal deployment in NCM batteries over the period.

In January-February 2025, CATL topped NCM suppliers on a kilotonne basis, holding a 36% share of metals deployed in the newly sold EVs.

EV Battery Intel Platform

The most detailed market data on EVs, batteries, metals and suppliers

The NCM metal deployment in the cells of LG Energy Solution increased by 21% to 37.9 kt, and the company’s fellow Korean cell supplier, SK On, achieved a 23% expansion to 12.4 kt.

The NCM EV battery universe is even more concentrated than the overall industry with the top three cell suppliers – CATL, LGES and SK On – responsible for 71% of battery metal deployment during the two months.

China goes NCM negative

By the same measure, the top country for deployment in NCM cells was China, responsible for 52.6 kt or 37% of the global total. The continuing adoption of LFP battery chemistries by the country’s automakers saw NCM raw material deployment contract by 7% in the world’s largest EV market, however.

The US with 21.6 kt exhibited healthy growth of 31% while Germany at number three was the fastest growing large market in January-February, upping raw material deployment in NCM batteries by 53% to 12.1 kt. The UK grew by 38% to 7.9 kt overtaking France at 6.2 kt where deployment fell by 5% for the fourth slot.

Contact the Adamas team to learn more or check out the intelligence services below.