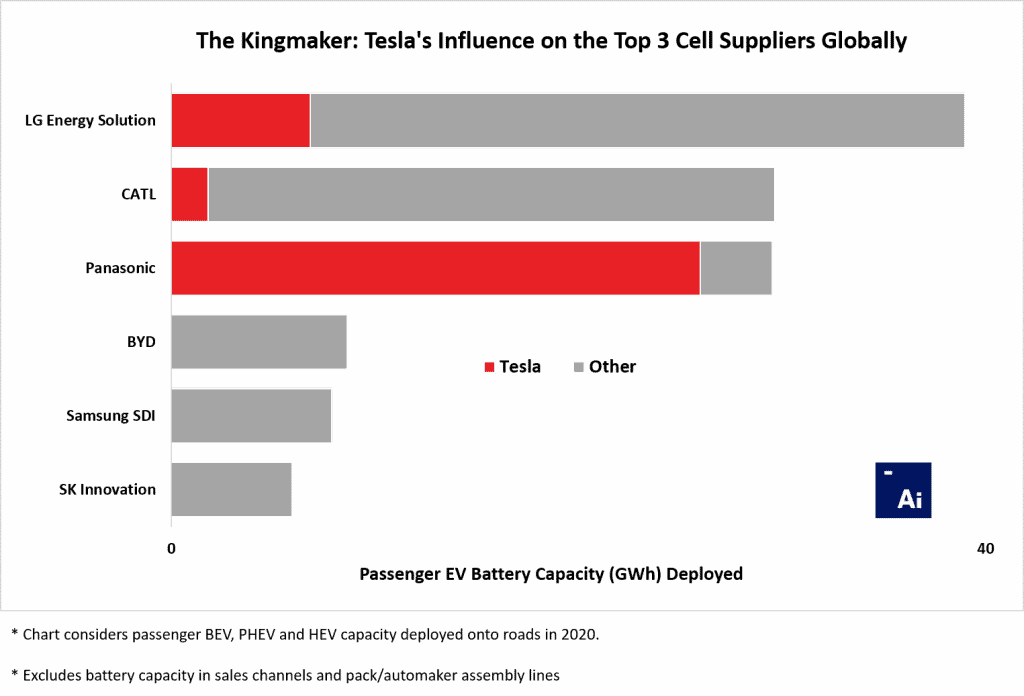

The Kingmaker: Tesla’s Undeniable Influence on the EV Battery Supply Chain

2020 Saw Tesla’s Dominance Expand Across Numerous Fronts

In 2020, Tesla outsold all other plugin electric vehicle makers globally and deployed more passenger EV battery capacity and battery materials, namely lithium, nickel and graphite, than its four closest competitors combined.

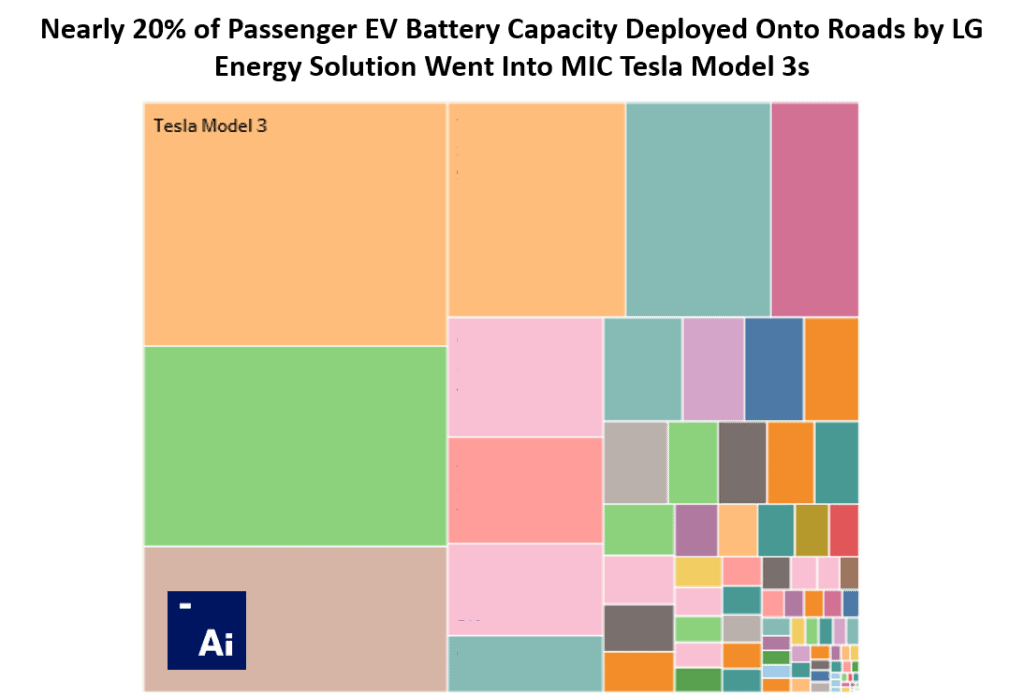

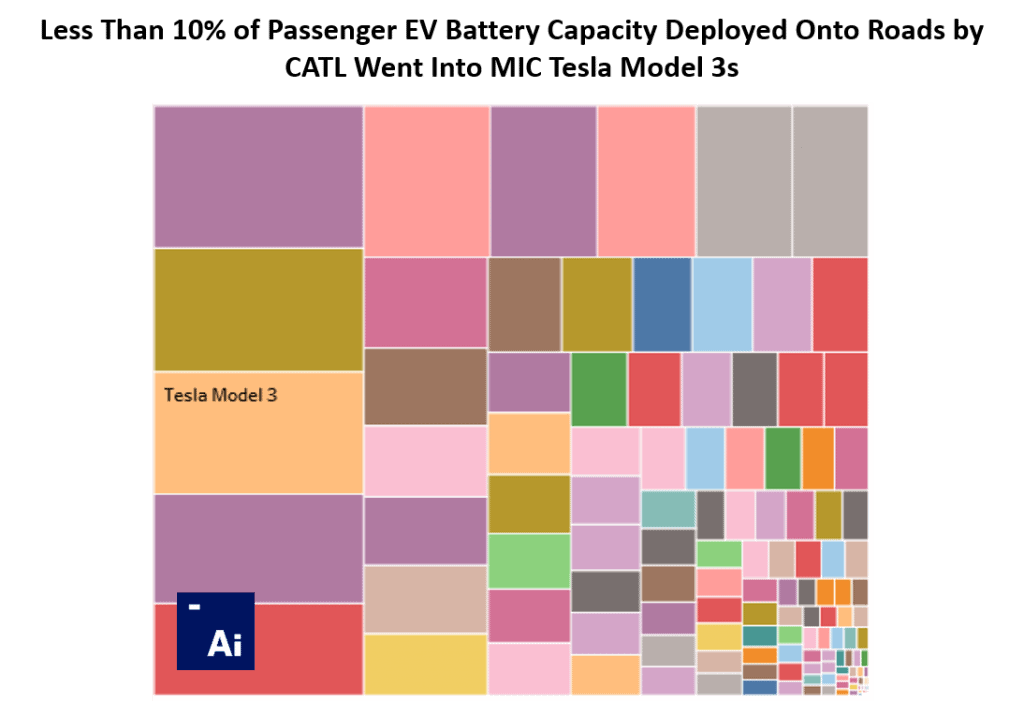

Last year is also the first year that Tesla manufactured EVs at scale outside the U.S. and the first year that saw it use cells not made by Panasonic. In early-2020, made-in-China (“MIC”) Model 3s began rolling off the line with high-nickel NCM 811 cells from LG Chem, and late in the year also began incorporating nickel- and cobalt-devoid LFP cells from CATL.

In 2020, nearly 20% of all passenger EV battery capacity deployed onto roads by LG Energy Solution (LG Chem spin-off) went into MIC Tesla Model 3s, making it the cell supplier’s widest channel to market for the calendar year.

In 2020, less than 10% of all passenger EV battery capacity deployed onto roads by CATL went into MIC Tesla Model 3s, making it the cell supplier’s third greatest ‘vehicle’ to market for the calendar year, albeit the fastest growing customer on CATL’s books. Deliveries of CATL-supplied Tesla Model 3s to customers only started in Q4.

Moreover, in 2020, nearly 90% of all passenger EV battery capacity deployed onto roads by Panasonic went into Tesla battery electric vehicles of all kinds, making it by far and large the cell supplier’s widest channel to market for the calendar year.

More Data and Insights from Adamas Intelligence

Must-have intelligence for automakers, cell suppliers, battery materials manufacturers, miners, explorers, investors and other stakeholders with a professional interest in the EV, battery and battery materials industries.

We offer a number of interactive data tools and subscription-based reports for clients seeking regular updates, analysis, and insights into the fast-moving markets and supply chains that we cover.

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 80 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

The tracker’s intuitive user interface and interactive charts and filters let users quickly zoom in on specific regions, countries, automakers, models, cell suppliers, battery chemistries, battery materials and more.

Subscription includes access to the online platform plus a wealth of Excel data, all updated monthly.

EV Motor Materials Monthly

Our new ‘EV Motor Materials Monthly’ is a subscription-based report and data service for tracking motor demand, NdFeB magnet demand, and other key developments in the global EV traction motor market month-after-month, as they happen; by region, country, motor type, EV type, EV make, EV model and motor supplier, plus the latest developments in rare earth and NdFeB alloy prices.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

EV Battery Capacity Monthly

Our ‘EV Battery Capacity Monthly’ is a subscription-based report and data service for tracking monthly deployment of battery capacity (in MWh) in passenger EV batteries by country, region, EV make, EV model, cell supplier, cell chemistry, EV type and more.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

EV Battery Lithium Monthly

Our ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking monthly deployment of lithium in passenger EV batteries by country, region, EV make, EV model, cell supplier, cell chemistry, EV type and more.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

EV Battery Nickel Monthly

Our ‘EV Battery Nickel Monthly’ is a subscription-based report and data service for tracking monthly deployment of nickel in passenger EV batteries by country, region, EV make, EV model, cell supplier, cell chemistry, EV type and more.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

EV Battery Cobalt Monthly

Our ‘EV Battery Cobalt Monthly’ is a subscription-based report and data service for tracking monthly deployment of cobalt in passenger EV batteries by country, region, EV make, EV model, cell supplier, cell chemistry, EV type and more.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

Back to overview