Snapshot: Made-in-China EVs in Europe

The European Union’s tariffs on electric vehicles made in China went into effect in October last year. Long in the making, in its current form the EU tariff regime is set to run through 2029 over the objections of Beijing.

The duties range from 7.8% on Tesla which exports Model 3s from its Shanghai factory to 35.3% on state-owned SAIC, China’s largest automaker which is in joint ventures with among others Volkswagen and General Motors.

These levies are additional to the EU’s standard 10% car import duty on vehicles imported from other countries, including the US.

In January, Tesla joined BMW and several Chinese automakers including BYD, Geely (owner of Volvo and Polestar), and SAIC to file a lawsuit against the European Commission over the trade barriers. Legal proceedings are expected to take around 18 months.

It was reported in April that the EU and China have begun negotiations to replace the tariffs with minimum pricing agreements although how such a scheme would work on EVs (as opposed to commodities like bananas or coffee) is unclear. No further updates on these negotiations have been reported since.

Not to be outdone, last week the UK, by far the largest market for Chinese EVs in the region, launched a subsidy scheme for buyers based on emissions produced during the EV’s manufacturing process.

The program effectively bars imported Chinese vehicles from qualifying for the up to £3,750 (around $5,000) per vehicle incentive and has naturally been decried as a backdoor tariff on Chinese automakers.

Meanwhile, the existing tariffs on made-in-China EVs have had some unintended consequences.

The electrification of the car parc in Europe, including the UK, other non-EU states and Russia, has picked up considerable speed in 2025.

Combined battery capacity deployed in the region from January through May 2025 was just under 80.0 GWh representing a 31% increase over the same period last year.

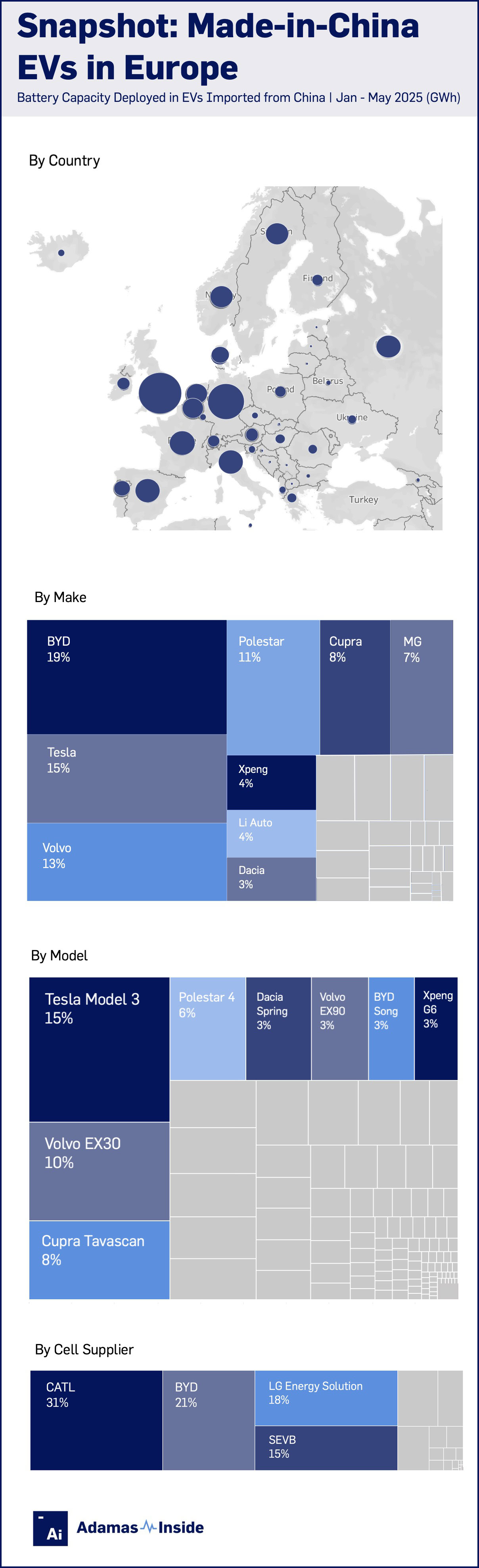

Over the same period made-in-China EVs, including plug-in and conventional hybrids, added a combined 13.4 GWh of battery capacity to European roads, a much more sedate rate of growth of 9% year on year.

EVs imported into the region from China this year represented less than 17% of the region’s total battery capacity deployed in newly sold EVs over the first five months, down from 20% last year.

The contribution of EVs imported from China – the majority of which are non-Chinese makes – to the electrification of the region’s car parc peaked mid-2024 at 27% as purchases were pulled forward ahead of the tariffs.

At first blush, the data may suggest the EU’s trade barriers had the anticipated effect of countervailing rising imports of Chinese EVs in the region.

However, unit volume data suggest sales lost by domestic OEMs to Chinese imports are surging.

Sales of all types of made-in-China EVs across the continent are up 45% year on year, but plug-in hybrid shipments have soared by 144% and conventional hybrids by a factor of 45 (sic) albeit from a very low base. Excluding made-in-China models, hybrid electric vehicle (HEV) sales in Europe grew by only 7% year-on-year.

The sudden change in the sales mix – predictably – follows the tariff structure: BEVs are subject to the duties but PHEVs and HEVs are not.

Combined BEV battery capacity deployed in Chinese EVs sold in Europe so far this year is up a modest 5% to 12.2 GWh compared to 66% expansion for PHEVs.

One of the quirkier aspects of the EU’s rules is that extended range vehicles or EREVs are considered fully electrified as the combustion engine never drives the wheels.

EREVs are a popular alternative for drivers shopping for a plug-in EV and on a global basis were responsible for a third of the 65.6 GWh rolled onto roads in PHEVs so far this year.

The EU’s treatment of EREVs under the tariff regime means Chinese OEMs are not bothering to target the bloc’s car buyers. In GWh terms, 94% of EREV battery capacity deployed in the region was in Russia.

The eye-popping change in HEV sales is matched by the expansion in battery capacity deployed for these minimally electrified vehicles and is almost entirely attributable to MG hybrids.

The storied British brand was acquired by SAIC in 2005, an irony that could not be lost on Brits shopping for electrified vehicles.

Nine months in it is far from clear if the Commission’s tariffs had achieved the EU’s goals of levelling the playing field for domestic OEMs. Rather it seems that the field of competition has shifted.

The duties have retarded the electrification of the bloc’s fleet for one and arguably damaged the likes of BMW and Volkswagen assembling EVs in China more than Chinese upstarts looking to make inroads on the continent.

Moreover, the dramatic rise in minimally electrified HEVs (and to a lesser extent PHEVs) from China would also eat into what for many automakers like Renault, Dacia and Toyota, have become their bread and butter models during the transition.

Japanese automakers which have doubled down on HEVs and have extensive production capacity on the continent dating back decades, must be shuddering at the idea that MG’s HEVs look poised to unseat iconic vehicles such as the Corolla on Europe’s best seller lists.

The EU-China summit being held this week was supposed to last two days including meetings in Hefei, China’s EV hub.

Amid a relationship that has become increasingly frosty as Europe’s trade deficit with China balloons and the country continues to offload its chronic overproduction, the room for compromise may be small. The stakes are high though and the road ahead bumpy for both sides.

Contact the Adamas team to learn more or check out the intelligence services below.