High Nickel Cathodes Dominated the Passenger EV Market in 2020

High Nickel Cells Made Up Over 60% of Passenger EV Battery Capacity Deployed Globally in 2020

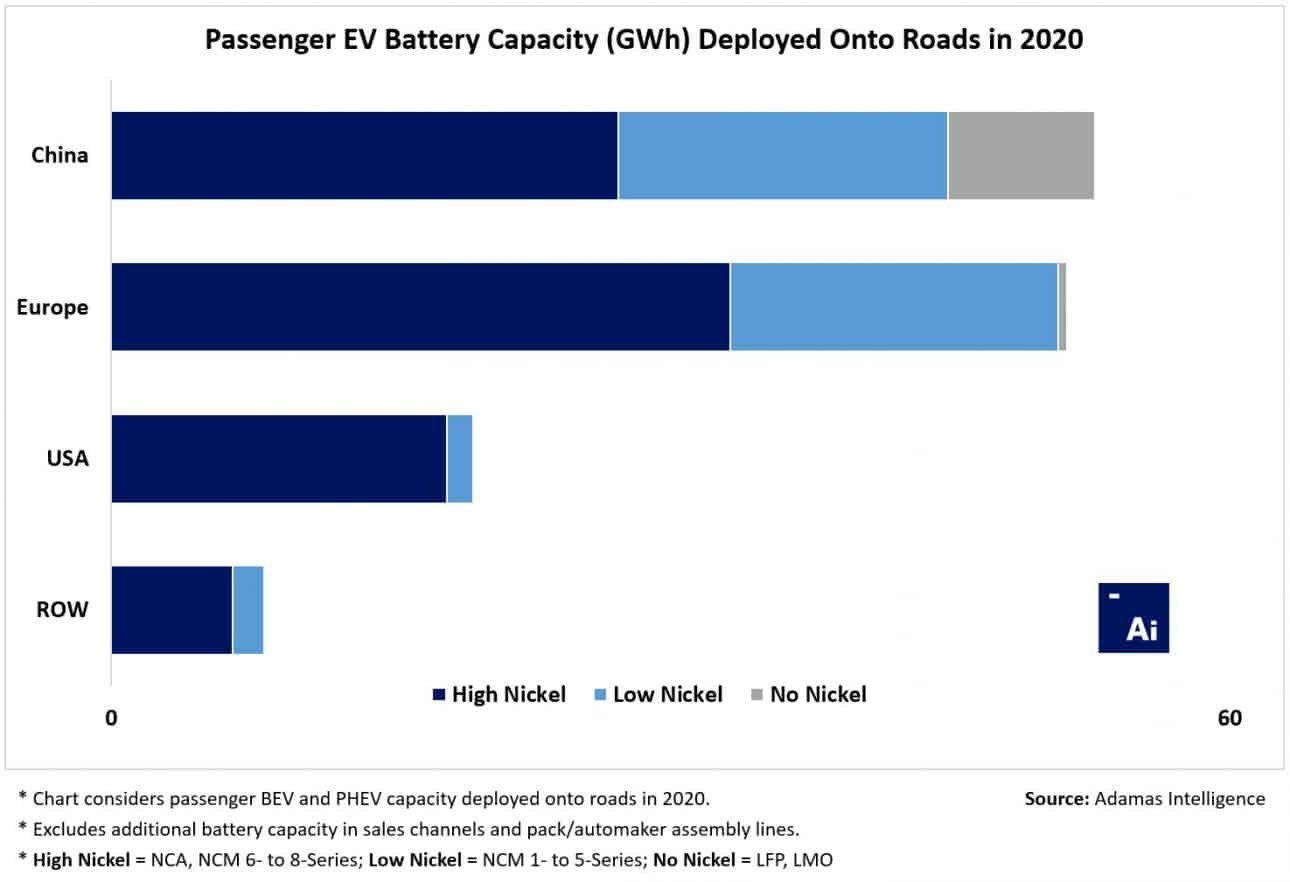

In 2020, a total of 134.5 GWh of passenger EV battery capacity was deployed onto roads in new BEVs, PHEVs and HEVs sold globally, as we examined in a recent insight.

Over 60% of all passenger EV battery capacity deployed globally in 2020 was in the form of high nickel cells, such as NCA or NCM 6- to 8-Series cells. Europe saw the greatest deployment of high nickel cells in 2020 (predominantly NCM 6- and 7-Series), followed by China (dominated by NCM 8-Series) and the U.S. (high-nickel NCA).

Furthermore, nearly 30% of all passenger EV battery capacity deployed globally in 2020 was in the form of low nickel cells, such as NCM 1- to 5-Series cells. Last year, China saw the greatest deployment of low nickel cells globally, followed closely by Europe and at a distance by the U.S. In virtually all regions globally, the low nickel market is dominated by NCM 5-Series and to a lesser extent NCM 1-Series.

Lastly, in 2020 less than 10% of all passenger EV battery capacity deployed globally was in the form of no nickel cells, such as LFP and LMO/LTO. Not surprisingly, China saw the greatest deployment of no nickel cells globally in 2020 (predominantly LFP), followed by Europe and the U.S.

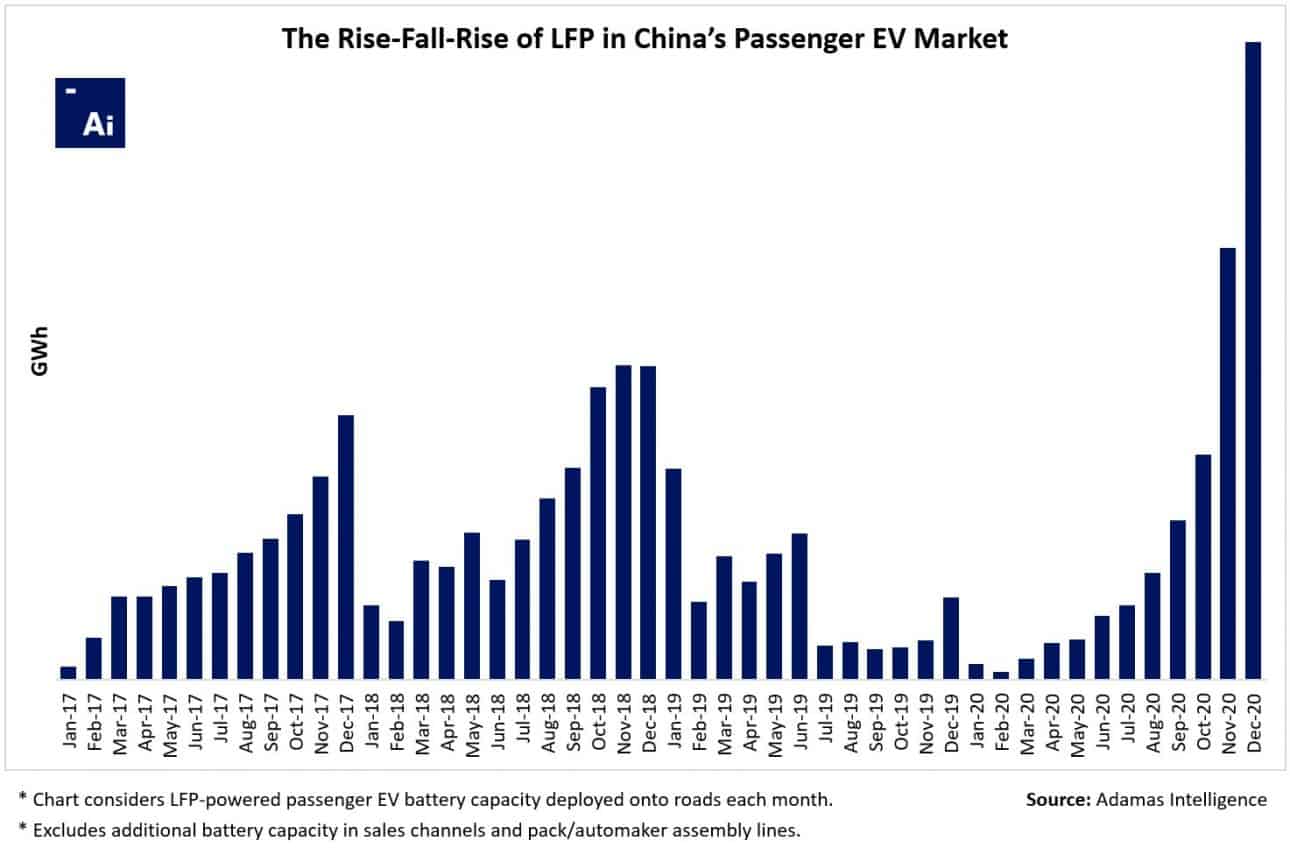

While LFP captured less than 10% of the passenger EV market last year by battery capacity deployed, it’s worth noting that this share reached as high as 11% in the fourth quarter of 2020 and we expect will edge closer to 15% by the middle of 2021.

Although unit sales of LFP-powered BEVs in China are rising like smoke, the sales-weighted average LFP-powered BEV in the nation has a battery pack capacity (in kWh) that is 51% lower than the sales-weighted average NCM 8-Series -powered BEV. As such, roughly speaking, the market needs to sell more than two LFP-powered BEVs for every one NCM/NCA-powered BEV sold for LFP to continue (re)capturing market share (by kWh deployed).

More Data and Insights from Adamas Intelligence

Must-have intelligence for automakers, cell suppliers, battery materials manufacturers, miners, explorers, investors and other stakeholders with a professional interest in the EV, battery and battery materials industries.

We offer a number of interactive data tools and subscription-based reports for clients seeking regular updates, analysis, and insights into the fast-moving markets and supply chains that we cover.

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 80 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

The tracker’s intuitive user interface and interactive charts and filters let users quickly zoom in on specific regions, countries, automakers, models, cell suppliers, battery chemistries, battery materials and more.

Subscription includes access to the online platform plus a wealth of Excel data, all updated monthly.

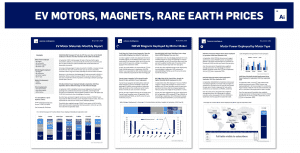

EV Motor Materials Monthly

Our new ‘EV Motor Materials Monthly’ is a subscription-based report and data service for tracking motor demand, NdFeB magnet demand, and other key developments in the global EV traction motor market month-after-month, as they happen; by region, country, motor type, EV type, EV make, EV model and motor supplier, plus the latest developments in rare earth and NdFeB alloy prices.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

EV Battery Capacity Monthly

Our ‘EV Battery Capacity Monthly’ is a subscription-based report and data service for tracking monthly deployment of battery capacity (in MWh) in passenger EV batteries by country, region, EV make, EV model, cell supplier, cell chemistry, EV type and more.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

EV Battery Lithium Monthly

Our ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking monthly deployment of lithium in passenger EV batteries by country, region, EV make, EV model, cell supplier, cell chemistry, EV type and more.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

EV Battery Nickel Monthly

Our ‘EV Battery Nickel Monthly’ is a subscription-based report and data service for tracking monthly deployment of nickel in passenger EV batteries by country, region, EV make, EV model, cell supplier, cell chemistry, EV type and more.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

EV Battery Cobalt Monthly

Our ‘EV Battery Cobalt Monthly’ is a subscription-based report and data service for tracking monthly deployment of cobalt in passenger EV batteries by country, region, EV make, EV model, cell supplier, cell chemistry, EV type and more.

Every report contains a detailed snapshot of the latest monthly market data, plus an additional 12 months of historical data for context and comparison. All reported monthly data available to subscribers in Excel format.

Back to overview