Global LFP adoption hits record as cathode’s share reaches 70% in China

The combined capacity of LFP packs deployed in newly sold EVs during the month reached 44.1 GWh, a 40% year-on-year increase. August was the second best month for LFP battery capacity deployed on record after June 2025.

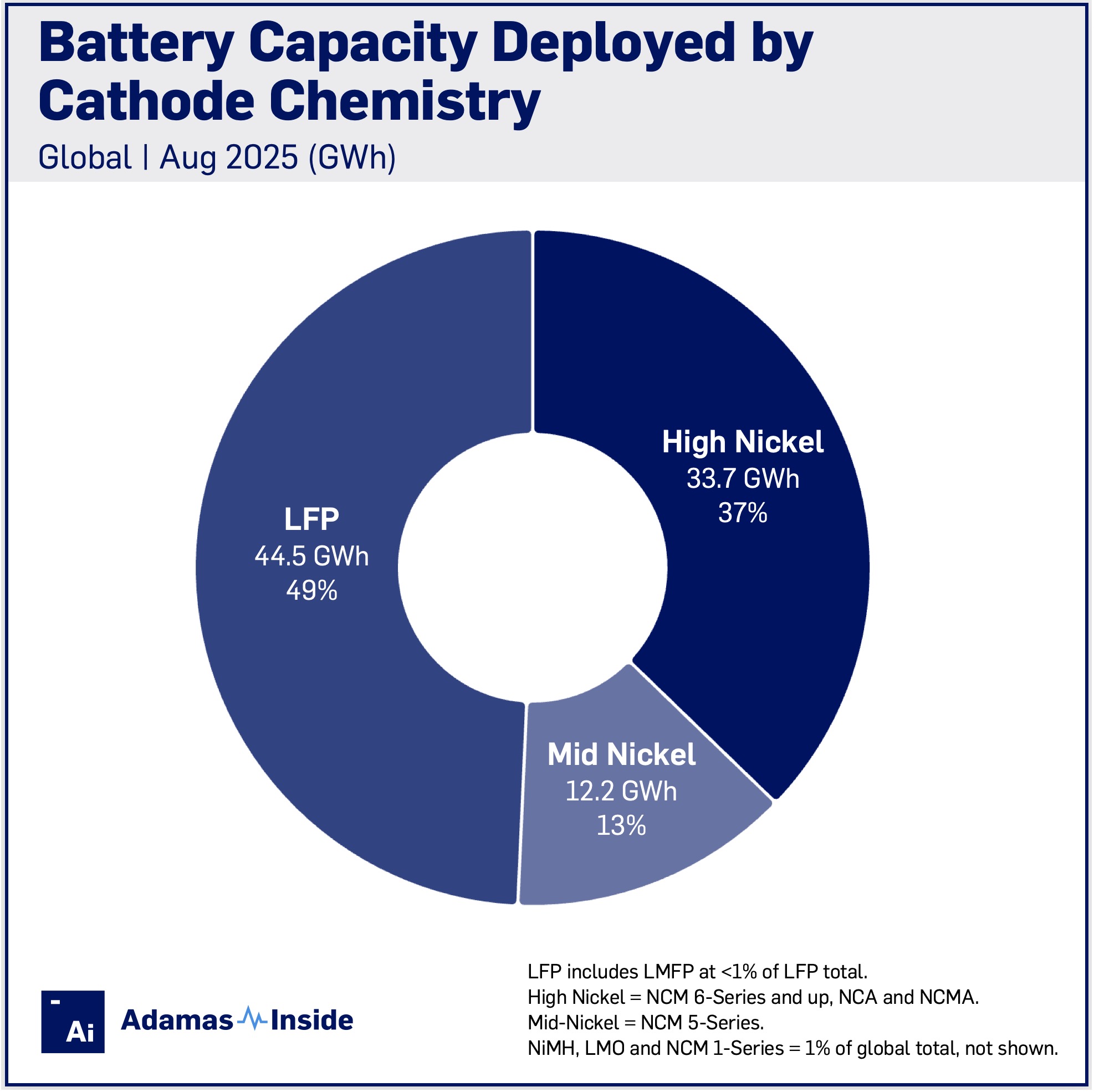

In August this year LFP was responsible for over 48% of global battery capacity deployed which clocked in at 91.4 GWh, underperforming the roll out of LFP with overall 24% growth year on year.

Over the first eight months of the year LFP was responsible for 295.6 GWh deployed, up 61% compared to the same period last year. The cathode chemistry represented 46% of the global total in GWh terms from January through August compared to 36% over the same period last year.

In China the cathode chemistry commanded just under 70% of the market in August. Of total global LFP battery capacity deployed in August, 39.9 GWh or 84% of the total rolled onto roads in China.

Among the top contributors to LFP adoption in the country in August were the Model Y assembled by Tesla in Shanghai, the popular new Geely Xingyuan subcompact hatch, and Xiaomi’s breakthrough SU7 sports sedan and its recently launched YU7 SUV.

In Europe LFP adoption remains limited and across the continent (including the UK and Russia), LFP battery capacity deployment was up sharply by 69% but still only amounted to 1.7 GWh for the month.

On the European market, LFP constituted 12% on a GWh basis in August.

The LFP versions of the Model Y and 3 led the pack in Europe followed by the Ford Explorer SUV made for the European market which sports an LFP pack supplied by CATL.

In the Americas, year-on-year growth was a more sedate 43% to 1.5 GWh. Tesla’s Model 3 accounted for 32% of LFP deployment in the Americas despite near zero year-on-year deployment growth. Overall adoption of nickel- and cobalt-free chemistry in the region is now pegged at 9%.

As an indication of Chinese automakers uneven ability to expand in the region, LFP deployment growth in August goes from 52% in Brazil to negative 5% in the US year over year.

Despite representing only around 2% of the global EV market in GWh terms, the role of Africa and the Middle East in the spread of LFP batteries is growing fast. In August, 1.0 GWh of fresh battery capacity hit roads in the region after tripling in size over August last year.

The Model Y represented 33% of LFP deployment in Africa and Middle East in August with the next five slots taken up by BYD-badged EVs.

From powering a few compact cars and utility vehicles in the passenger vehicle segment, LFP adoption kicked into high gear in early 2020.

The catalysts were BYD’s introduction of the so-called Blade prismatic battery pack and conversion of its entire model line-up to the cathode chemistry, and Tesla starting shipments of entry level LFP models from its Shanghai factory.

Fast forward to today and on a cumulative basis, more than a third or 1.1 TWh of the battery capacity installed since then has been in EVs equipped with LFP packs.

Contact the Adamas team to learn more or check out the intelligence services below.