Global car parc electrification slows as US market goes into reverse

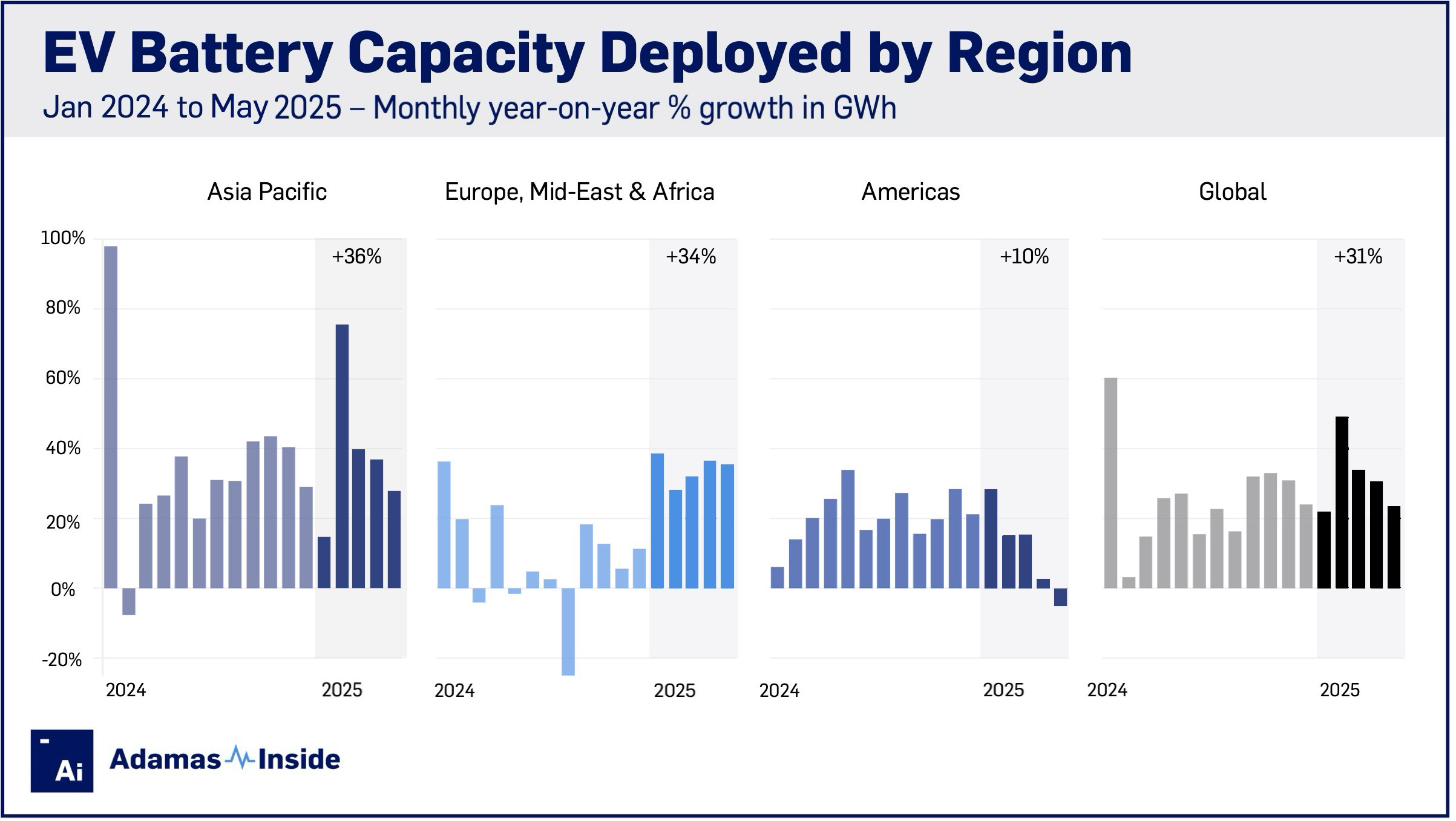

During the first five months of 2025, 376.5 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 31% more than the same period last year.

Asia Pacific added fresh capacity at a faster rate (+36% year over year) than the rest of the world although regional growth in Europe, Middle East and Africa is quickly catching up.

China continues to drive global growth, boasting its best monthly deployment of 2025 in May at 48.2 GWh and affording the country an eye-catching 57% of the global market.

By contrast in the Americas, where the US and Canada make up 90% of the market, monthly battery capacity is falling on a year-on-year basis for the first time in years.

EMEA momentum

The two top regional markets – Germany and the UK – expanded at a brisk pace January through May with battery capacity deployed surging by 52% and 40% respectively so far in 2025, helping to lift the EMEA region’s growth to above 34% in GWh terms. That’s despite a poor performance in France, the region’s third-largest market, where the GWh deployed in 2025 has now fallen below 2024 levels.

Volkswagen has been on a tear this year with EVs in the Wolfsburg stable occupying six out of the top ten spots on the continent in GWh terms, led by the ID.7. The all-electric sedan is a rare success story in a global market where SUVs, MPVs and crossovers are increasingly the norm.

Electrification in the Middle East and Africa continues to accelerate with the market expanding by 73% year to date.

Turkey has deployed 4.4 GWh of battery capacity, surpassing several more mature markets in the region. With a 133% year-on-year growth, it ranks sixth, closely trailing the Netherlands at 4.5 GWh and outperforming Norway, Sweden, and Denmark. The T10X manufactured by national champion Togg was responsible for one out of every five kWh rolled onto roads in Turkey in 2025.

US drags down Americas

After a decent first quarter, growth in the Americas has now gone in reverse, shrinking by 5% in May. Year-to-date regional growth now clocks in at just below 10% over 2024.

From January to May, new electric vehicles in the US increased battery capacity on roads by just 7%. May was particularly weak, with a negative growth of 8%, reaching only 9.6 GWh.

In Canada, battery capacity deployment grew by 14% year-to-date. In Mexico, capacity surged by 131% to 1.5 GWh, narrowing the gap with Brazil, which reached 1.8 GWh year-to-date. After a strong 2024, Brazil’s growth has slowed to single-digit percentages.

Tesla’s woes in Europe have been well-documented, but in its home market the Texas-based company is also struggling. Despite the introduction of the well-received new Model Y in North America at the start of the year, the combined battery capacity of the units sold this year across the Americas is down 15% to 10.4 GWh compared to the same period in 2024. While some of the sluggishness could be the model changeover, Tesla’s Model 3 has likewise underperformed with new owners steering a total of 3.9 GWh onto regional roads.

Terawatt year

In absolute terms over the five months, EV buyers in the Asia Pacific region rolled 231.5 GWh of fresh battery capacity onto the region’s roads.

European drivers (including those in the UK, Russia and non-EU states) added 80.0 GWh and those in the Americas 56.1 GWh. The Middle East and Africa’s contribution of a shade under 9.0 GWh to global battery capacity deployment now translates to more than 2% of the total and over 12% of the EMEA region.

With vehicle sales historically speeding up towards the end of the year (December 2024’s global tally fell just short of 100 GWh), 2025 could well still turn out to be the first year where 1 TWh of EV battery capacity is deployed worldwide.

However, efforts by China to ease the industry’s corrosive price wars and significantly slowing demand in US, may make that milestone recede in the distance.

In a surprise turn of events given its 2024 woes, the probability of terawatt year may hinge on European EV buyers’ continuing momentum.

Contact the Adamas team to learn more or check out the intelligence services below.