Germany’s 2025 EV battery capacity deployment surges by nearly 50%

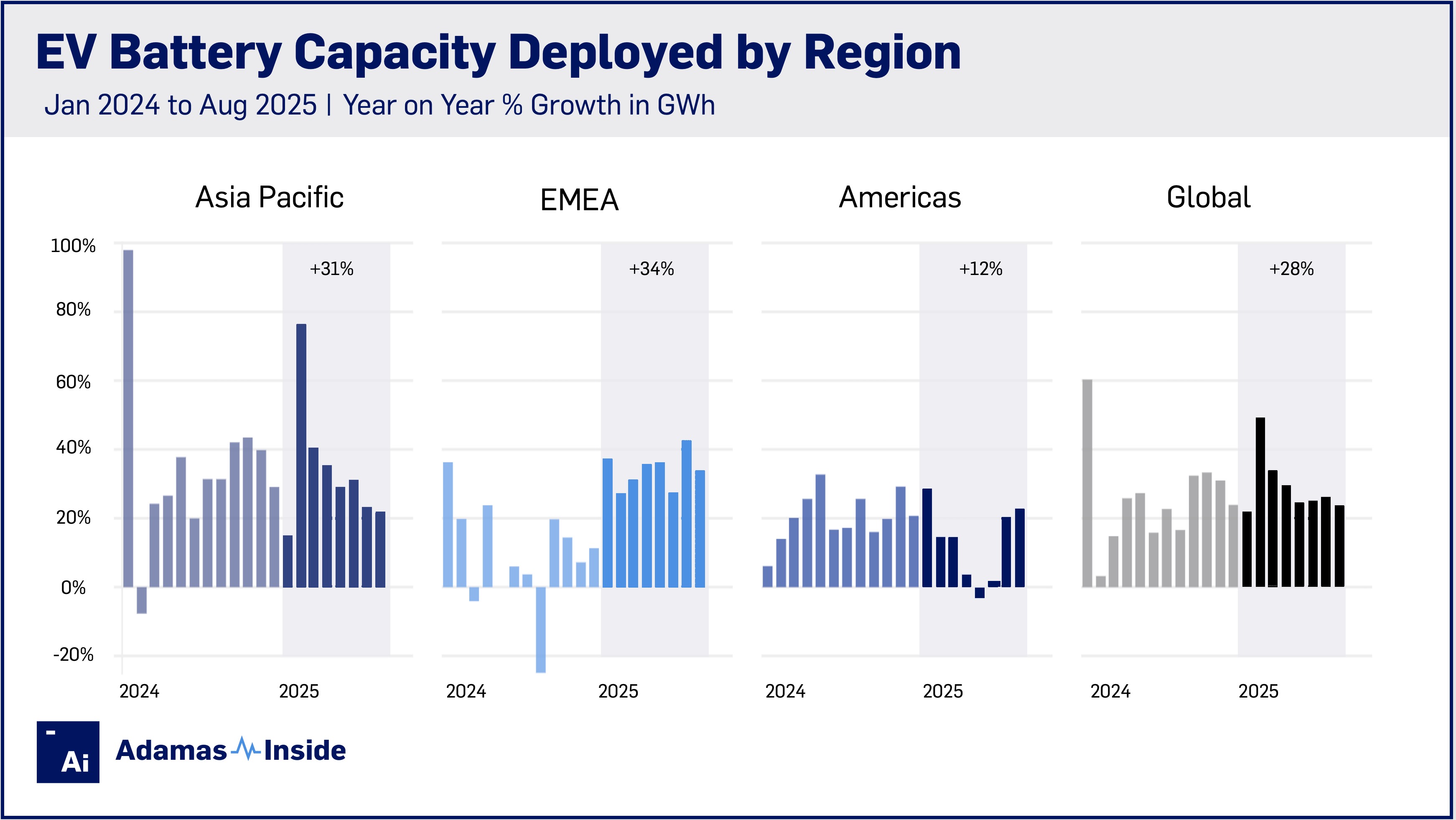

Over the first eight months of 2025, 648.5 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 28% more than the same period last year.

The Asia Pacific region accounts for 62% of global battery capacity deployment and so far this year has added GWh to roads at a faster pace than the rest of the world, but there has been a marked drop-off in expansion rates since the end of the first quarter.

In the region, August represented 22% growth in GWh over the same month last year, trailing Europe’s 27% electrification rate for the month and even falling behind the Americas, which, after dipping into the red during the second quarter, has regained momentum.

The Americas’ comeback was led by the US, which accounted for four out of every five GWh deployed across the two continents in August.

While customers in the US may have been hastening their EV purchases to beat the expiration of incentives at the end of September, Canada’s market has contracted by 25% year on year in August for a total of 1.2 GWh, a reflection of the uncertainty surrounding trade with its much larger neighbor to the south. Canada has the dubious distinction of being the worst performing major market in August. The only other sizable market that showed a decline was Belgium.

A surge in battery capacity deployed in Mexico (up 218% to 2.7 GWh year to date), the fourth-largest market in the Americas behind Brazil, helped keep the region aloft. Similar to the US, the Mexican market is likely being buoyed by buyers rushing to avoid more expensive EVs in the future.

The Mexican government under pressure from the US administration, has agreed to levy 50% import tariffs (up from 15% currently) on Chinese-made vehicles as part of its 2026 budget. The US and Canada instituted 100% surtaxes a year ago.

Germany, the world’s third-largest market, saw a 47% year-over-year surge in battery capacity deployed in August. In 2025 so far, German autobahns have welcomed 9.2 GWh additional battery capacity compared to 2024.

That translates to a much quicker electrification of the European nation’s car parc this year than the US, which only added 7.7 GWh through August.

Growth in France picked up considerably in August, up 21% year on year, bringing the country into positive territory for the year albeit only just with less than 1% growth compared to the first eight months of 2024.

Taken together, Europe, Middle East and Africa recorded market expansion of 34% in August, boosted by fast-growing markets like Turkey, now the world’s eighth largest in GWh terms.

Turkey recorded growth of 179% in August, hitting 1.2 GWh for the month and on its current trajectory could surpass Canada on a monthly deployment basis before the end of the year. Turkey is the fourth fastest growing major EV market globally after India, Mexico and Vietnam.

A cooling of the market in China saw the country’s year-over-year battery capacity deployment grow by just 18% in August. However, with 53.3 GWh deployed during the month, the sheer size of the market makes more sedate rates of expansion almost inevitable.

China’s efforts to moderate intense competition on its domestic market to prevent corrosive price wars, business failures, and overproduction (what Beijing calls “involution”) may also be starting to have an effect.

China’s slowdown may have been more marked if not for the nation’s EV buyers’ preference for full-electric vehicles, which inherently have larger batteries than their plug-in hybrid counterparts. Chinese buyers bought 20% more BEVs in August than in the same month in 2024, compared to only 2% increase in PHEVs sales.

Conventional hybrids have never been a significant part of the Chinese market, and sales of these minimally electrified vehicles continue to decline.

That stands in contrast to Japan, which, on a monthly battery capacity deployment basis, trails much smaller automotive markets such as Israel, Vietnam, and Austria, thanks to a heavy reliance on HEVs. Japan’s market in GWh terms stands at 3.4 GWh this year after an 8% decline year over year.

After a lackluster few years, South Korea’s EV market has taken off in 2025, reaching 10.7 GWh for the first eight months, a 72% year-on-year improvement. Deployment in August surpassed that of France, making South Korea the world’s fifth-largest market by GWh deployed for the month and less than a hundred MWh behind the UK.

Contact the Adamas team to learn more or check out the intelligence services below.