European vehicle parc electrification growth catches up with Asia Pacific

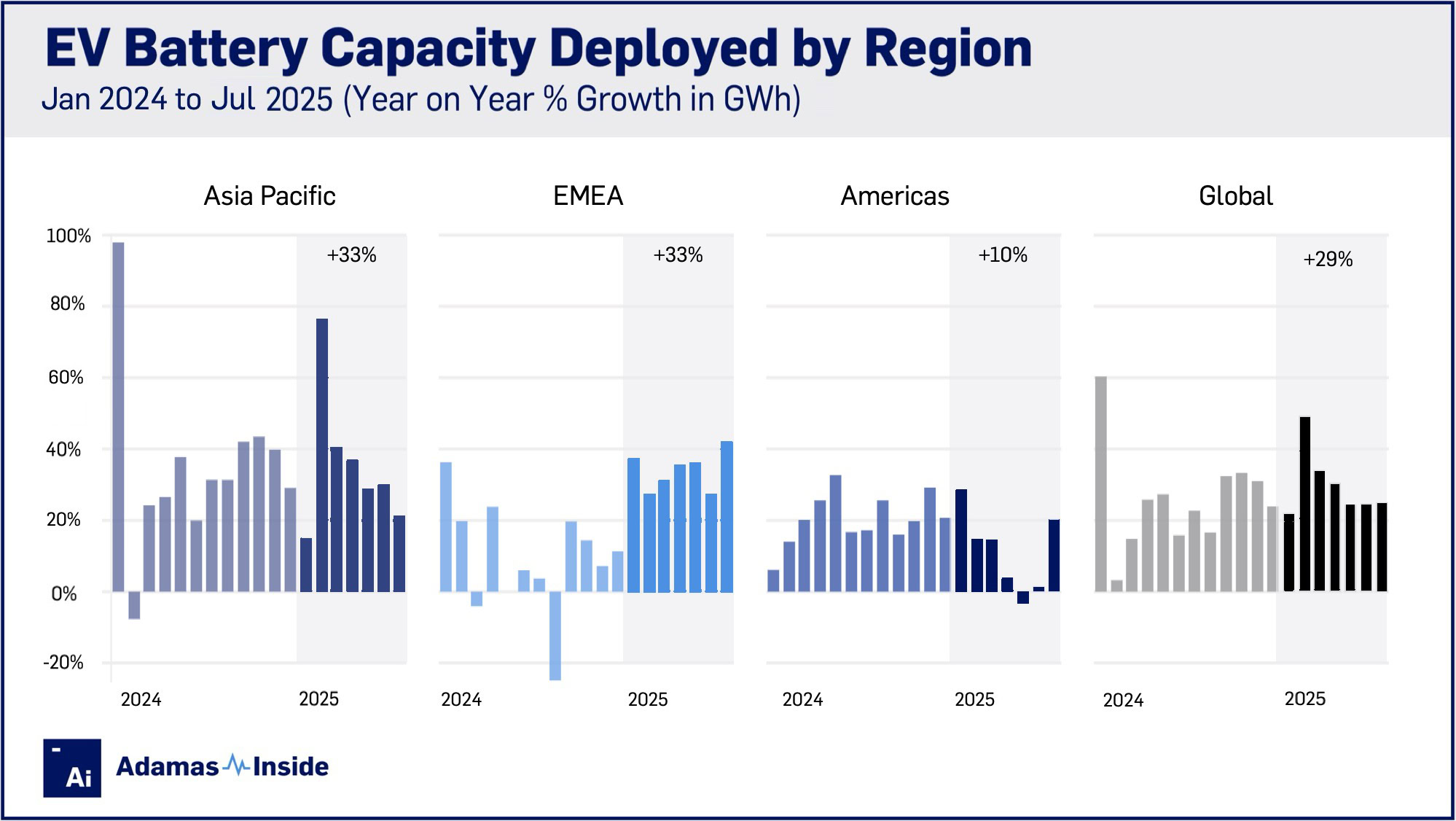

Over the first seven months of 2025, 556.0 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 29% more than the same period last year.

The Asia Pacific region has added new battery capacity faster than the rest of the world this year, accounting for 62% of global battery capacity deployment. However, there has been a marked drop-off in expansion rates since the end of the first quarter.

In the region, July represented a 21% growth in GWh over the same month last year. While this trails Europe’s 37% electrification rate, it matches the Americas’ rebound to just over 20% growth after a dismal second quarter.

The Americas’ comeback was led by the US, which accounted for four out of every five GWh deployed across the two continents in July, marking the best month so far this year with 14.1 GWh. Canada, which together with the US, comprises 91% of the regional market, however, contracted by double-digit percentage points.

Customers in the US may be bringing forward EV purchases before the expiry of incentives at the end of September. The bounce in the US market came about despite Tesla’s struggles to attract new customers. The combined battery capacity deployed in Tesla’s top-selling models (Model 3, Model Y, and Cybertruck) dropped by 17% in July compared to the previous year.

A surge in EV sales in Mexico, the fourth-largest market in the Americas behind Brazil, also boosted the region’s performance. The Mexican market may be hitting a wall in the coming months – under pressure from the US administration, the country imposed 50% import tariffs on Chinese-made vehicles in September. EVs imported from China made up nearly three-quarters of the battery capacity deployed in Mexico in July.

A cooling of the market in China saw the country’s year-over-year performance decline to 18% in July (the weakest month since January 2025). China’s efforts to moderate intense competition on its domestic market to prevent corrosive price wars, business failures, and overproduction (what Beijing calls “involution”) may be starting to have an effect.

The sheer size of the market and already high penetration rates (46% of all passenger vehicles sold in July were electrified, with the majority being full-electric models) would also be a factor in slowing growth.

It’s worth noting that the 305.0 GWh of battery capacity deployed from January to July this year already surpasses China’s 2022 annual tally.

After a lackluster few years, South Korea’s battery capacity deployment surged by 73% in July, reaching 1.8 GWh. This growth surpassed that of France, making South Korea the world’s fifth-largest market by GWh deployed for the month.

Breakneck growth in Indonesia, Vietnam, India and Malaysia should underpin expansion through the end of the year across the region, but a prolonged slowdown in China could put in jeopardy the chances of making 2025 the first year where 1 TWh of EV battery capacity is deployed worldwide.

Germany, the world’s third-largest market, saw a 63% year-over-year surge in battery capacity deployed in July. In 2025 so far, German autobahns have welcomed 47% more battery capacity than in 2024, and together with the UK, which grew 38% year-over-year, these nations are the fastest-growing major markets this year.

While growth picked up in July, measured over the first seven months of the year, France remains in decline compared to last year due to the winding down of EV incentives there.

Taken together, Europe, Middle East and Africa recorded market expansion of a whopping 42% in July, boosted by fast-growing markets like Turkey, now the world’s eighth largest EV market behind Canada in GWh terms. Turkey recorded growth of 191% in July, hitting 1.2 GWh for the month.

Contact the Adamas team to learn more or check out the intelligence services below.