Equinor partners with Standard Lithium on $160M deal

Flagship DLE

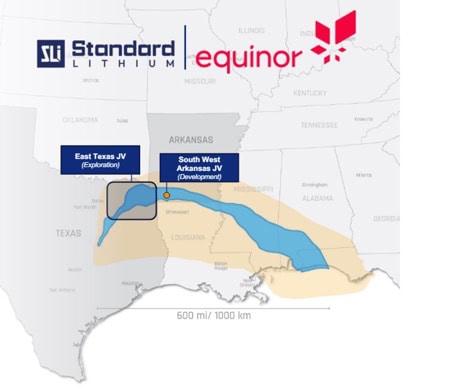

Norway’s state oil company, Equinor, will invest up to $160M into Standard Lithium’s South West Arkansas and East Texas projects, earning up to 45% stake in both.

The transaction involves three components, an initial $30M cash payment, a $60M work program (worth $33M carry to SLI) and a final $70M cash payment upon positive FID.

South West Arkansas is Standard Lithium’s flagship oilfield brine DLE project which completed a PFS in 2023. East Texas contains exploration tenements with promising 1,000+mg/L Li concentrations, roughly double that of South West Arkansas.

Adamas take:

The investment continues the recent trend of big oil moving into lithium, and specifically into the U.S. Smackover formation. Notably, in 2023, ExxonMobil initiated grassroots exploration drilling and R&D efforts into neighboring tenements in the region.

The deal piggybacks Equinor onto the extensive test work Standard Lithium has conducted on the brines which accelerates years of R&D relative to Exxon’s approach.

However, much of Standard Lithium’s work was spent on the development of a proprietary DLE technology which now appears to be discontinued in lieu of an outsourcing strategy, to the benefit of Koch Industries whose DLE technology has demonstrated superior performance.

In our view, the deal is heavily tilted to Equinor’s favor owing to the depressed lithium price environment. The $133M net investment to SLI values the two projects at $295M, a typical 33% premium to the company’s market capitalization prior to the announcement.

Assuming South West Arkansas’s PFS-defined $1.3B CAPEX is funded with 70% debt, 30% equity, it will require $215M in equity contribution from SLI.

In our view, only the $70M milestone payment upon FID is likely to contribute to CAPEX, resulting in a $150M funding gap the company will need to navigate.

[Extract from the May issue of the EV Battery Lithium Monthly service.]

Chris Williams, Analyst at Adamas Intelligence

Chris is an Analyst at Adamas Intelligence focused on the global lithium industry. He researches and analyzes the lithium value chain to uncover actionable opportunities for clients.

Chris has 11-years experience in mining and oil & gas operations optimization, delivering value from data intensive insight generation. He completed his Bachelor and Masters of Engineering at the University of Queensland, majoring in Mechanical Engineering, and is currently completing a Masters of Business Administration at the University of British Columbia.