Car parc electrification in the US falls further behind rest of the world

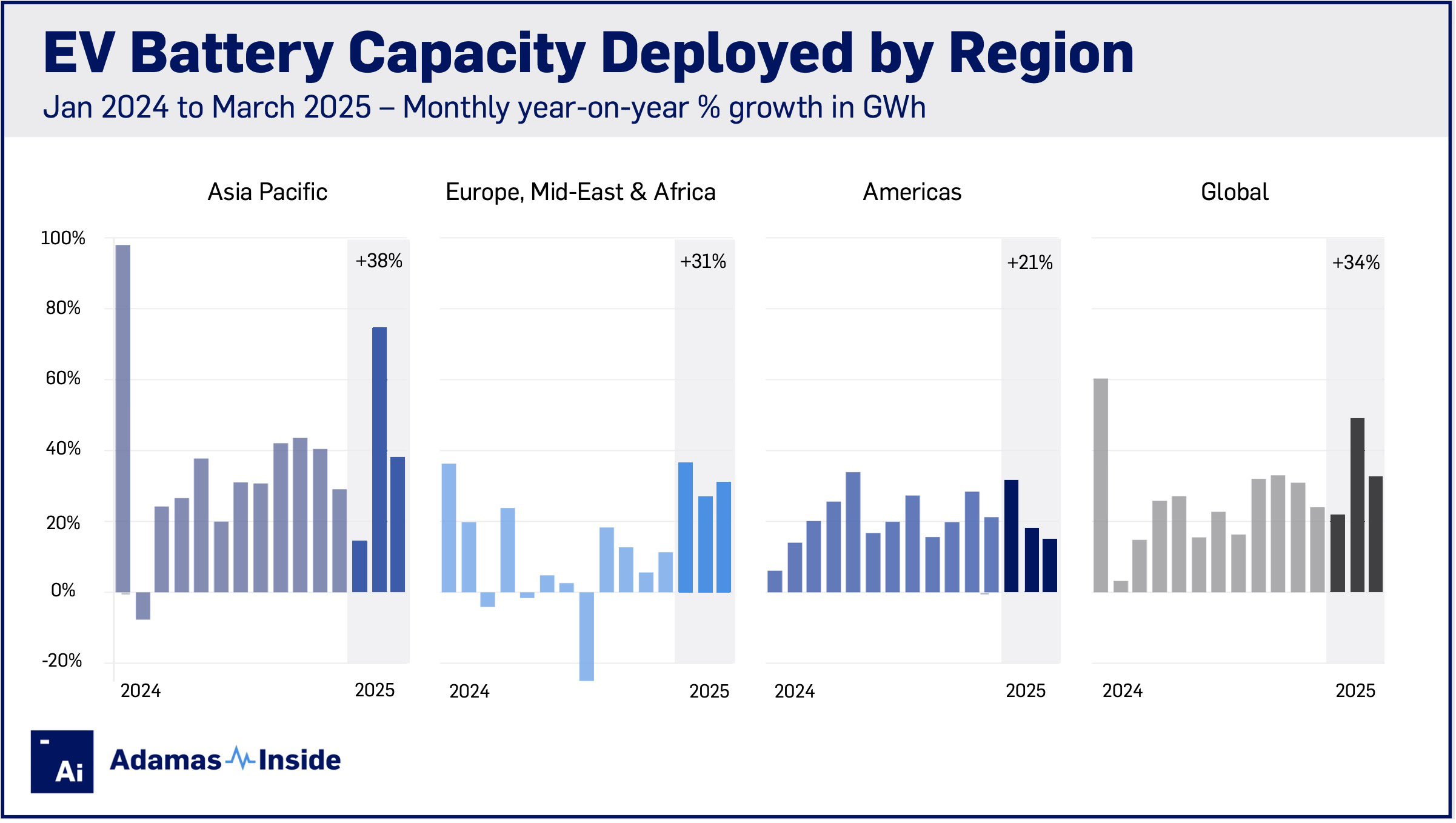

During the first quarter of 2025, 213.2 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 34% more than the same period last year.

Even with a commanding 60% of the global market, Asia Pacific still added fresh capacity at a noticeably faster rate (+38% year over year) than the Americas.

After going off to the races at the start of the year, the growth in the Americas – where the US and Canada make up 90% of the market – fell to the lowest in more than a year pulling down regional expansion to a more modest 21% in Q1 2025.

In Q1, new EVs in the US added 17% more battery capacity to the nation’s road. In Canada, new EVs increased battery capacity by 39%, while in Mexico, it surged by 167%.

After a choppy 2024 when the market went into decline more than once, strong growth returned to Europe with the market expanding by 29% year to date. Although less than a tenth the size of the European market, the Middle East and Africa grew rapidly, up 66% year over year to lift the EMEA region’s growth to above 31% in GWh terms.

In absolute terms, in Q1 2025, EV buyers in the Asia Pacific region rolled 127.2 GWh of fresh battery capacity onto the region’s roads while European drivers (including those in the UK, Russia and non-EU states) added 47.7 GWh and those in the Americas 33.6 GWh. The Middle East and Africa’s contribution of 4.7 GWh to global battery capacity deployment now translates to more than 2% of the total.

The strong start to the year in Europe was due in part to a change in the sales mix towards full electric vehicles with BEV sales rising by 29% year over year in Q1 2025 compared to a growth rate half that for new plug-in hybrid registrations.

In Asia Pacific, BEVs have also outpaced PHEV sales so far in 2025, reversing a trend in place for the last few years. BEVs represented 48% of the 3.7 million electrified vehicles sold in the region during the first three months of the year, led by China where more than half of EV buyers opted for full electric vehicles.

In Q1, EV sales in the Americas fell short of the one million mark, with BEVs being responsible for 36% of sales. The minimally electrified conventional hybrids constituted the bulk of the American EV market.

A new bill making its way through the US Congress, which comes on the back of already disruptive tariffs affecting the North American automotive industry, could have a massive impact on the regional market.

The provisions of the bill to extend tax cuts implemented during the first Trump administration include eliminating the generous $7,500 US federal tax credit for new EVs by the end of next year. The $4,000 tax credit for used EVs would be repealed, as would subsidies for home charging stations.

Existing owners could face a $250 annual fee to make up for lost gas tax revenues for the public purse while businesses would now also be cut off from credits for leased fleets.

While far from finalized, some changes are likely to make it into law which would encourage prospective EV buyers to pull purchases forward before the credits run out.

That could boost the US electric car market in 2025 but would probably see the country fall further behind the rest of the world through the end of the decade.