BYD contribution to China’s car parc electrification falls to lowest in four years

During the third quarter of 2025, 287.8 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 26% more than the same period last year and the highest quarterly deployment on record.

The quarter was boosted by a breakout September with global battery capacity deployed hitting a new all-time high at 109.5 GWh (the first month ever in triple digits) after year-on-year growth of more than 27%.

China found itself in the uncharacteristic position of being one of the slowest growing major EV markets in Q3 at just over 19% year on year to 162.3 GWh. While the rest of the world was setting new records, China is still to beat Q4 2024 when 168.6 GWh of fresh capacity was deployed.

The Chinese performance contrasts with the US which gained 36% or 40.9 GWh over the three months and Europe, led by Germany (+50% to 11.4 GWh), which sped ahead by 30% overall adding 51.4 GWh to end-September.

China’s efforts to moderate intense competition on its domestic market to prevent corrosive price wars, business failures, and overproduction (what Beijing calls the “involution” of the industry) are starting to have an effect.

Tide going out

Nowhere is the cutthroat nature of the domestic Chinese market more evident than in the recent fortunes of BYD, the world’s top EV brand.

Established as a mobile phone battery manufacturer in the mid-90s, the Shenzhen-based company moved into autos in 2003 with the acquisition of Qinchuan Automobile. BYD only halted all production of pure internal combustion engined vehicles in March 2022.

While still streets ahead of its nearest rival in battery capacity deployed, BYD’s share of the domestic EV market fell to its lowest level in four years in Q3 2025.

BYD cornered 18% of the Chinese market in GWh terms during Q3, the first time the company’s share fell below 20% since Q4 2021. BYD’s contribution to the electrification of Chinese roads peaked at 28% at the start of 2023.

BYD moves vast numbers of plug-in hybrids, about half its shipments, a testament to its ICE roots.

The reliance on PHEVs drags down the average battery size of BYD’s fleet – at 36.8 kWh for the units sold so far this year, it is well below its all-electric rivals like Tesla (72.3 KWh), Xiaomi (91.7 kWh) and Leapmotor (54.5 kWh). Xpeng also sells PHEVs, but the upmarket EV maker’s average size still clocks in at 69.6 kWh per vehicle.

Some erosion of BYD’s competitive position was inevitable in a market where over 100 makes compete for EV buyers’ attention and barriers to entry for startups are low. Like BYD, many brands have also moved into EVs after honing skills in other tech industries.

But so far, economies of scale, vertical integration and a low-cost all LFP battery strategy that helps it price even some well-equipped models below $10,000, have protected the automotive giant’s outsized role in the Chinese EV industry.

Offshoots

Even when considering BYD Company Limited’s more upmarket offshoots Denza (which started life as a joint venture with Mercedes-Benz a decade ago), and the Yangwang and Fang Cheng Bao brands, both launched in 2023, the group’s share in China is now down to early 2022 levels.

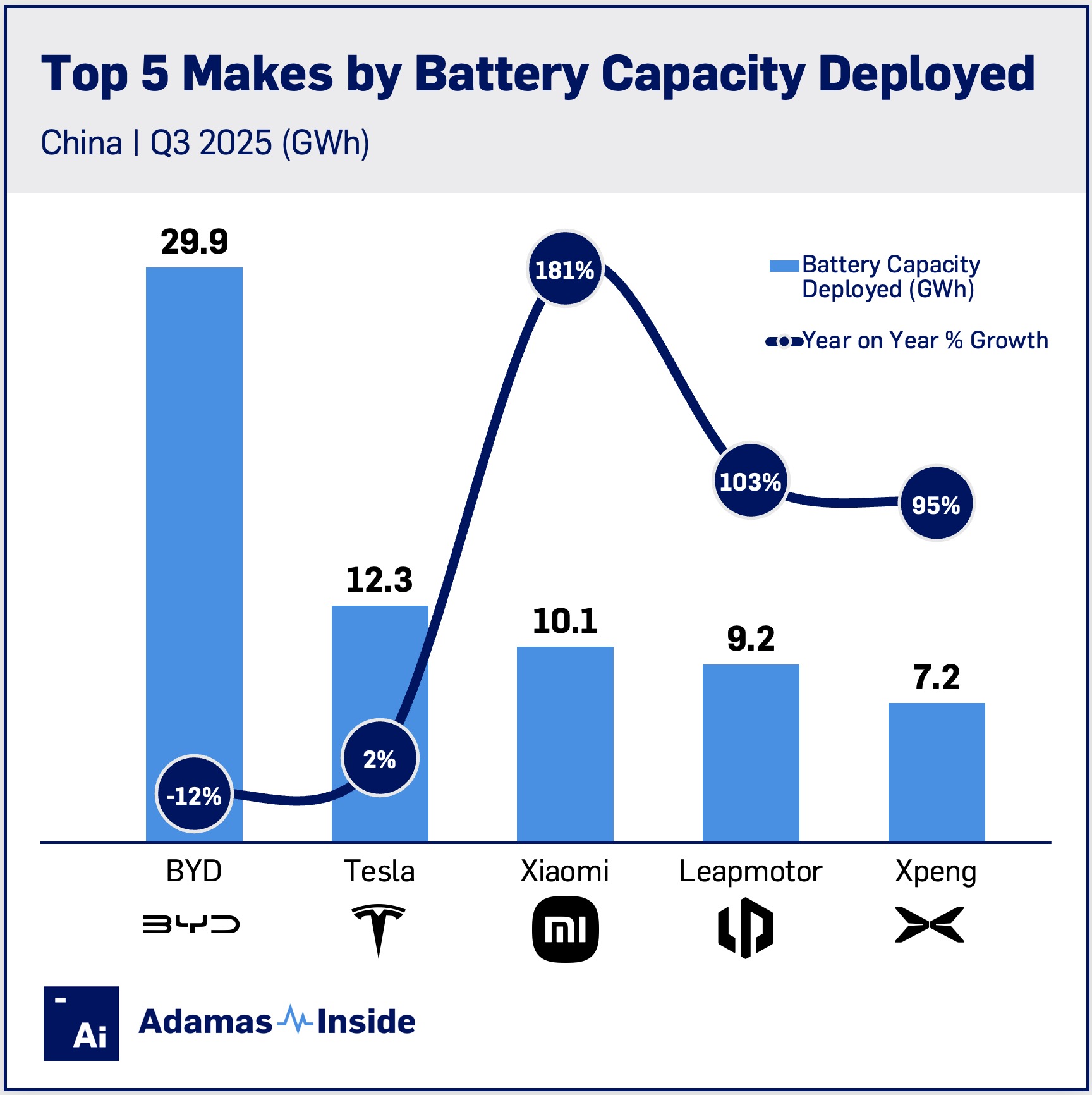

In absolute terms BYD also had an unhappy Q3 with 29.9 GWh deployed, a 12% year-on-year decline.

Tesla in second spot eked out gains – up 2% to 5.8 GWh in Q3, but other top makes enjoyed a blockbuster three months.

Newcomer Xiaomi, which after less than two years on the market shot up to the third spot, expanded GWh deployed by 181% to 10.1 GWh.

Leapmotor drivers rolled 103% (9.2 GWh) more battery capacity onto China’s roads and Xpeng’s 7.2 GWh for Q3 represented a 95% increase over the same quarter last year. Both Leapmotor and Xpeng have only been in existence for little over a decade and their founders first made a name for themselves in tech and telecoms.

Against the current

Another indication of the bumps in the road for BYD is that its best placed model, the Sealion 06, only made it to number eight for the quarter in terms of combined battery capacity deployed for the quarter.

The company’s new Sealion 06 mid-size SUV led the pack, but its bread-and-butter models, the Seagull and the Yuan Plus (called the Atto 3 outside China), have become long in the tooth for some buyers, falling by 45% and 54% in GWh terms respectively.

Tesla’s Model Y holds onto the top spot, and the Model 3 comes in at number 5. Xiaomi’s launch model, the SU7 sports sedan, is second, and its new SUV is already at number 4. Xpeng’s Mona M03, a compact sedan, ranked seventh.

Geely’s eponymous Xingyuan, a new subcompact crossover, splits the top ranked makes coming in at number three models for the quarter for battery capacity deployed.

When considering all the brands in the Geely Group stable, the company places second in Q3 in GWh terms behind BYD, pushing single-brand automakers like Tesla, Xiaomi and Leapmotor down the table.

Contact the Adamas team to learn more or check out the intelligence services below.