The Global Passenger EV Market to Deploy 762.9 GWh Onto Roads in 2023

A bold data-backed prediction from Adamas Intelligence

In 2023, a booming 762.9 GWh of battery capacity will be deployed onto roads in newly passenger EVs globally (+/- 12%), Adamas Intelligence predicts.

Additionally, in 2023, Adamas projects that 19.7 million passenger EVs (HEVs, PHEVs, BEVs) will be sold globally (+/- 10%), translating to a sales-weighted average pack capacity of 38.7 kWh, up from 34.0 kWh in 2022.

The Adamas rule of thumb for predicting battery capacity deployment

Adamas Intelligence analysis has identified an interesting trend from which we have established an insightful “rule of thumb”.

Over the past 8 years, we have observed that the amount of battery capacity deployed onto roads in December of each year provides a reasonably accurate estimate for the average monthly capacity to be deployed in the year to follow.

In other words, if we multiply the amount of battery capacity deployed onto roads in December of a given year by twelve, the result tends to be within +/- 12% of the actual deployment in the year to follow.

Below we can see the actual battery capacity deployed onto roads each year since 2015 versus what was predicted by the Adamas rule of thumb.

From 2015 through 2018, the rule of thumb predictions were accurate to within a range of +5% and -12%.

In 2019, the rule of thumb over-predicted reality by 35%. This was due to a spike in EV sales in December 2018 in China in advance of subsidy rollbacks that provided a false signal for the year ahead.

In 2020, the rule of thumb over-predicted reality by 12%, or rather, the onslaught of COVID-19 kept reality from reaching predicted levels.

In 2021 and 2022, the Adamas rule of thumb predicted global battery capacity deployment to within 6%, leading us to boldly project that 2023 will see a whopping 762.9 GWh deployed onto roads globally.

Rule also effective at predicting EV unit sales

Similarly, over the past 8 years, we have observed that the number of passenger EVs (HEVs, PHEVs, BEVs) sold in December of each year provides a reasonably accurate estimate for the average monthly sales in the year ahead.

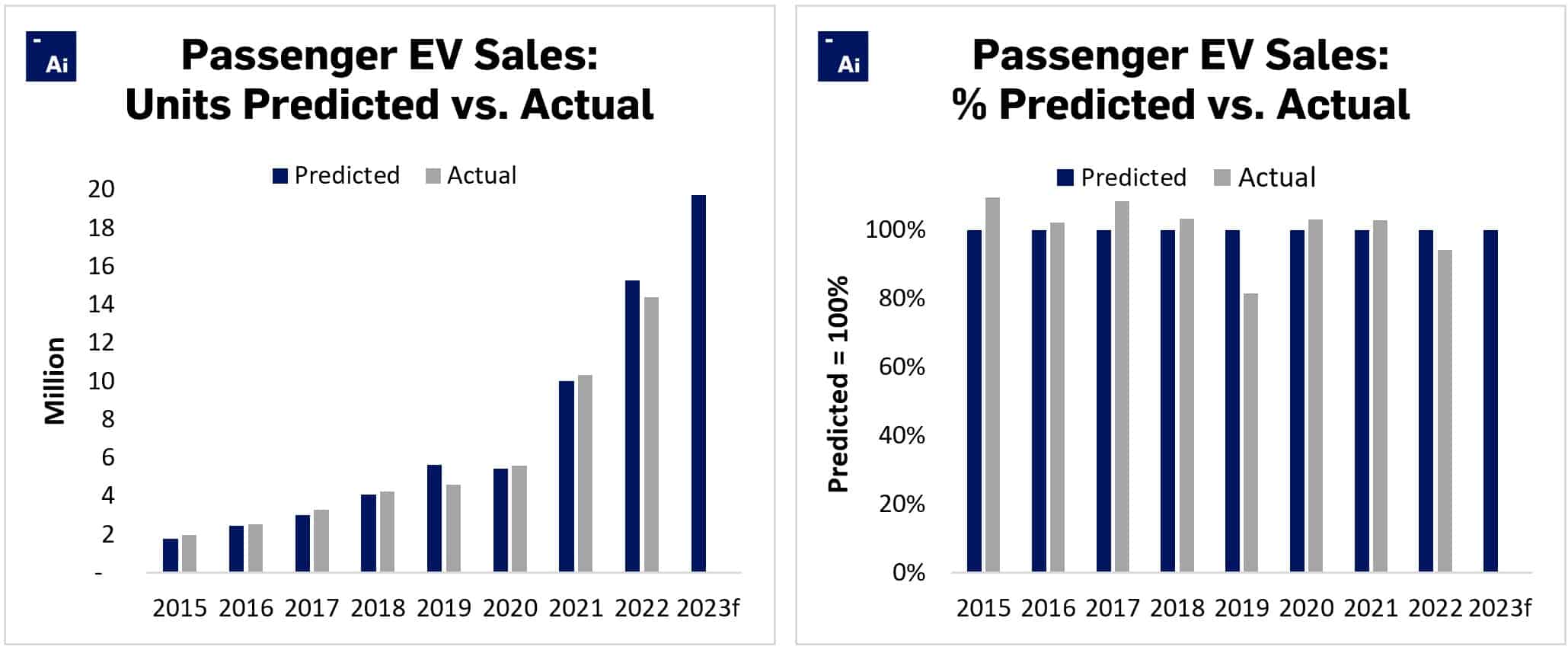

Below we can see the actual passenger EV sales each year since 2015 versus what was predicted by the Adamas rule of thumb.

From 2015 through 2018, the rule of thumb predictions were accurate to within 10%.

In 2019, the rule of thumb over-predicted reality by 23%. As with battery capacity, this was due to a spike in EV sales in December 2018 in China in advance of subsidy rollbacks that provided a false signal for the year ahead.

In 2020 and 2021, the rule of thumb predictions were within 3% of actual sales numbers each year and in 2022 within 6%.

As such, Adamas confidently projects that 19.7 million passenger EVs will be sold globally in 2023, a 29.1% increase over 2022.

Exceptions to the rule

The Adamas rule of thumb provides a solid proxy for the upcoming year assuming that the overarching macroeconomic conditions and incentive structure that exist in December are not fundamentally upended in the year to follow.

Changes to incentives for EVs can stimulate a short-term spike in sales that provides a misleading signal for the year ahead.

Similarly, major changes to macroeconomic conditions, like those provoked by the pandemic or the Russia – Ukraine war, can suppress global EV sales and battery capacity deployment, leading actual market performance to fall short of predictions.

Additionally, it should be noted that the Adamas rule of thumb is not as effective at the level of individual countries, EV types, makes, models, and more. For individual markets or segments, one must take a more nuanced approach.

Lastly, it should be emphasized that the global EV sales market cannot sustain double-digit growth indefinitely. As the market matures and growth slows, the rule of thumb will begin to increasingly overshoot actual results.

However, for the coming 3 to 5 years, we’re confident the Adamas rule of thumb will continue to deliver.

EV, Battery and Battery Materials Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 100 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Rare Earth Intelligence:

Rare Earth Magnet Market Outlook to 2035

In this report, we provide a detailed overview of the global NdFeB alloy, powder, magnet and magnet rare earth oxide markets, including a breakdown of historical production, consumption and prices from 2015 through 2021. Next, we unravel the anticipated near-term impacts of the pandemic recovery on world markets and forecast global supply, demand and prices from 2022 through 2035.

Rare Earth Pricing Quarterly Outlook

The ‘Rare Earth Pricing Quarterly Outlook’ subscription-based report looks back on the rare earth market’s performance over the trailing three months and details Adamas Intelligence’s latest near-term and long-term rare earth oxide (“REO”) price forecasts to 2035.

Rare Earth Minerals Monthly

The ‘Rare Earth Minerals Monthly’ is a subscription-based report and data service for tracking global rare earth minerals trade, mineral concentrate prices, rare earth oxide prices, payability ratios, and other key developments on the supply- and demand-side of the market month-after-month.

EV Motor Materials Monthly

The ‘EV Motor Materials Monthly’ is a subscription-based report and data service for tracking motor demand, NdFeB magnet demand, and other key developments in the global EV traction motor market month-after-month, as they happen; by region, country, motor type, EV type, EV make, EV model and motor supplier, plus the latest developments in rare earth and NdFeB alloy prices.

EV Motor Power and Motor Materials Tracker

Building on ongoing EV registrations in over 100 countries, our web-based platform helps users track monthly deployment of motor metals and materials, motor units, motor power, and the ever-evolving competitive landscapes of motor types and motor suppliers.