EV battery nickel deployment by cathode chemistry and region

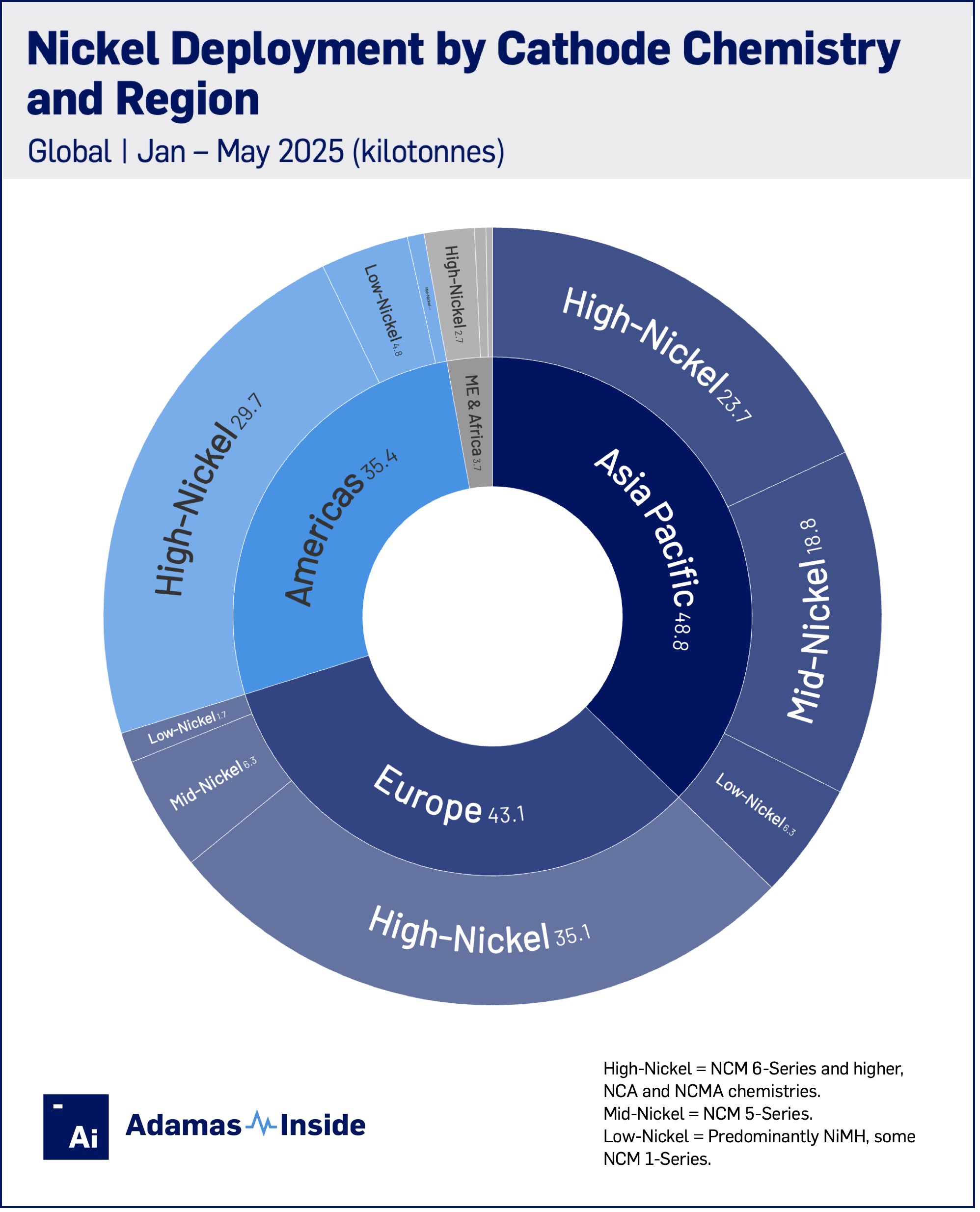

In the first five months of 2025, batteries in electric vehicles (EVs), including plug-in and conventional hybrids, contained 131.3 kilotons of nickel, a 12% increase compared to the same period in 2024.

Nickel deployment in EV batteries grew more slowly than overall battery capacity, which reached 376.5 GWh, a 31% increase from January to May 2025 compared to the same period in 2024. New EV registrations climbed 28% to 10.7 million units, with robust growth in Europe, the Middle East, and Asia Pacific offsetting weaker demand in the Americas.

Nickel’s underperformance was mainly the result of Chinese automakers’ continued preference for LFP batteries and lingering use of low-nickel NCM packs, which have seen a negative year-on-year nickel deployment growth in the region.

In January-May 2025, nickel deployment across the Asia Pacific region declined by 1% to 48.9 kt, mostly due to a retreat in mid-nickel cathode usage, which fell by double-digit percentage points.

NCM 5-Series remains the cathode chemistry of choice for some Chinese automakers’ mid-market offerings, but LFP is quickly eating into this segment too.

Total nickel in the battery packs of newly sold EVs in the Americas, the vast majority of which in the US and Canada, advanced by 10% to 35.5 kt while in Europe deployment surged by 31% to 43.3 kt. The Middle East and Africa are increasingly contributing to nickel deployment in EV batteries, accounting for 3% of the global market with 3.7 kt, a 28% rise compared to the same period last year.

While LFP captured nearly two-thirds of the Asia Pacific market in GWh terms in January-May, the nickel-free cathode chemistry only represents 12% of battery capacity deployment in the rest of the world despite growing by 44% year on year.

The high-nickel batteries still reign supreme outside China, with NCM 6-Series and higher, NCA and NCMA packs accounting for 61% of the metal rolled out so far this year, up from 56% during January through May last year.

EVs fitted with mid-nickel batteries are an afterthought in the Americas, making up less than 2% of the total or 0.9 kt versus 6.3 kt in Europe, a 15% share.

Nickel deployment in Western markets was also boosted by HEV buyers. These minimally electrified vehicles only play a small part in Chinese automakers’ EV fleets as consumer preferences skew to full electric, plug-in hybrids and range extenders (EREVs).

Conventional hybrids, which are predominantly fitted with nickel metal hydride batteries and a growing proportion of other nickeliferous packs, made up for their humble size (average nickel contained comes to 4.3 kg per EV) through volume.

HEVs were responsible for 10% of global nickel deployment in January through May 2025, outperforming the overall market with 14% growth year on year to 13.2 kt and coming to within shouting distance of nickel deployment in PHEVs which expanded by only 2% to 15.2 kt over the first five months of the year compared to 2024.

Note: Reported battery capacity and materials deployment constitute installed terminal tonnes of materials and do not take into account losses during conversion, refining and manufacturing processes.