US suffers worst month for EV battery capacity deployment in three years

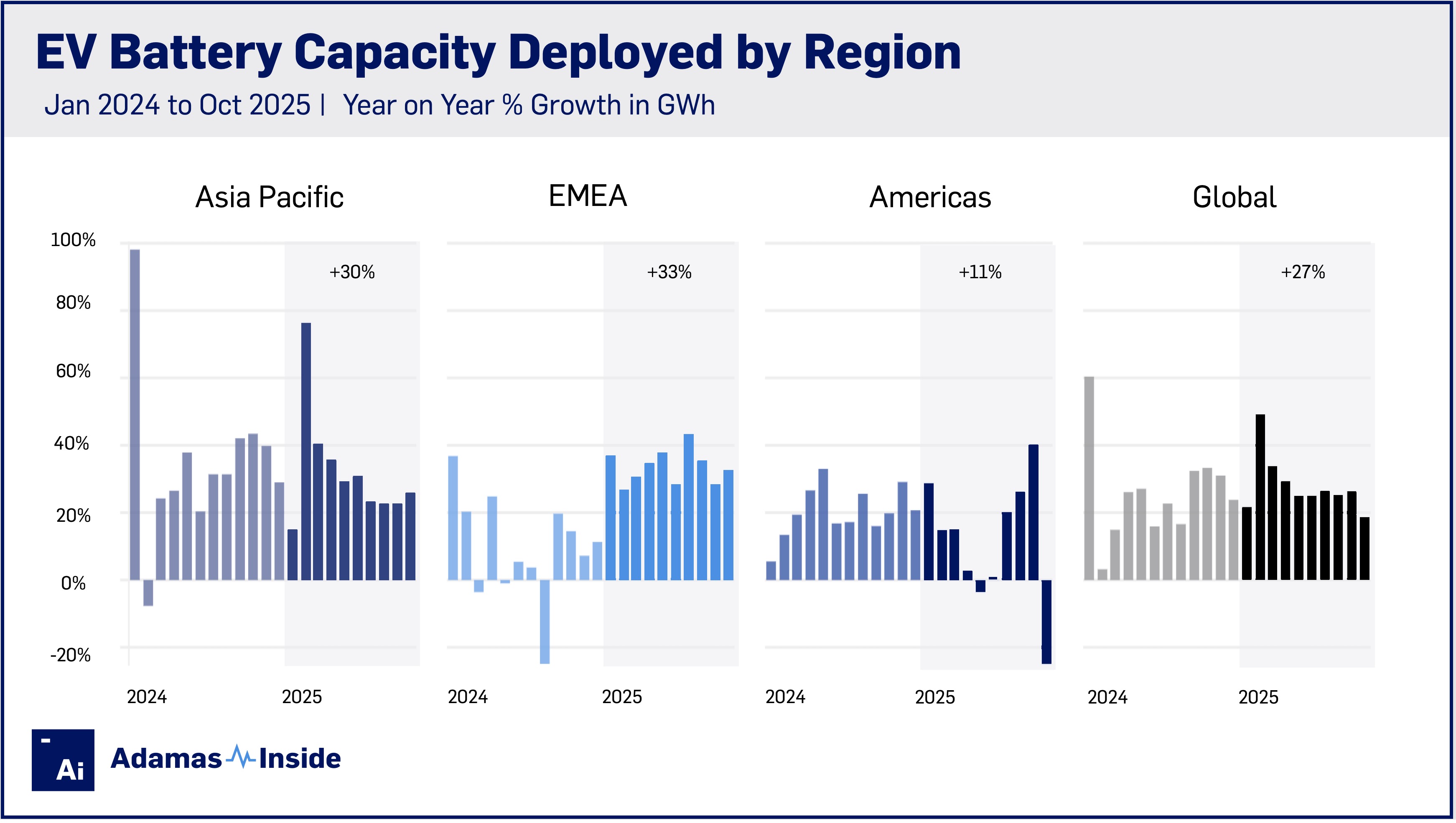

Over the first 10 months of 2025, 858.5 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 27% more than the same period last year.

October was only the second month on record after September where global battery capacity deployed hit triple digits. That sets up 2025 to become the first ever calendar year to see 1 TWh of fresh battery capacity hit the world’s highways and byways.

Asia-Pacific recorded 70.8 GWh deployed in newly sold EVs in October, easily clearing the previous monthly record for the region set in September of 67.5 GWh.

Europe fell short of its September all-time high of 21.7 GWh but still came in at a robust 18.6 GWh for October. In the Americas, battery capacity deployed plummeted as expected following the withdrawal of US retail incentives at the end of September.

At only 6.4 GWh in October, the US saw a 57% month-on-month plunge from the country’s record-setting September. October was the worst month since November 2022 for the American EV market. The slump in the US was enough to drag global monthly growth in October to the lowest since August last year.

Year to date expansion

Canada is experiencing an even softer year than its southern neighbour. While the US is still in positive territory year to date, Canada has experienced a string of bad months and the country’s car parc electrification rate is now below the same 10 months last year.

The US and Canada represent 92% of the market in the Americas, and the underperformance of the two countries dragged down regional growth to 11% year to date, hitting 125.2 GWh for the 10 months.

After slower third quarter growth, Asia Pacific has rebounded, lifting regional deployment from January through October 2025 by nearly 30% year on year to a total of 543.3 GWh.

The robust expansion is made more remarkable by the fact that Asia Pacific accounted for a full 63% of global battery capacity deployment over the 10-month period.

After a choppy 2024, European growth has been consistently strong in 2025, and year-to-date the region has expanded by 30% to 170.4 GWh.

When adding the still small (2% of the global total) but fast-growing Middle East and Africa market, year-on-year growth rises to 33% to 190.1 GWh as per the accompanying graph.

The EMEA region was responsible for more than one out of every five fresh kilowatt hours hitting global roads for the first time through October.

Country growth

Among the top 10 countries for year-to-date EV battery capacity deployed, Germany and South Korea stood out as the strongest performers, while Turkey recorded the fastest growth (+128%, reaching 10.6 GWh)

Germany, the world’s third-largest EV market after China and the US, grew by 47%, reaching 37.1 GWh over the first ten months. South Korea, ranked sixth globally, has returned to strong growth after several lacklustre years, posting a 67% year-on-year increase to reach 14.1 GWh, while Turkey surpassed more mature European markets including Norway, Netherlands, Belgium, Sweden and Denmark to occupy the number eight slot.

Global leader China expanded at a 27% year-over-year rate to 484.5 GWh and the US market in second with 103.5 GWh, added 11% more battery capacity to roads this year than in 2024.

The UK, the fourth largest market this year in GWh terms, expanded by 35% through October, clocking in at 32.4 GWh, opening up a healthy gap to fifth-placed France which only grew by 7% for 18.4 GWh deployed so far this year.

Canada is the only top country to show a year-over-year decline, down 14% to 11.1 GWh, and, on current form, could cede its position at number seven to Turkey before the end of the year.

Norway and the Netherlands, slotting in at position nine and 10, grew by 34% and 17% respectively with both countries adding 9.4 GWh to roads within their borders.

Contact the Adamas team to learn more or check out the intelligence services below.