Top 5 EV cell suppliers by manganese deployed

Rather than eat into LFP’s market share as expected, LMFP's still tiny contribution (<1%) to manganese deployment has declined sharply year over year.

Over the first nine month of 2025, a total of 55.7 kt of manganese were deployed onto roads globally in the batteries of all newly sold passenger EVs (BEVs, PHEVs and HEVs) combined, 5% more than the same months last year.

Growth rates for manganese deployment were on par with that of cobalt (+5% to 45.1 kt) but well below nickel (+13% to 257.7 kt) as the trend towards higher nickel content battery chemistries, including NCM and NCMA, continues and mid-nickel cathodes (around 30% or less Mn content) go into a slow retreat.

The widespread adoption of LFP in China (now 70% on a battery capacity deployed basis) is the main culprit behind the underperformance of manganese.

At the same time LMFP (lithium manganese iron phosphate) batteries have not lived up to their billing. Rather than eat into LFP’s market share as expected, the chemistry’s still tiny contribution (<1%) to manganese deployment has declined sharply year over year.

Many automakers are considering LMFP for entry and mid-tier vehicles, notably Volkswagen through its partnership with Chinese cell supplier Gotion and BYD which is said to be testing the batteries in a few niche models, but large-scale deployment is probably years away.

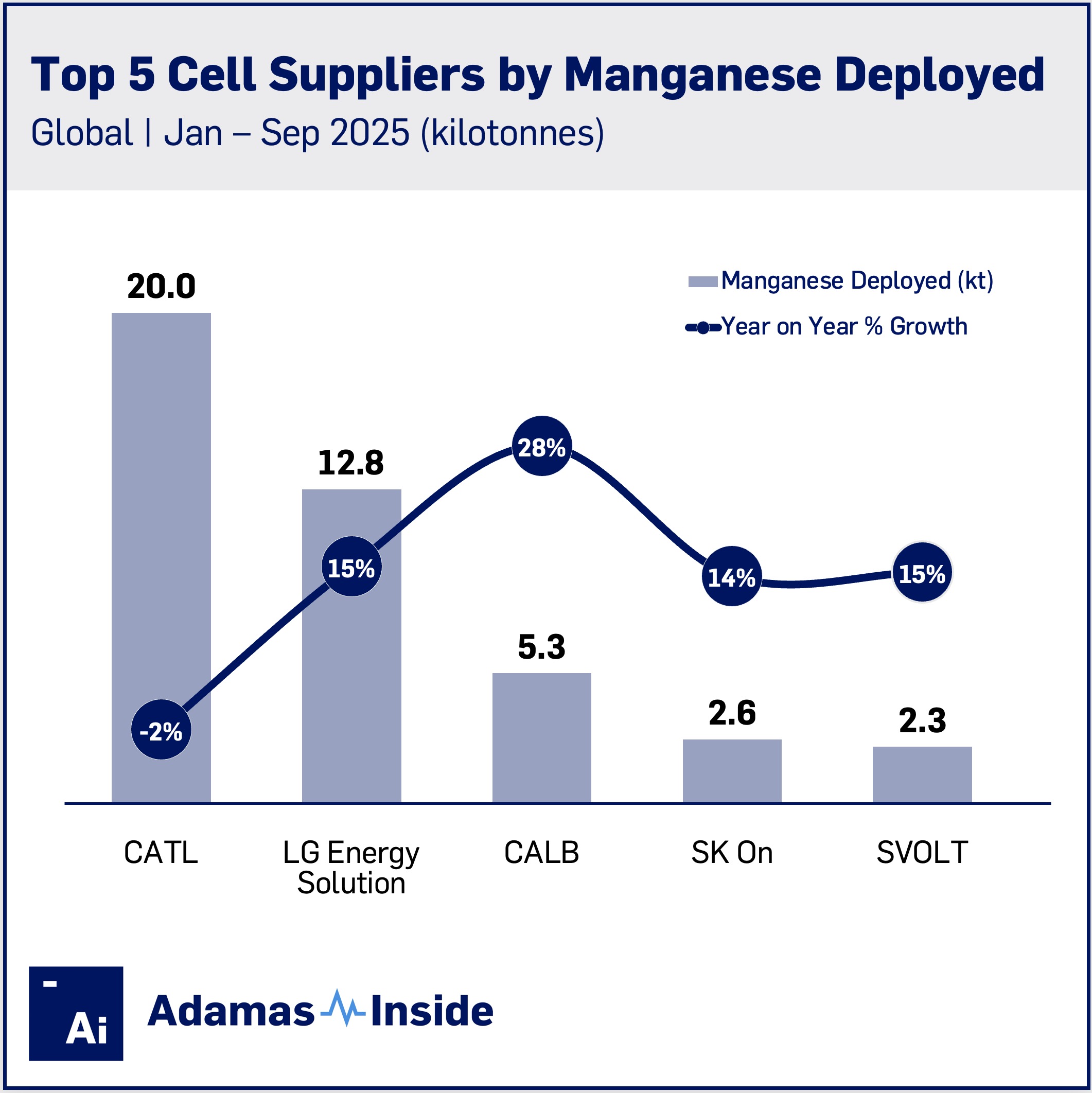

CATL, which does commercially supply LMFP cells currently, has a wide lead over rivals with 20.0 kt of manganese deployed from January through September, a 2% decline year-over-year.

CATL cornered 30% of the global market by battery capacity deployed so far this year but enjoyed an even greater slice of the manganese pie at 36%.

Despite manganese-free LFP cells making up over 40% of CATL chemistry mix on a GWh basis, the Chinese behemoth continues to have a large customer base for mid-nickel batteries. NCM 5-Series batteries were responsible for a full three-quarters of the company’s nickel deployment.

In second spot, LG Energy Solution deployed 12.8 kt through end-September 2025, 15% more than the same months last year on the back of high-nickel NCM batteries supplied to a varied customer base that includes Tesla, Volkswagen, Ford and Hyundai among others. LGES’s global share for battery manganese is now 23%

Ultium Cells, the General Motors and LGES joint venture which manufactures NCMA batteries fitted to the automaker’s Chevrolet, GMC and Cadillac brands (and the Honda Prologue produced on behalf of the Japanese company in Mexico) sits well outside the top 5 with 0.7 kt manganese deployed but that figure represents 120% year on year growth.

In third, CALB deployed 5.3 kt of manganese onto roads globally in January through September 2025, up 28% year-over-year. With higher manganese loading per average EV supplied thanks to its reliance on NCM 5-Series cathodes, CALB has been chipping away at the lead of the top two cell suppliers.

Year to date, the average passenger EV sold globally containing CALB cells housed 6.4 kilograms of manganese while that of CATL and LGES contained 4.9 kilograms and 5.1 kilograms, respectively.

In fourth, SK On deployed 2.6 kt of manganese, up 14% year-over-year, followed closely by SVOLT with 2.3 kt, a 15% improvement. SVOLT displaced SEVB for fifth after the latter registered a 17% decline year on year.

Contact the Adamas team to learn more or check out the intelligence services below.