Top 10 countries by EV battery graphite deployed

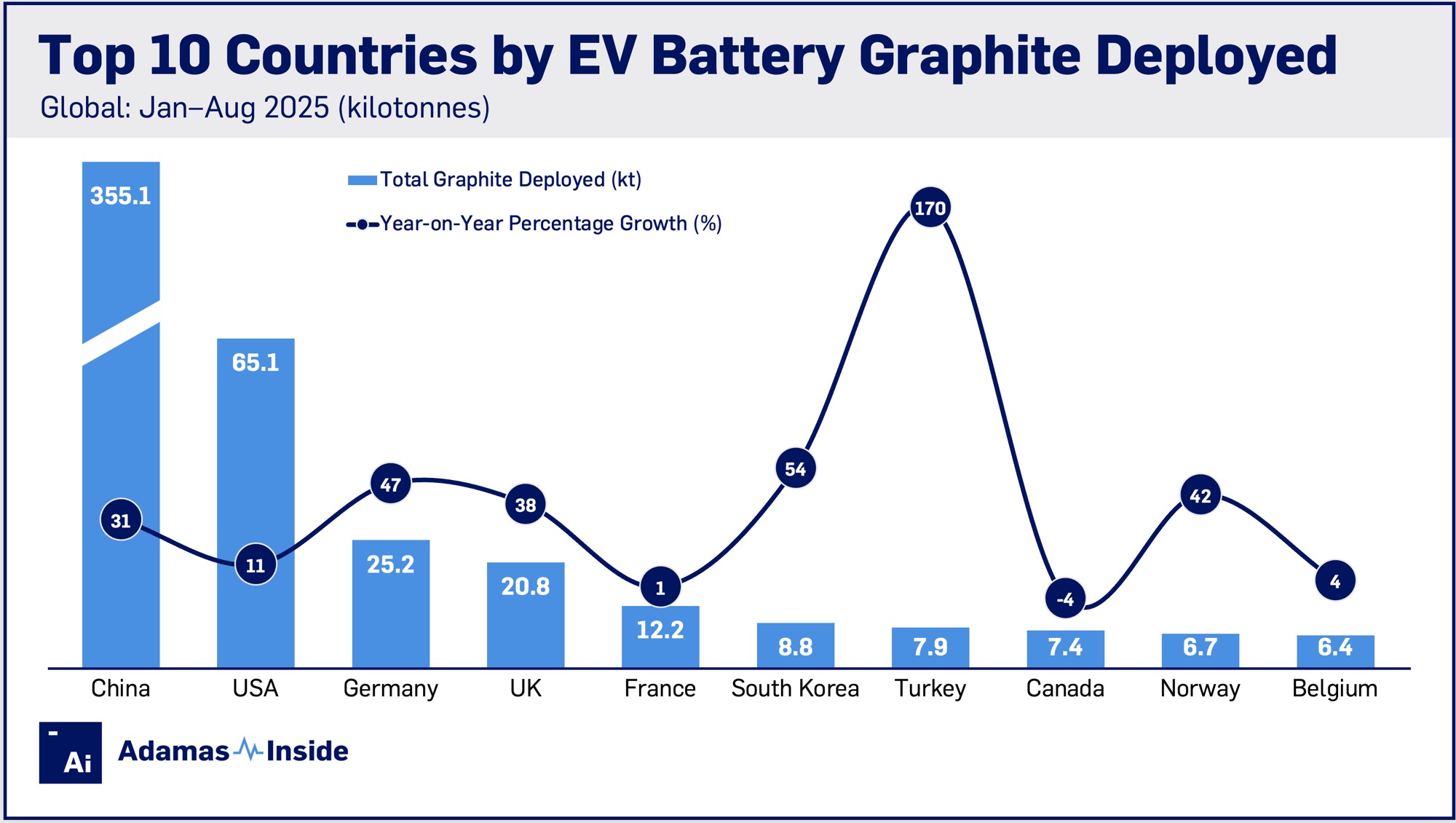

Globally, 606.8 kilotonnes of graphite were deployed onto roads in electrified passenger vehicles sold from January through August 2025, representing a 30% (or 140.7 kt) increase over the same eight months in 2024.

The batteries of virtually all EVs being sold globally use graphite as the anode material. China’s export controls announced last week covering the battery sector included restrictions on graphite anode active materials (AAM), both the synthetic and natural/synthetic blends.

The Chinese EV market is larger than the rest of the world combined and a full 59% of all graphite deployment in the batteries of newly sold EVs globally now take place within the borders of the country. Graphite deployment in China totals 355.1 kt for the period, a 31% year-on-year increase.

Using data from our Battery Metals Intel Platform to consider not only EVs sold in China but also those manufactured inside the country and exported globally, the dominance of the Asian nation for EV battery materials becomes even starker.

Only a tiny portion of EVs sold in China are imported and in graphite deployment terms that comes to less than 2.0 kt so far this year. Graphite deployment in all EVs made and sold in China and exported by the country’s automakers total 406.8 kt from January through August – an eye-popping 67% of the global total.

In the US 65.1 kt of graphite were deployed from January through August, an 11% expansion over 2024. In contrast Germany’s EV market is booming and 47% more EV battery graphite were rolled on autobahns for a total of 25.2 kt so far 2025.

The fourth largest market, the United Kingdom, also showed robust growth, up 38% to 20.8 kt. France, however, has struggled this year with a total of 12.2 kt which represents a less than 1% advance over 2024.

After a few soft years, South Koreans have piled back into EVs this year and in graphite deployment terms growth in the country reached 54% to 8.8 kt.

Turkey with a 170% surge to 7.9 kt was catapulted past several other countries to become the seventh largest market in battery graphite deployment terms.

Canada was the only major market to suffer a decline, registering 7.4 kt graphite deployed, down just over 4% year on year.

The two relatively mature European markets rounding out the top 10 – Norway and Belgium – had diverging fortunes. Norwegian graphite deployment was up 42% to 6.7 kt while Belgium only grew by 4% for a total of 6.4 kt.

Contact the Adamas team to learn more or check out the intelligence services below.