Tesla Model Y abdicates its Asia Pacific lithium throne

A combined total of 217.4 kilotonnes of lithium carbonate equivalent (LCE) were deployed onto roads globally from January through May this year in the batteries of all newly sold passenger EVs, including plug-in and conventional hybrids, a 28% increase over the same months in 2024.

The Asia Pacific region made up a full 60% of the global total with LCE deployment over the first five months of 2025 rising by 32% year on year to 131.4 kt, outperforming both Europe (+30% to 49.1 kt) and the Americas, where year-on-year growth barely hit double-digit percentage points.

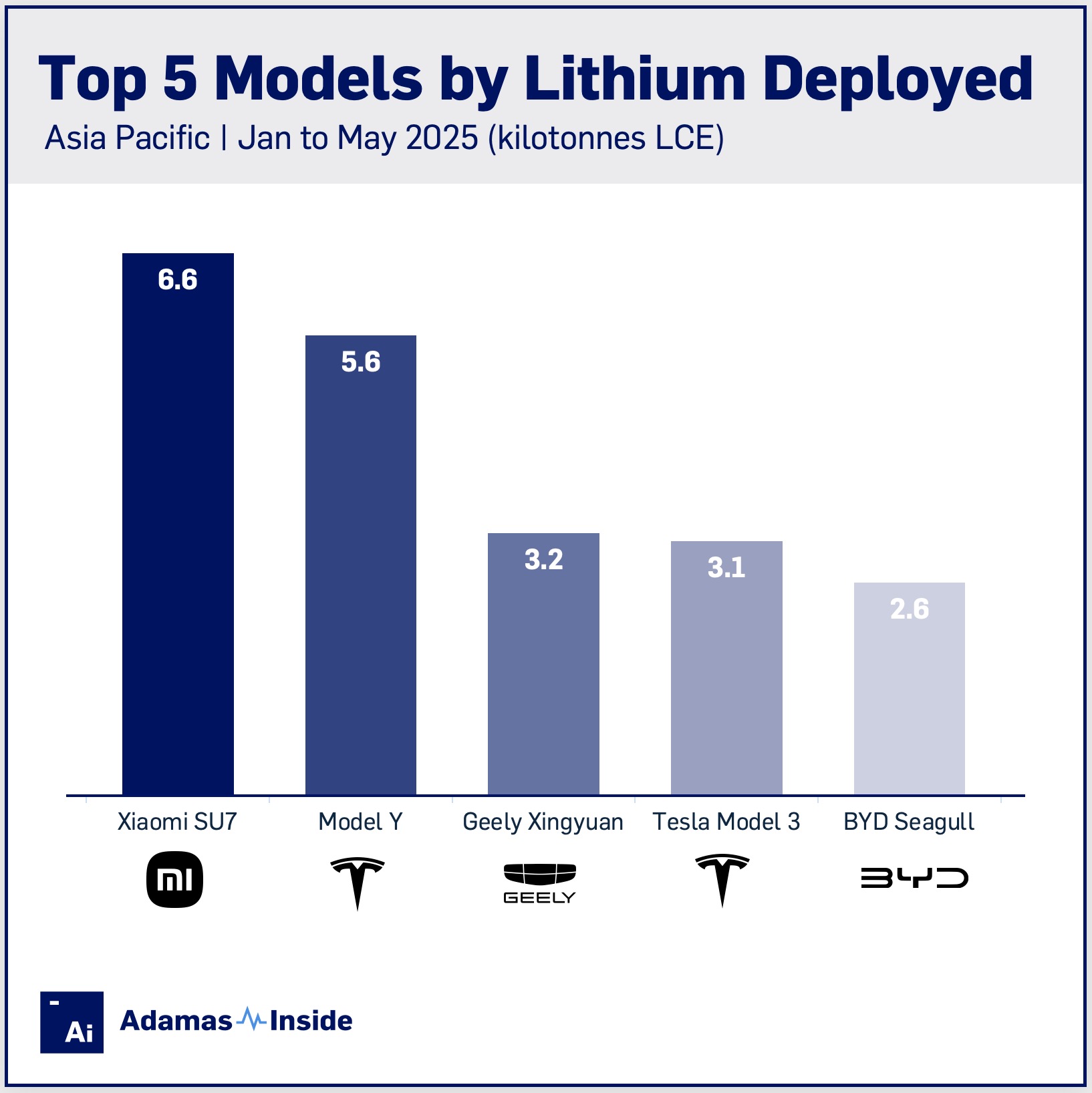

In Asia, Tesla’s Model Y gave up its long-held top spot with 5.6 kt of LCE deployed after a 22% decline over January–May 2024. Ramp-up in deliveries of the updated version of Tesla’s workhorse SUV only began in earnest in March, which helps explain its under-performance. Still, competition from the new number one BEV model in China is only set to heat up over the rest of the year.

Xiaomi’s SU7 is building on its spectacular launch early in 2024 with the sporty sedan adding 6.6 kt of LCE onto roads across China, the only country where it is currently available for sale. The lithium contained in the batteries fitted to the SU7 surged by a factor of seven compared to the same period last year.

According to reports, orders for Xiaomi’s recently launched YU7 SUV are pouring in, so Tesla will have its work cut out to regain the crown in Asia Pacific with the Model 3 (+22% at 3.1 kt LCE deployed) also bumped down the ranking thanks to a popular newcomer.

Geely’s new Xingyuan grabbed third place, deploying 3.2 kt of LCE so far in 2025. The cheap and cheerful compact hatch is an LFP-only model.

BYD sports three entries in the top 10 with the Geely Xingyuan’s head-to-head competitor, the Seagull, at 2.6 kt LCE coming in fifth, besting other models in the world number one EV maker’s stable, including the Yuan Plus (called the Atto 3 in some markets) and the Song in both PHEV and BEV form.

Note: Reported battery materials deployment constitutes installed terminal tonnes and does not consider losses during conversion, refining, and manufacturing processes.

Contact the Adamas team to learn more or check out the intelligence services below.