Ground truthing Canada’s hard rock lithium projects

Adamas Intelligence recently attended site visits to both PMET Resources’ Shaakichiuwaanann and Q2 Metals’ Cisco projects, situated in the James Bay region of Quebec, Canada.

In our view, these projects are significant on a global basis, offering North America the potential for greater lithium self-sufficiency in the 2030s from an enduring cost position. For this reason, a deeper level of diligence is warranted.

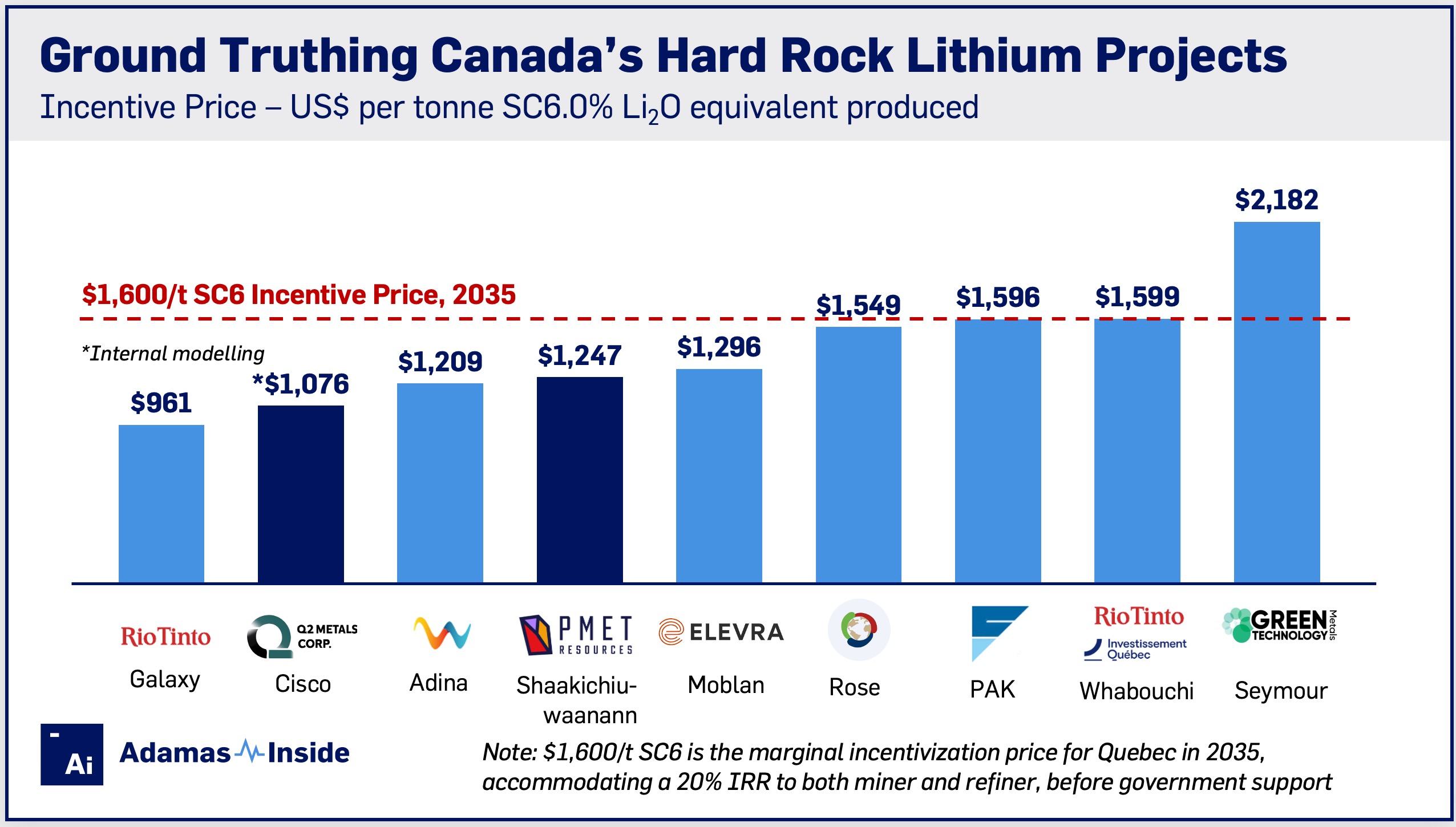

We forecast that a balanced market in 2035 requires an incentive price of $1,600/t for 6.0% Li2O spodumene concentrate (SC6) in Quebec. This price level accommodates an internal rate of return of 20% (post-tax) for both miners and local refiners in Quebec.

At the project level, harmonizing capital, operating and sustaining costs into incentive prices allows us to readily compare economic value. As benchmarked in an earlier insight, there are currently only four projects in Canada that are appreciably below the marginal incentive price of $1,600/t, including Shaakichiuwaanann.

As a pre-resource stage project, we have modelled Q2 Metals’ Cisco by incorporating a geological model and triangulating peers’ feasibility study metrics, informing an incentive price of $1,070/t SC6 for the project. This price assumes metallurgical test work supports dense media separation (DMS)-only processing. Additional details on this will be explored later in the insight.

In coming weeks, PMET Resources is due to release a feasibility study on Shaakichiuwaanann. The scope will be very similar to the 2024 preliminary economic assessment: a two-phase, open pit to underground mine targeting the CV5 pegmatite, a DMS-only concentrator targeting up to 800 ktpa 5.5% Li2O spodumene concentrate, with trucking to Matagami and rail to Bécancour. Accordingly, our expectation for the feasibility study is for a modest decline in economic value relative to the PEA. This reflects greater accuracy of the feasibility studies and incorporation of a more conservative price deck. Management is on an urgent path to first production and will therefore release a lithium-only study to initiate the permitting process. Importantly, absent from the FS will be a range of opportunities which we view as material:

1. Cesium biproduct credits. PMET recently declared Shaakichiuwaanann contains the world’s largest pollucite-hosted cesium pegmatite resource, mostly concentrated at the CV13 deposit adjacent to CV5 where the project’s spodumene extraction is focused. The recovery of pollucite via XRT ore sorting represents an attractive bolt-on opportunity for Shaakichiuwaanann. Our modelling indicates that unlike tantalum credits commonly associated with spodumene concentrators, cesium biproduct credits via sale of cesium oxide concentrate could be measured in hundreds of dollars per tonne SC6, though there remains a considerable amount of work to accurately quantify this. Programs are underway, such as XRT ore sorting test work using CV13 core, though what intrigues us the most is the marketability of this niche metal. Incremental demand drivers such as next generation solar panels offer blue-sky potential, while supply is heavily concentrated within Chinese control – namely Sinomine’s Tanco mine in Canada, Bikita tailings reprocessing in Zimbabwe, and as a byproduct from a lepidolite refineries in Jiangxi, China. This positions PMET and its cesium resource with immense strategic value and optionality. After all, in its refined form, high purity cesium metal is almost as valuable as gold, fetching a price ~2,500 times greater than a typical cesium oxide concentrate on a cesium contained basis.

2. Eastern transport route. A proposed, state-sponsored road extension of Highway 167 from the Renard mine to the Trans Taiga Highway could reduce PMET’s concentrate trucking by some 120km and rail by 260km (ex-Chibougamau, as compared to ex-Matagami). Our models suggest that transportation via the eastern route may reduce operating costs by $40/t SC6.

Though the road construction had been scoped for 2037, recent wildfires, which blocked access to the Trans Taiga highway, have highlighted greater urgency for access diversification in the region. This impetus is further strengthened as it supports the development of lithium mines, such as PMET’s Shaakichiuwaanann and Winsome Resources’ Adina.

3. Lithium sulphate intermediate product. Shaakichiuwaanann is relatively remote, but therein lies the opportunity to produce a more concentrated, intermediate product such as lithium sulphate monohydrate. Management is aware of electric calcination technology, which could utilize inexpensive hydroelectricity and significantly reduce product transportation costs. We perceive this as a longer-term, albeit valuable opportunity for Shaakichiuwaanann, should the product align with offtakers.

Rounding out the site visit to Shaakichiuwaanann, we saw the 150-bed camp positioned on the Trans Taiga highway with road access recently constructed to the CV5 ore body. The camp positions PMET with a robust platform to move the project into late stages of development.

Next steps under contemplation include sinking a shaft to extract a bulk sample from CV5, which will inform front-end engineering and design, further derisking the project for the construction phase.

Q2 Metals’ Cisco is roughly 3 years behind PMET’s Shaakichiuwaanann in development.

A maiden mineral resource estimate is expected to be released in the first half of 2026, which as illustrated by an independently assessed exploration target could be as large as 215 to 329 Mt grading 1.0 to 1.38% Li2O. This would make Cisco one of the largest undeveloped spodumene resources globally.

Subsequent infill and extensional drilling include an eye-catching 457 m intersection of spodumene mineralization (hole-44, assays pending) which runs down the center of the mineralized zone. This hole is in contention for being one of the top spodumene intervals globally.

Unlike Shaakichiuwaanann and near-term producer Whabouchi, we expect Cisco to be mined only by open pit methods, with a low waste-to-ore strip ratio averaging 3:1. Our models suggest that mining costs at Cisco could be around $130/t SC6, about $125/t SC6 below that of Shaakichiuwaanann as depicted in its 2024 (lithium-only) PEA.

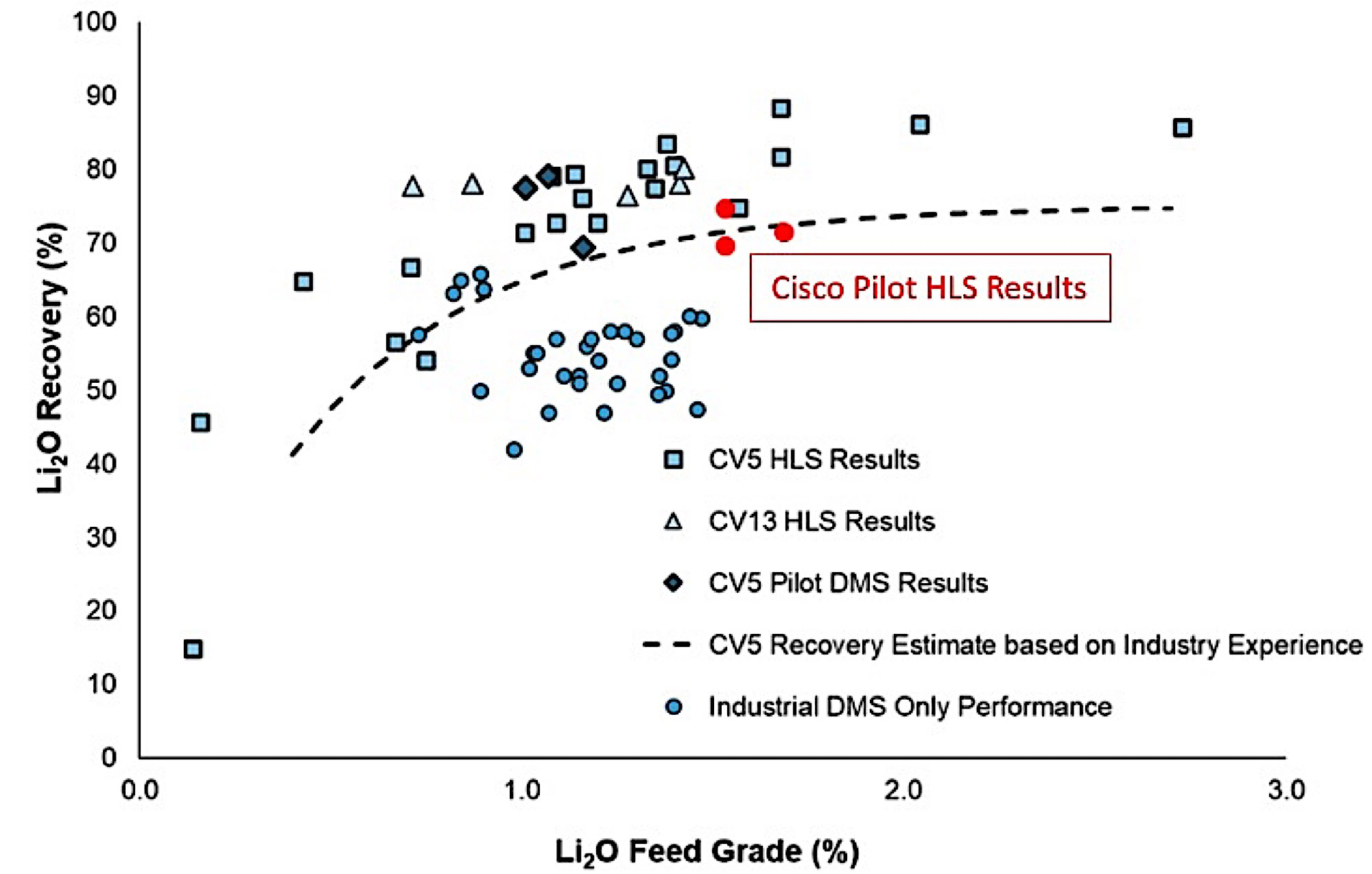

Metallurgical complexity is a significant driver of spodumene concentrator economics. Achieving satisfactory concentrate grade-recovery by DMS-only processing, and thus avoiding grinding and recovery via froth floatation, can reduce capital intensity by as much as 30 – 40%. This can be the difference between a viable and a subeconomic project, especially in high-cost jurisdictions like Canada.

To date, metallurgical test work completed at Cisco includes a pilot heavy liquid separation (HLS) program which tested three ~40m composite samples (assaying 1.53-1.68% Li2O) near the high-grade core of the mineralized zone. Using a crush size of 6.3mm, a saleable 5.0-5.5% Li2O spodumene concentrate was produced at ~70% lithia recovery, with low iron oxide ~0.5% Fe2O3.

Compared to PMET’s HLS test work, these results provide an early indication that DMS-only processing at Cisco is viable—albeit with slightly higher energy requirements (optimal crush size of 6.3 mm, versus 9.5 mm used at Shaakichiuwaanann) and marginally lower recoveries for an equivalent 5.5% Li2O spodumene concentrate. Greater spatial variability of HLS test work is required to solidify the case for DMS-only processing at Cisco.

Anecdotally, the delta in HLS results correlate with the size of spodumene crystal sizes observed at the site visit. The high-grade core of CV5 displayed very large spodumene crystals, often 3-4 inches in diameter. By comparison, Cisco hole-44 displayed spodumene crystals 1-2 inches in diameter, which helps explain why recoveries have thus far responded more favorably to a finer crush size.

What further sets Q2 Metals’ Cisco project apart from peers is its location in the southern end of the James Bay region. The Billy Diamond highway provides sealed road access directly from the project site to Matagami rail head, 150km to the south. By contrast, Shaakichiuwaanann’s concentrate has an 834km journey to Matagami. Our modelling suggests that Cisco could deliver to Quebec ports for $105/t SC6, which is roughly $85/t SC6 below the cost of Shaakichiuwaanann, as depicted in its 2024 PEA.

At present, exploration is entirely helicopter assisted out of the existing camp equidistant from the project site and Matagami. Ground access to the Cisco ore body from the highway requires refurbishment and extension of an existing track, including a 20-30m wide river crossing. On this road, a new camp is planned for completion by the end of the 2026 summer season, readying Cisco for next phases of development.