Europe and the Americas now drive only 16% of global lithium carbonate consumption

From January through October 2025, a total of 495.0 kt of lithium carbonate equivalent (LCE) were deployed onto roads globally in the batteries of all types of newly sold passenger EVs, a 25% increase over 2024.

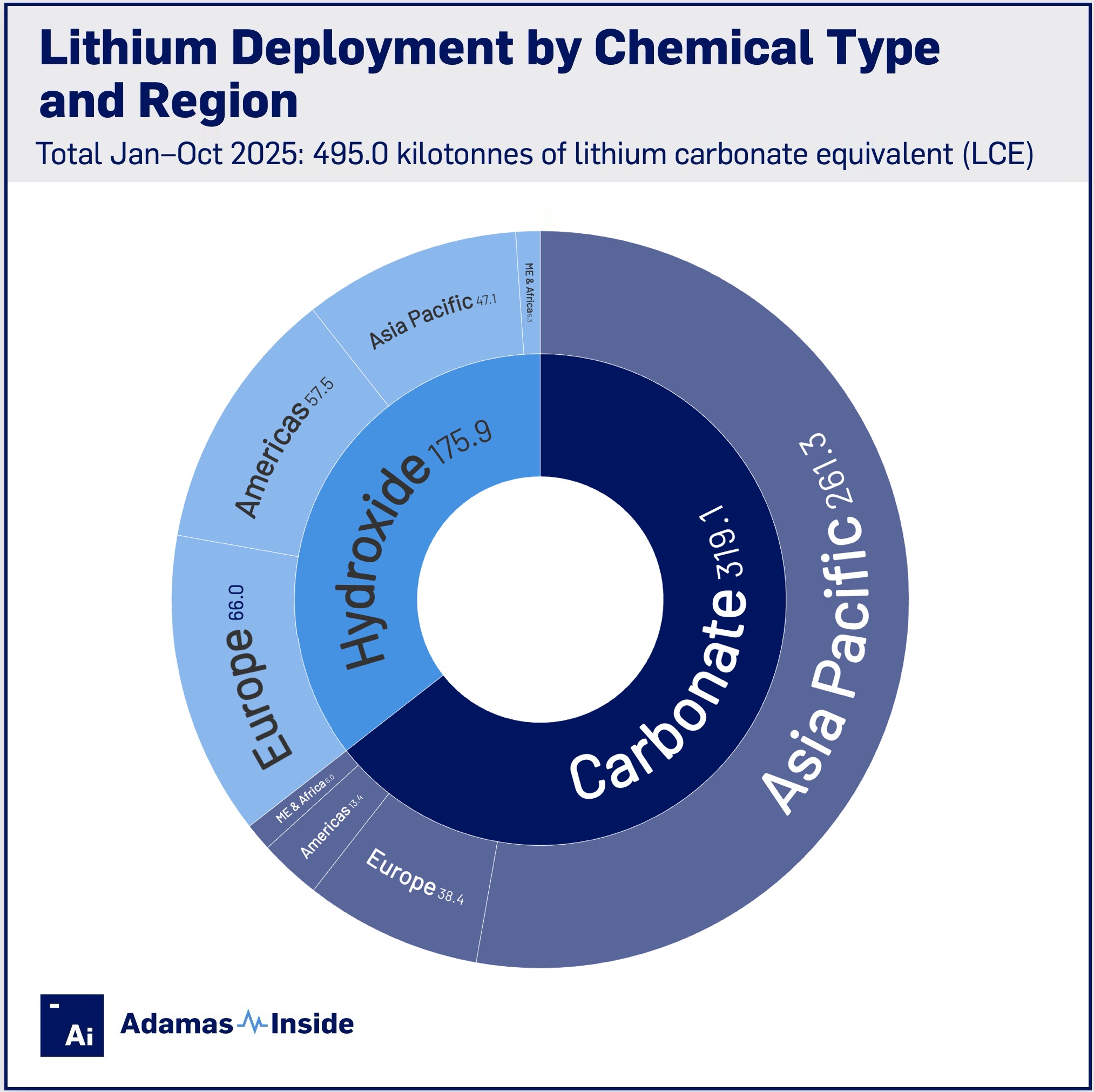

Of this total just under 65% or 319.2 kt was in the form of lithium carbonate whereas lithium hydroxide deployment made up 35% at 175.9 kt over the first 10 months of the year.

A full 62% of all lithium units deployed globally over the period were contained in the batteries of EVs sold in the Asia Pacific region after a 27% expansion over last year to 308.4 kt.

Europe’s 104.3 kt deployed, up 29% year over year, kept the continent’s global share constant at 21%, while representation of the Americas declined to 14% and the Middle East and Africa’s proportion rose to slightly above 2%.

Year-on-year growth in the Americas, where the US and Canada represent some nine tenths of the market, fell behind the rest of the world at less than 11% after deployment of 70.9 kt of LCE during the period.

Asia Pacific increased its share of global lithium carbonate consumption so far this year to 82%. Carbonate kilotonnes deployed in the region outpaced overall growth of lithium consumption at 32% year on year to 261.4 kt. In contrast, lithium hydroxide growth for Asia Pacific was a tepid 4% during the period to 47.1 kt lowering its share of lithium hydroxide deployment to 27% from 31% in 2024.

Europe fueled 12% (38.4 kt, up 13% year-on-year) of global lithium carbonate consumption last year and 38% (66.0 kt, up 39%) of global hydroxide consumption.

The Americas powered just 4% (13.4 kt) of global lithium carbonate last year and 33% (57.5 kt) of global hydroxide use, with the region’s contribution down on both counts. The mismatch in rates of growth was similar to Europe – just 8% for lithium carbonate rising to 33% year on year for lithium hydroxide.

The regional consumption patterns of lithium carbonate versus hydroxide largely correlate with regional deployment patterns of cell chemistries in terms of total battery capacity deployed.

China’s outsized role in the global EV industry and the country’s increasing adoption of LFP batteries is driving growing global carbonate use. The chemistry represented 68% of the total in the country over the first ten months of 2025 on a GWh basis, boosting worldwide adoption of LFP batteries to 46% of the total by the same measure.

In Middle East and Africa, Europe and the Americas combined, LFP’s share is rising, albeit slowly, boosted by increasing EV exports from China. LCE deployment in EVs manufactured in China equipped with LFP batteries and exported worldwide has surged 96% year over year to 22.9 kt from January through October this year.

That pushed LFP adoption in GWh deployed terms outside China to 13%, from 10% last year. High-nickel ternary batteries, which mostly use lithium hydroxide during CAM synthesis, continue to dominate outside China.

Note: Reported battery materials deployment constitutes installed terminal tonnes and does not take into account losses during conversion, refining, and manufacturing processes.

Contact the Adamas team to learn more or check out the intelligence services below.