The battery bulge

Automakers are increasing average battery pack capacity across the board, led by PHEVs

During the first seven months of 2023, just shy of 41 GWh of fresh battery capacity were deployed onto roads globally in newly sold plug-in hybrids (PHEVs).

The annual figure is likely to roar past the 80 GWh bar – after all, a December rush for that new car smell is a well-established pattern on EV markets.

In doing so, that growth would equate to a mouth-watering 60%-plus year-on-year increase.

And it’s not just overall EV sales growth driving the rise in battery capacity deployment – it’s EV sales growth combined with a steady rise in average battery sizes, Adamas data shows.

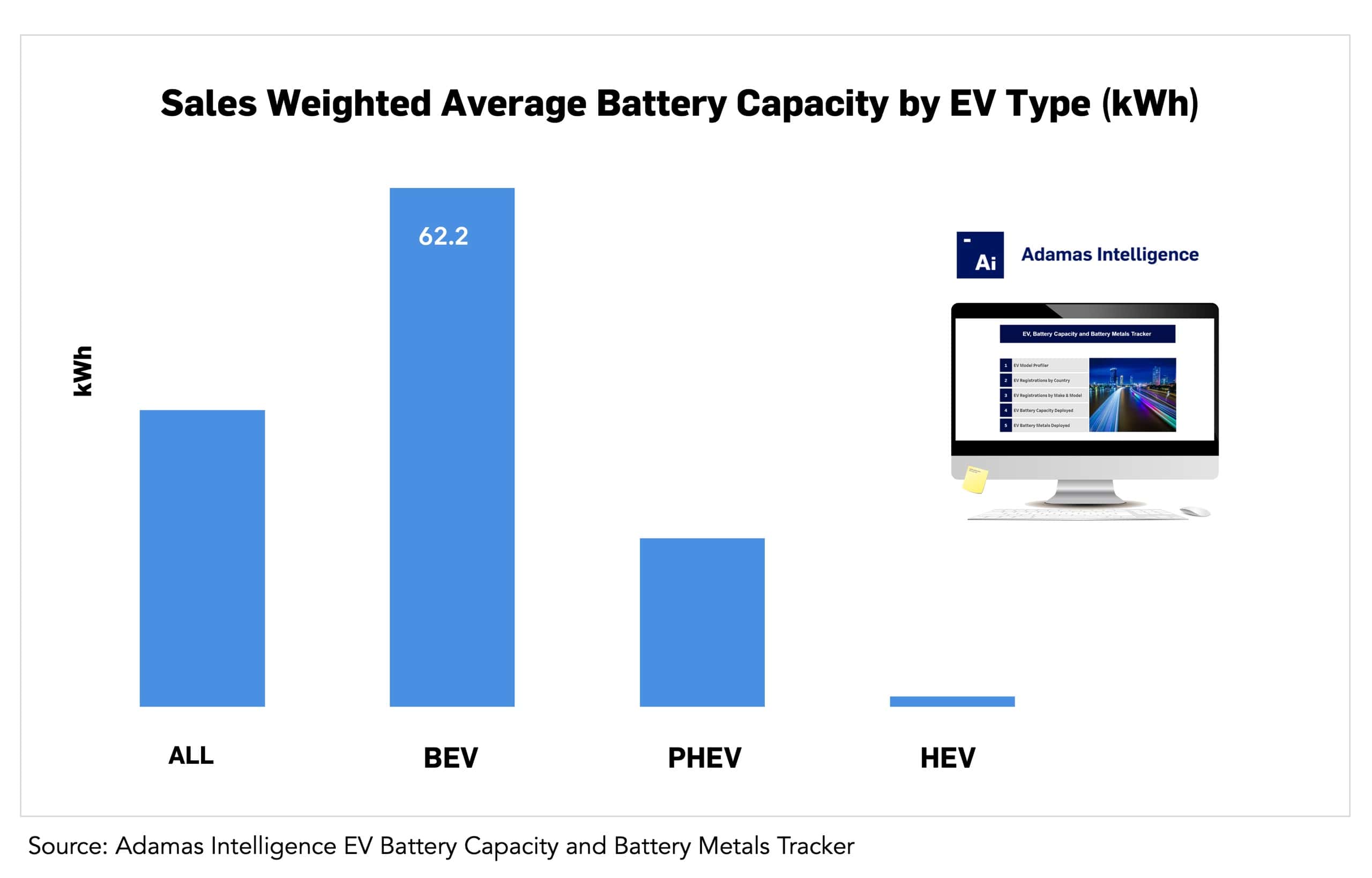

Overall, the average passenger EV sold globally in July of this year had a battery pack capacity of 35.6 kWh, nearly 10% higher than a year ago.

Not your grandpa’s PHEV

Considering conventional hybrid batteries have been stagnant around the 1.2 kWh mark for years, and HEVs remain a popular choice in a number of large markets, including Japan, the across the board battery size of 35.6 kWh is a pretty beefy number.

Over the same period, average BEV battery capacity jumped 9% to an average of 62.2 kWh in July of this year. That’s on par with the battery capacity of the standard range Tesla Model 3 made in China and the Model Y made in Germany.

Batteries of plug-ins (PHEVs) are bulging even quicker with average size of 20.2 kWh in July, up 14% from the same month the year prior. Popular PHEVs available in China like the Li Auto L9 sport batteries twice that. Five years ago PHEV drivers had to make do with just 12 kWh, Adamas data shows.

PHEVs enjoyed a 21% global market share year to end-July, up from 16% in 2020. Worldwide, PHEV sales are up 50% year-on-year while 34% more BEVs have been sold over the same period.

In China, PHEVs have cornered 30% of the market this year in terms of unit registrations but surprisingly in the US the market position of PHEVs has deteriorated and market share in the region is down to just 11% versus 22% in Europe.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.