European car parc electrification accelerates amid EV target changes

In December, the European Commission proposed revising the EU’s 2035 ban on the sale of new internal combustion engine vehicles, shifting from outright prohibition to an emissions reduction target of 90% below 2021 levels.

The remaining 10% of emissions could be offset through use of EU-made low-carbon steel and synthetic fuels. This would permit continued sales of plug-in hybrids, range extenders, conventional hybrids, and some traditional ICE vehicles.

Back in May, the EU gave its first sign that relaxation of the ambitious targets, which are still to be ratified, may be coming when it allowed the bloc’s automakers to skirt billions in dollars in fines for missing CO2 targets across their fleets in 2025, giving the most affected companies like Volkswagen and Stellantis two more years to catch up to regulations.

The relaxed regulations come amid a spike in EV adoption across the continent this year after a difficult 2024 when year-on-year growth in battery capacity deployment fell back to the low single digits in major markets like France and Norway and went into reverse in others, including Germany and Sweden.

Over the first 10 months of 2025, 858.5 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 27% more than the same period last year.

European growth has been consistently strong in 2025, and year-to-date the region has expanded by 30% to 170.4 GWh, matching the rate of expansion in Asia Pacific and far outpacing the Americas.

Europe, when including the UK, other non-EU states and Russia, accounted for one out of every five GWh of EV battery capacity hitting global roads for the first time.

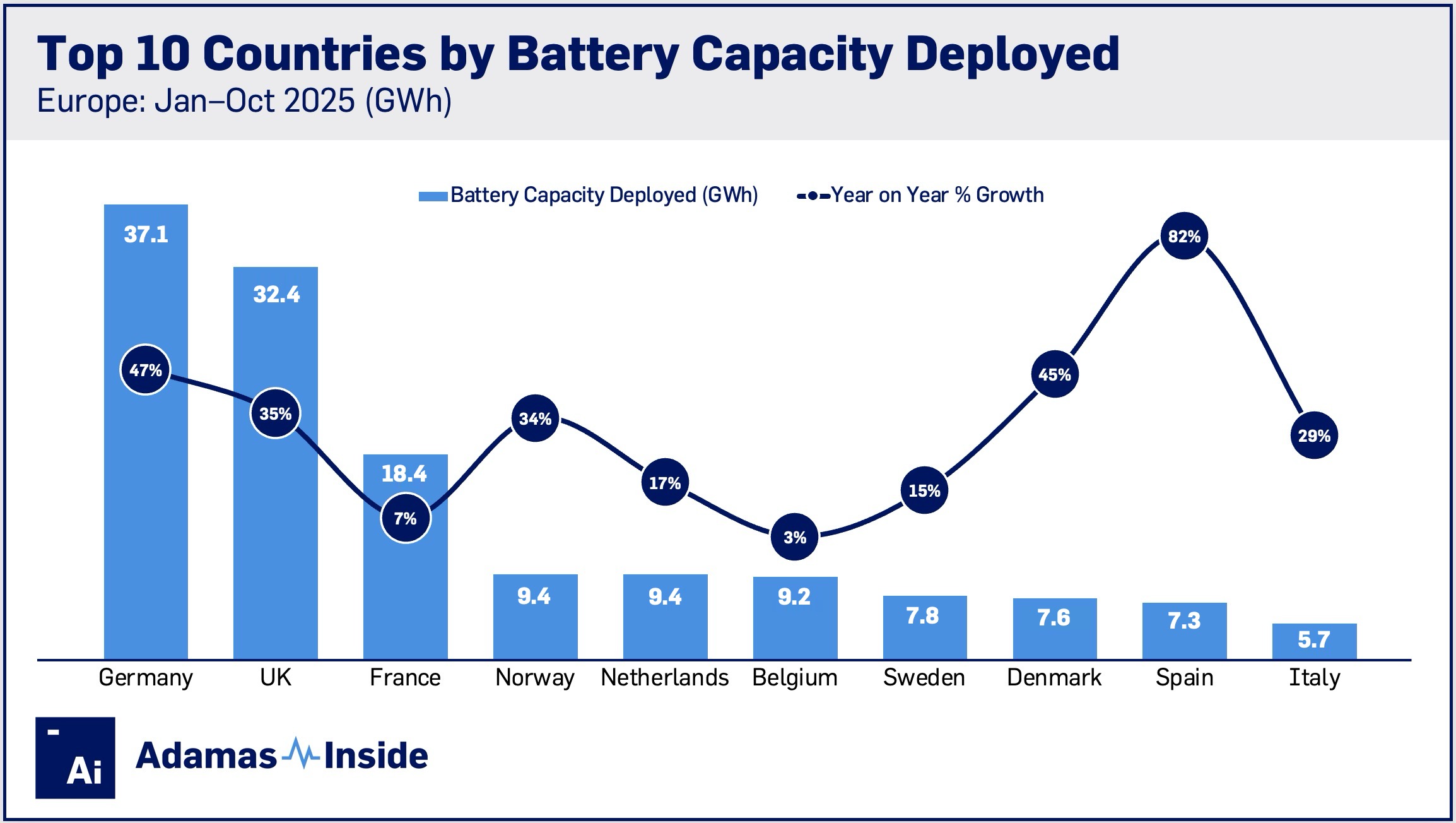

Germany, the world’s third-largest EV market after China and the US, grew by 47%, reaching 37.1 GWh over the first ten months of 2025, opening a healthy gap to second-placed Britain, which came to within 1 GWh of overtaking the automaking powerhouse in calendar 2024.

The UK, the fourth largest market globally in GWh terms, expanded by 35% through October, clocking in at 32.4 GWh compared to fifth-placed France, which only grew by 7% to 18.4 GWh deployed so far this year. Together, Germany, the UK and France constitute more than half the European market in GWh terms.

Fourth-placed Norway, coming off two lacklustre years, also returned to strong growth in 2025 with 9.4 GWh deployed, a 34% increase over 2024. The Scandinavian nation has long been the leader on the continent for EV adoption with nine out of ten of all vehicles sold in the country so far electrified in some way.

The Netherlands saw more modest market growth this year at 17% to 9.4 GWh, to slot in just behind Norway and overtake its southern neighbor, Belgium, which notched up the slowest growth among the top European EV markets at 3% for 9.2 GWh.

Sweden and Denmark grew by 15% to 7.8 GWh and 45% to 7.6 GWh respectively, fending off Spain, the most robust market in the region this year, for seventh and eighth place.

Spanish EV buyers have flocked to electrified vehicles this year rolling 7.3 GWh onto the country’s roads, 82% more than in 2024. Italy rounds out the top 10 with respectable growth of 29% to 5.7 GWh.

Unlike the low countries and the Nordics, where BEVs make up around half of sales, conventional hybrids dominate the Spanish and Italian markets, which helps to explain their lower ranking in GWh terms despite unit sales volumes far exceeding their Northern neighbors.

Contact the Adamas team to learn more or check out the intelligence services below.