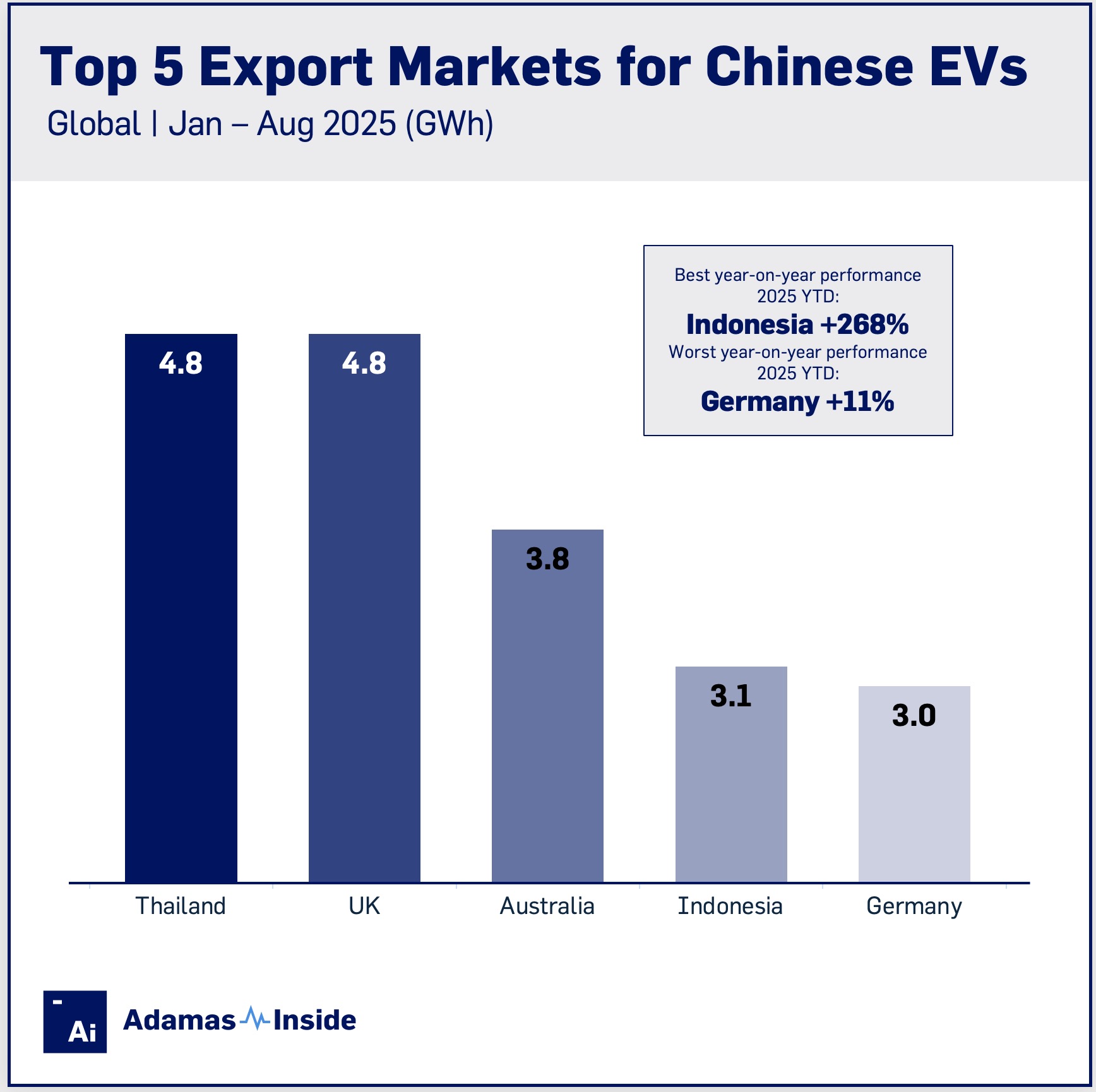

Top 5 destinations for Chinese-made EVs

Over the first eight months of 2025, 648.5 GWh of battery capacity was deployed onto roads globally in all newly sold passenger EVs combined, 28% more than the same period last year.

Made-in-China plug-in hybrids and full electric vehicles, made up a full 412.8 GWh or 64% of the global total. Of the total battery capacity of Chinese-made EVs made and sold from January through August, 56.3 GWh hit roads outside the country.

The top destination for Chinese exports was Thailand at 4.8 GWh, a jump of 87% compared to the same eight months of 2024. The furious pace saw Thailand leapfrog the UK, Australia and Germany for the top spot.

The BYD Sea Lion, a midsize crossover, was the number one Chinese EV in Thailand on a GWh basis. The BYD Group occupies several of the top model slots in the Asian nation, including its luxury offshoot brand, Denza.

Thailand does not levy an additional import tariffs on Chinese EV exports and more than 90% of the battery capacity deployed on the South East Asian country so far this year come from China.

The UK occupies the number two spot, just slightly behind, with just under 4.8 GWh of battery capacity deployed, representing a 22% year-over-year expansion. The UK levies a standard 10% import duty on EVs from China.

Made-in-China EVs constitute 21% of the UK market in battery capacity deployed terms while that same figure for third-placed Australia is 75%. Of the 5.1 GWh deployed in Australia, 3.8 GWh were exported from China, a 16% increase over 2024.

The fastest growing export destination for Chinese EV makers is Indonesia, where battery capacity deployed surged by 268% to 3.1 GWh, overtaking fifth-placed Germany. In Germany, 3.0 GWh of the fresh battery capacity imported over the first eight months of 2025 came from China, an 11% increase over 2024.

While Chinese EV completely dominate the Indonesia EV market, as expected, in automotive powerhouse Germany, the share of Chinese imports on a GWh basis is only 11%.

Germany’s top Chinese model is the Cupra Tavascan, manufactured by the Volkswagen-JAC Group joint venture. Both the Cupra and second most popular made-in-China model, the Volvo EX30, attract additional duties under the European Union’s tariff scheme.

Tavascans sold in Germany attract a 20.7% surcharge while the Volvo (in the Geely stable) is slapped with a 18.8% duty, on top of the across the board 10% duty for all EV imports.

Contact the Adamas team to learn more or check out the intelligence services below.