Top 5 EV cell suppliers in Europe and the Americas by lithium deployed

A combined total of 374.1 kilotonnes of lithium carbonate equivalent (LCE) were deployed onto roads globally from January through August this year in the batteries of all newly sold passenger EVs, including plug-in and conventional hybrids, a 26% increase over 2024.

Europe and the Americas made up 41% of the global total with LCE deployment over the first eight months of 2025 rising by 21% year on year to 135.7 kt across the three continents. The growth rate was dragged down by a middling performance in the Americas, where only 12% more EV battery lithium hit the roads for the first time compared to the same period in 2024.

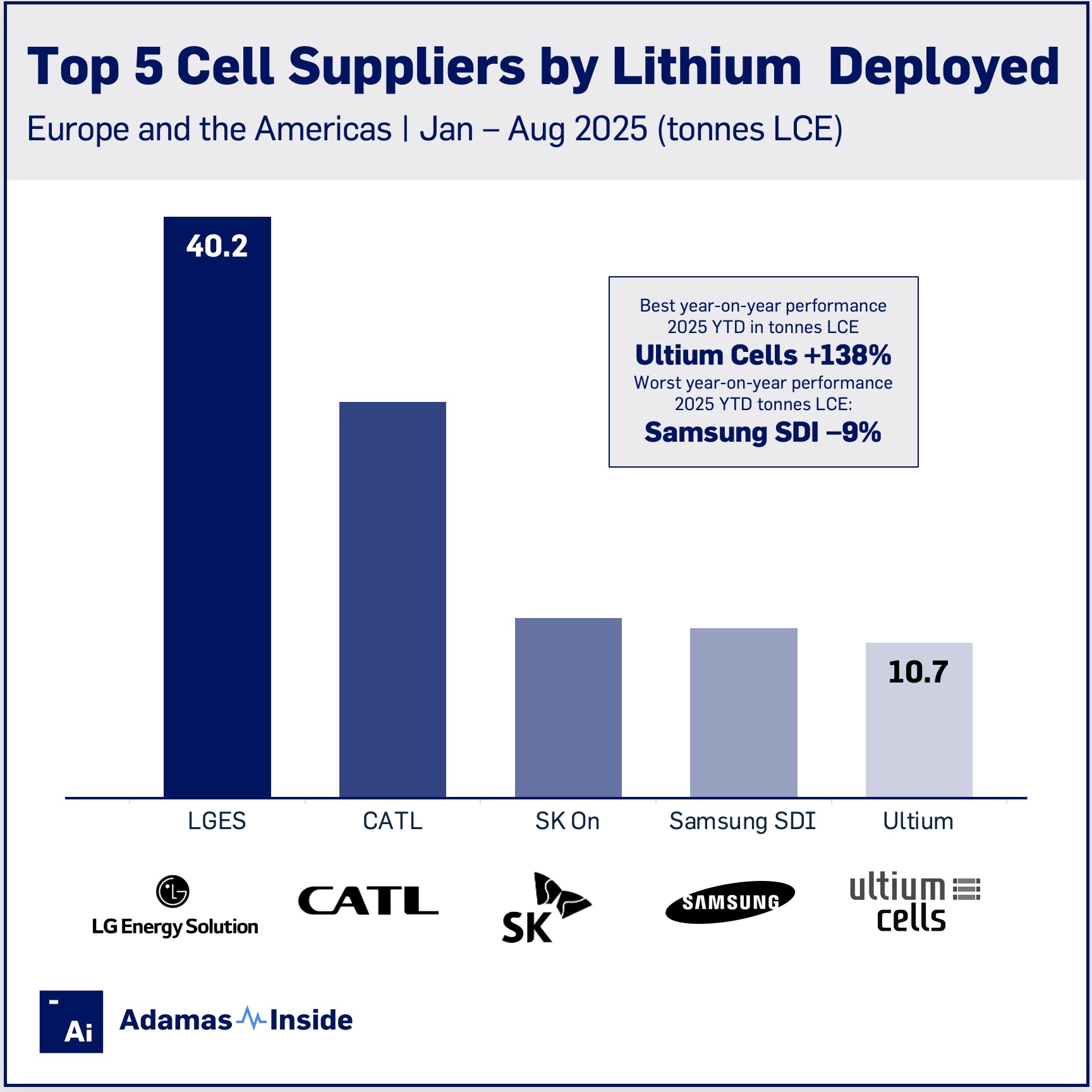

LG Energy Solution retained its clear lead with 40.2 kt of LCE deployed across the regions after a 21% rise year over year. LGES boasts a varied customer base, including Tesla, Ford, and a number of brands in the Volkswagen and Stellantis stables. Over 80% of the LCE deployed by LGES during the period was in Europe.

CATL, the top cell supplier to the global industry by a wide margin, came in second in Europe and the Americas after a deployment jump of 43% from January through August for a total of 27.4 kt. CATL’s top model across the regions is the Audi Q6 e-tron, followed by the Tesla Model 3 and the Nissan Ariya.

Premium brands Porsche, BMW and Volvo (part of the Geely group) also count among the Chinese company’s customers. Just over 16% of the lithium deployed by CATL in Europe and the Americas was contained in the batteries of EVs assembled in China.

Some distance behind CATL are SK On and Samsung SDI with 12.4 kt and 11.7 kt LCE deployed respectively so far in 2025. SK On posted a 7% year-over-year gain, giving it the edge over Samsung SDI, which is having a tough 2025 with a 9% decline.

Just over 14% of the lithium deployed by LGES, SK On and Samsung SDI in the Americas and Europe so far this year were in newly sold EVs exported from South Korea.

Rampant Ultium Cells, a joint venture between General Motors and LGES, displaces Panasonic Energy (down 28% to 9.0 kt) in the top 5 after a 138% surge in LCE deployment to 10.7kt.

Ultium manufactures NCMA cells in Ohio fitted to, among others, the Cadillac Lyriq, the massive GMC Hummer SUV and the Chevrolet Equinox, a mid-market offering introduced last year to great success.

GM also builds the Honda Prologue in Mexico on behalf of the Japanese carmaker and together with the Equinox, the two mid-size SUVs contribute 40% of the battery maker’s LCE deployment in the Americas (the models are not on sale in Europe).

Contact the Adamas team to learn more or check out the intelligence services below.