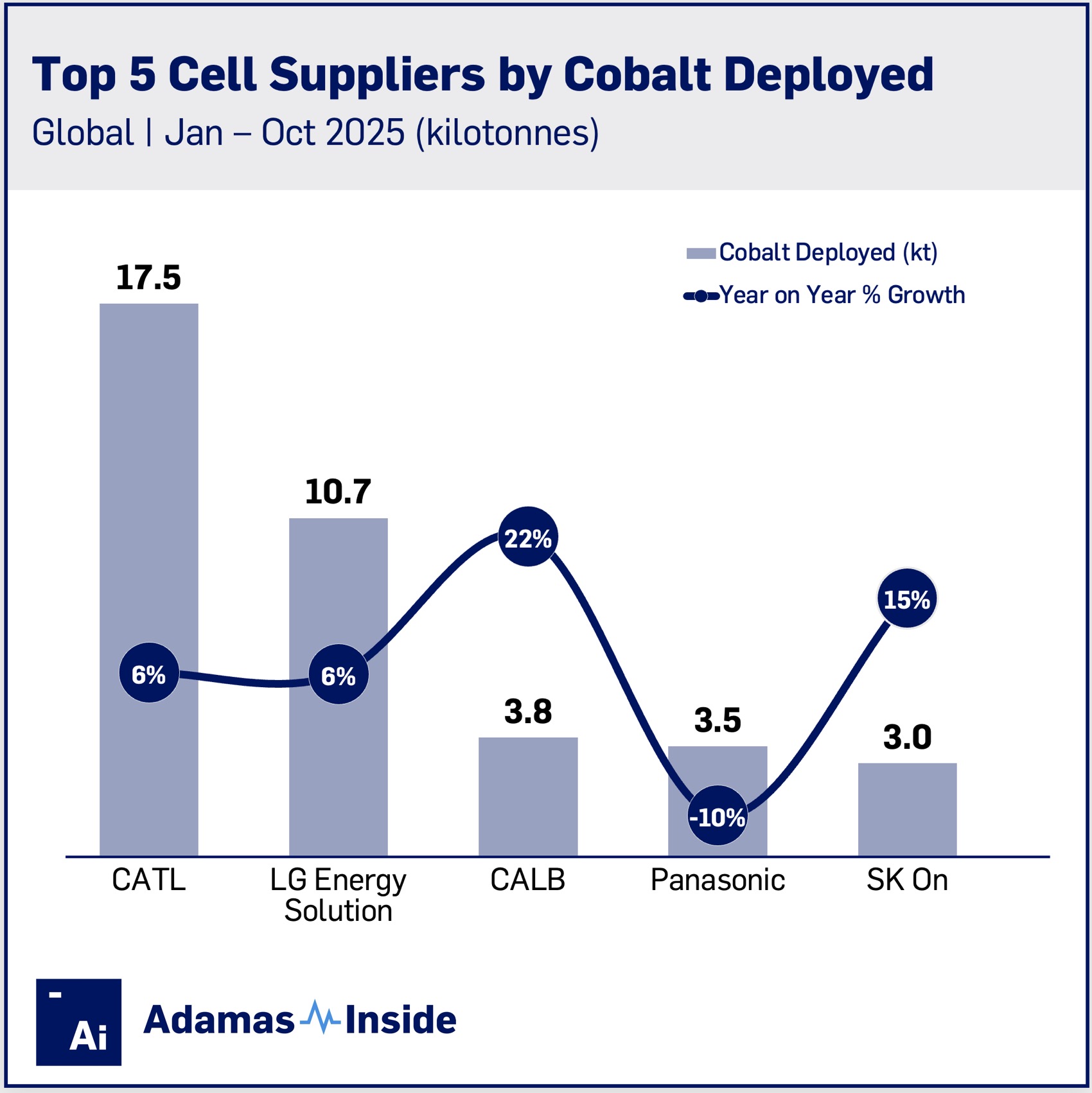

Top 5 global cell suppliers by cobalt deployed

Over the first 10 months of 2025, a total of 50.7 kt of cobalt were deployed onto roads globally in the batteries of all newly sold passenger EVs (BEVs, PHEVs and HEVs) combined, a modest 5% more than the same period in 2024.

Cobalt deployment growth for the period came in well below the overall rate for battery capacity deployment, which totaled 858.5 GWh, a 27% expansion, and new EV registrations, which rose by 23% to just 23.5 million.

There was wide divergence in year-on-year growth across regions with Asia Pacific contracting (–3% to 23.2 kt) and the Americas underperforming (+3% to 8.8 kt), leaving Europe (+17% to 17.4kt) and Middle East and Africa (+36% to 1.3kt) to do all the heavy lifting to keep cobalt deployment in positive territory.

Different trajectories for different regions also showed up in the rankings for cell suppliers.

While LG Energy Solution topped the tables in Europe (+16% to 6.9 kt) and the Americas (–12% to 1.6 kt), the Korean battery maker only made it to number three in Asia Pacific where as usual CATL played an outsized role.

LGES lost market share in Asia Pacific with deployment down 13% to 1.8 kt. In turn, CATL has been on a roll in Europe, increasing cobalt deployed by 38% to 4.8 kt from January through October last year placing it second behind LGES.

On the continent, CATL supplies, among others, brands in the Volkswagen and BMW stables, and the Chinese giant is also finding success with the increasing number of Chinese-assembled vehicles exported to the region, notably the Polestar and Volvo marques under the Geely umbrella.

Despite the regional swings and roundabouts, on a global basis CATL and LGES delivered similar year-on-year growth of 6% and the two companies maintain a wide lead over the competition.

Globally, 34% or 17.4 kt of the cobalt deployed in newly-sold EVs were contained in CATL supplied batteries while LGES captured 21% of the market after deploying 10.7 kt.

In the top five, number three, CALB, grew fastest at 22% year on year to 3.8 kt, thanks in part to the popularity of newer models from its customers, Xpeng and Onvo. The former’s G6 coupe-styled upmarket SUV has only increased in popularity since its Q3 2023 launch, while Nio’s attempt to move downmarket with the new Onvo brand has also found enthusiastic buyers.

Panasonic has endured a tough 2025 on all fronts, and in cobalt deployment terms, the Japanese company’s tireprint shrank by 10% from January through October 2025, damaged by challenges at its long-time partner Tesla. The NCA batteries fitted to Tesla’s BEVs now make up only 28% of Panasonic’s cobalt deployed, less than the proportion supplied by NiMH batteries used in the conventional hybrids of its top customer Toyota.

Rounding out the top five is SK On. The Korean cell supplier increased cobalt deployment to 3.0 kt, up 15% compared to last year. SK On’s batteries are fitted to among others Hyundai, Kia, Mercedes Benz and Ford models (including the soon to be discontinued F-150 Lightning pick up).

Contact the Adamas team to learn more or check out the intelligence services below.