Top 5 EV makers by lithium deployed in August 2023

Largest OEMs improve market share year over year

Globally, 37,775 tonnes of lithium carbonate equivalent (LCE) were deployed onto roads in newly-sold electrified vehicles in August 2023, representing a 52% (or nearly 13,000 tonne) increase compared to August 2022.

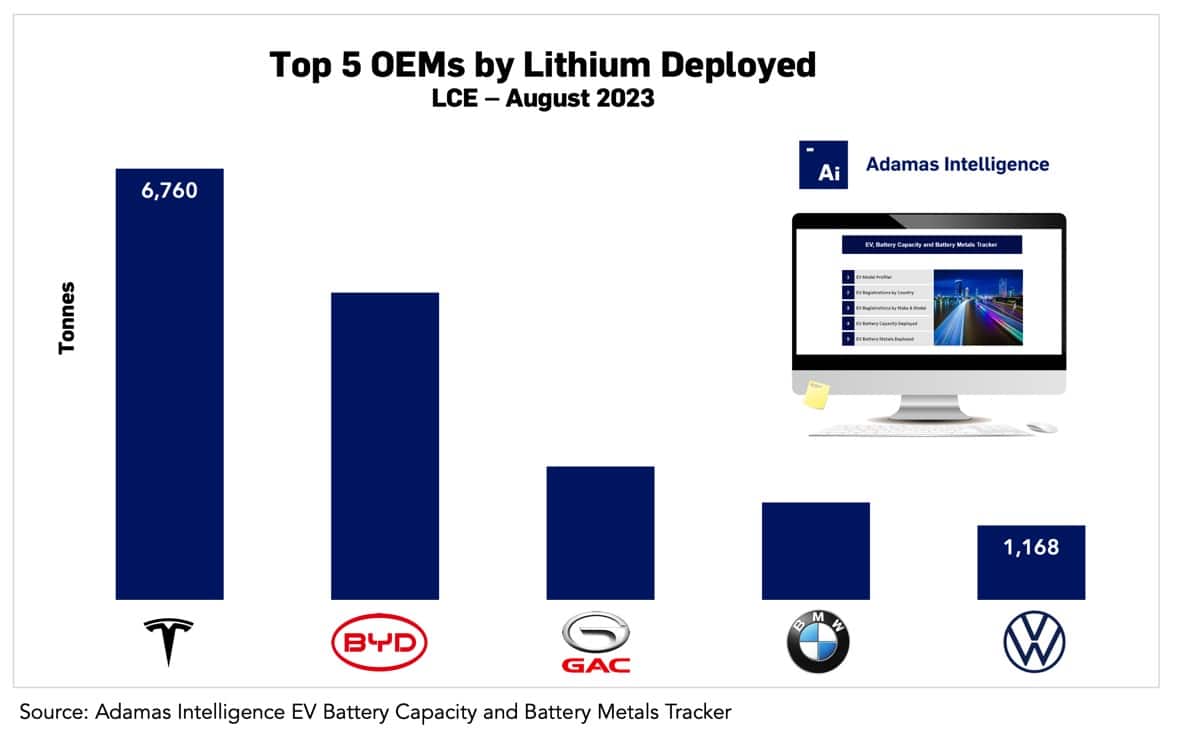

Tesla once again beat out world’s number two EV maker, BYD, for the top spot with 6,760 tonnes of LCE deployed in its S,3,X,Y lineup.

By comparison, BYD deployed 4,819 tonnes of LCE in August across a portfolio of over 20 electrified models.

With a 67% increase year-over-year, Tesla extended its lead over its Chinese rival in August 2023, which saw its own LCE deployment rise just 44% over the same period.

The third, fourth, and fifth largest lithium consumers in August this year were GAC, BMW, and Volkswagen, respectively. GAC deployed 2,095 tonnes in August, an increase of 85% compared to the same month in 2022 while BMW’s LCE deployment rose 110% to 1,528 tonnes. Volkswagen put 1,168 tonnes of LCE onto roads in its newly-sold EVs, representing an expansion of 75% compared to August 2022.

Notably, lithium deployment has become more concentrated at the top. At a combined 16,370 tonnes of LCE, the top 5 EV makes represented 43% of the total in August 2023, up from 40% the same month last year.

Bigger batteries, more lithium

Batteries are being bulked up across EV types, but PHEVs are enjoying the greatest growth by a long shot. In August 2023, the average PHEV sold globally had a pack capacity of 21.8 kWh, 8% higher than the month prior and massive 27% higher than the same month the year prior.

This trend, as expected, has translated into a rise in lithium use per PHEV over the same period. The Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows that the amount of lithium contained in the average PHEV’s pack increased by 24% year-on-year in August 2023 and now tops 13 kg of LCE per passenger vehicle.

The rise in average lithium loading in BEV batteries has been more modest, rising 7% year-over-year to more than 37 kg of LCE per vehicle in August 2023. Consequently, the amount of lithium in the average PHEV is now 36% that of the average BEV, up from 31% last year, on an LCE basis.

Adamas take:

Overall, lithium demand growth is outpacing already booming EV sales this year as automakers (enabled by advances in battery chemistry and cell and pack design improvements) continue to boost battery pack capacities to assuage worries about range – still the number one concern for drivers of gasoline-powered cars thinking of switching to electrified vehicles.

With many new PHEV models sporting a combined range of over 1,000 kilometers (enough to easily cover the distance from New York to Toronto), range-concerned drivers (dare we call them road rangers?) may find themselves transitioning to a PHEV before a BEV if only the number of models available outside China were increased.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.