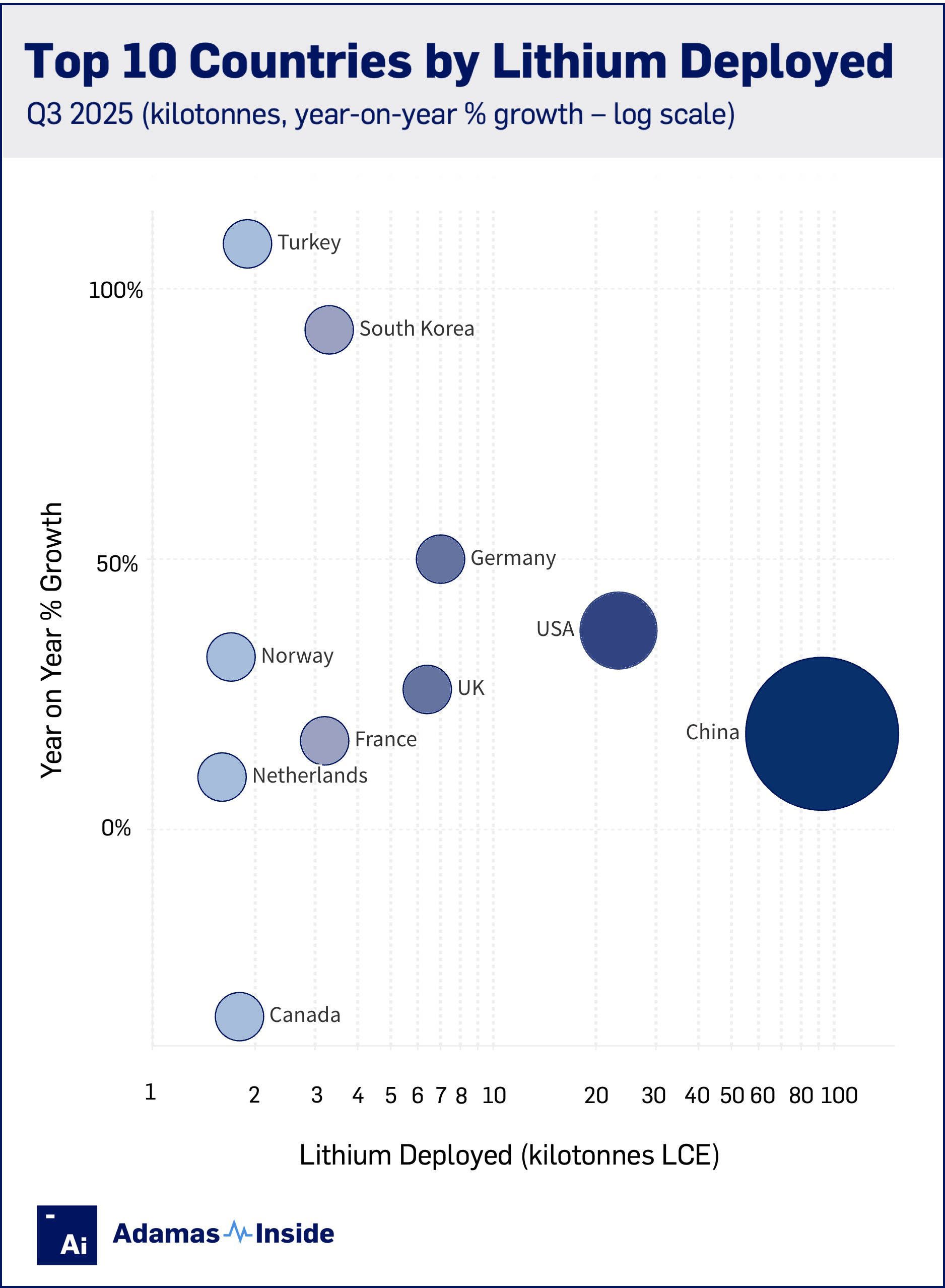

Top 10 countries by EV battery lithium deployed

During the third quarter of 2025, a record 165.6 kilotonnes of lithium carbonate equivalent (LCE) were deployed onto roads globally in the batteries of newly sold electrified vehicles combined, up 25% year over year.

While still a country mile ahead of others in absolute terms, lithium deployment growth in China has fallen below most other major EV markets. For Q3, China lifted deployment by 18% to 92.2 kt LCE.

The US, UK and South Korea, among others, were registering record quarterly lithium deployment in Q3, but the fourth quarter of last year still constitutes the high-water mark for China.

While China is entering a slowdown, US buyers went EV shopping in Q3 ahead of the expiry of retail subsidies at the end of September. New EV drivers rolled 23.3 kt of lithium onto the country’s roads during Q3, 37% more than the same period last year.

Number 3, Germany, is having a banner year, expanding lithium deployed by 50% to 7.0 kt in Q3. Germany’s Q3 total was only slightly below the all-time high recorded in the three months to end-June.

Unlike in China, the US and the UK, Germany’s top EV in terms of lithium deployment for the quarter was not the Tesla Model Y. Instead, it was the Volkswagen ID.7, a sought-after mid-size sedan among a sea of SUVs. The first six slots in Germany go to EVs in the Volkswagen stable, and the Model Y does not make the top 10.

The robust growth saw Germany overtake the UK where 26% more of the battery material hit roads for the first time compared to last year – 6.4 kt in Q3 2025 versus 5.1 kt in Q3 2024.

After a couple of years of tepid growth, South Korea opened the floodgates this year with 3.3 kt deployed in Q3, a whopping 92% more than in 2024. Sequential growth was 27% over Q2, the country’s previous record quarter.

Lithium deployment in South Korea was also led by the Tesla Model Y, but the next seven slots were occupied by models from homegrown champions Hyundai and Kia, and KG Mobility.

KGM (formerly SsangYong Motor bought out of bankruptcy in 2022) has enjoyed great success with the re-introduction of its Mussa model name, this time in the form of a full electric large pickup.

The French EV market picked up in Q3, up 16% year over year to 3.2 kt. However, the strong third quarter only just lifted lithium deployment year to date into positive territory after the country’s slow start to 2025.

Turkey leapfrogs more mature markets like Norway, the Netherlands, Belgium, Denmark and Sweden to slot in as the seventh largest nation in lithium deployment terms. New EV drivers rolled 1.9 kt of LCE onto roads in the Middle Eastern nation in Q3, 108% more than the same quarter last year.

Turkey also sped past Canada, which was the worst performing sizeable EV market for the quarter with a 35% year-over-year drop to 1.8 kt. The Model Y and Model 3 topped the deployment ranking in Canada, but both Tesla’s workhorses showed large declines compared to Q3 2024.

Rounding out the top 10 are Norway and the Netherlands, which still showed healthy growth rates in Q3, up 32% to 1.7 kt and 10% to 1.6 kt, respectively, despite already high EV penetration rates. Of the vehicles sold during the September quarter in the Netherlands, 68% were electrified, while Norway, a fleet electrification trailblazer, saw penetration rates dip to 89%, down from a peak of 93% of total vehicle registrations in the previous quarter.

Note: Reported battery materials deployment constitutes installed terminal tonnes and does not take into account losses during conversion, refining, and manufacturing processes.

Contact the Adamas team to learn more or check out the intelligence services below.