SK On and Polestar take the high-nickel road

SK On inks first supply agreement with Polestar for 2025 flagship model

South Korean battery maker SK On said this week it has inked a deal with Polestar to supply lithium-nickel-manganese-cobalt (NCM) batteries for the Sino-Swedish carmaker’s upcoming flagship Polestar 5.

The supply agreement with Polestar, owned by China’s Geely, kicks off in 2025 and shows that the longer term demand for NCM batteries is still healthy, particularly for high-end performance vehicles.

Polestar opted for SK On “due to their superior battery cell technology that offers high-performing chemistry, fast charging, efficient discharging and superior driving range” it said in an announcement this week.

The high-nickel cells to be used in the 5 are “ultra-long 56 cm cells”, presumably with pouch form factor. By comparison, Tesla’s 4680 cells, the largest cylindrical cells in use today, are just 8 centimeters tall.

In 2021, SK On’s parent invested $60 million in Polestar through its New Mobility Fund, a joint venture with Geely.

The Polestar 5 full-electric four-door coupe (which is the production version of the sleek Precept concept) was expected to go on sale next year to compete with the likes of the Porsche Taycan and Tesla Model S, but the battery deal suggests the launch has been delayed to 2025.

Zhejiang Geely Holding Group, which also owns a stake in Mercedes-Benz, acquired Volvo from Ford in 2020 and the company subsequently spun off Polestar, which had been the Swedish company’s motorsports unit, as its electrified brand.

High-nickel batteries not confined to performance cars

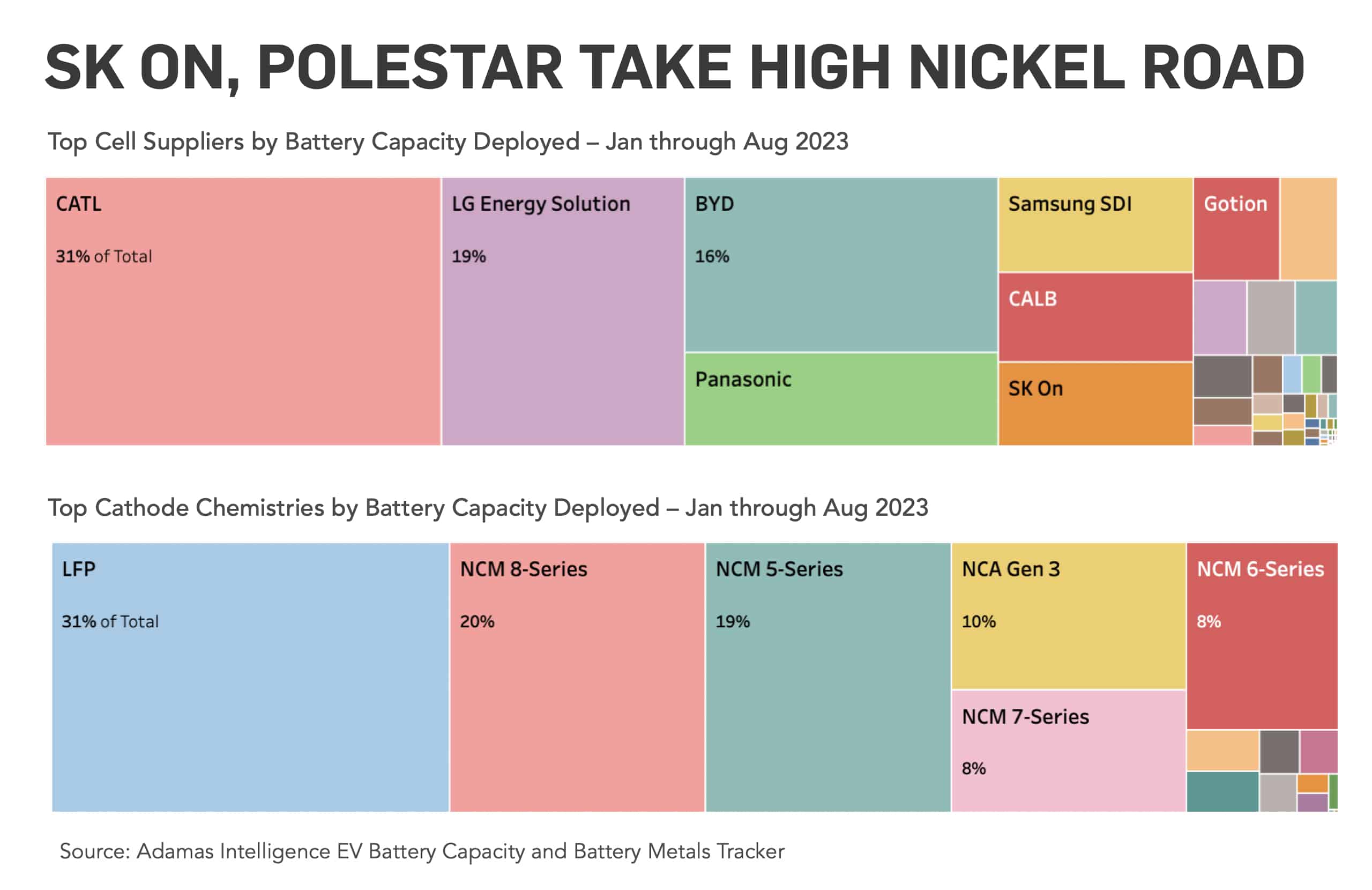

The Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows SK On is the world’s number 7 cell supplier in terms of battery capacity deployed globally in newly-sold EVs from January through August 2023. With 19.6 GWh hitting roads so far this year, SK On enjoys a 5% share of the global market.

The Seoul-based firm does not currently supply Polestar with batteries despite the two-year old co-investment with Geely. The Polestar 2 BEV mainly uses LG Energy Solution’s NCM 6-Series cells. In China, the D-Segment car uses cells from the world’s number one supplier, CATL.

In Europe, the Polestar 2 is the third best-selling BEV in its segment, just behind the BMW i4 and the undisputed leader on the continent, Tesla’s Model 3.

So far this year, the use of high-nickel cathode chemistries (including NCM 6-9 series, NCA and NCMA) has expanded to capture 47% of the passenger EV market by MWh deployed onto roads, data from the AI Tracker reveals.

The bigger slice of the battery pie for high-nickel cells comes despite Tesla’s rising use of nickel- and cobalt-free LFP (lithium-iron-phosphate) batteries for its Model 3 and Model Y workhorses, and BYD’s use of LFP across its full model line-up.

While high-nickel cells are indeed a top choice for performance and/or long-range models like the Polestar 5, NCM 6-9 series cells can also be found in entry-level and standard range models from all corners of the globe, including the Hyundai Ioniq 5, Kia EV6 and VW ID.4.

Adamas take:

Until LFP gains serious traction outside China, where it has cornered more than 50% of the market to-date, expect high-nickel batteries to sustain their leading share of the global market.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.