Eramet’s Centenario ramp up signals pivotal moment for direct lithium extraction technology

Adamas Intelligence recently visited the site of Eramet’s Centenario project, situated in the province of Salta, Argentina.

Centenario is the world’s first commercial-scale, greenfield, absorption-type direct lithium extraction (DLE) plant without evaporation ponds – the first of its kind outside China.

This class of technology represents a step-change in the efficiency of lithium extraction from brines. Its ability to unlock vast brine resources at low operating costs were considered by some to be an existential threat to the hard rock lithium industry, while its low impact means greater social acceptance.

From our perspective, sentiment toward DLE peaked in 2022, coinciding with record lithium prices and heightened investor focus on ESG credentials.

Since that time, the pace of DLE development has moderated due to challenging market conditions and the long lead times associated with brine-to-technology adaptation.

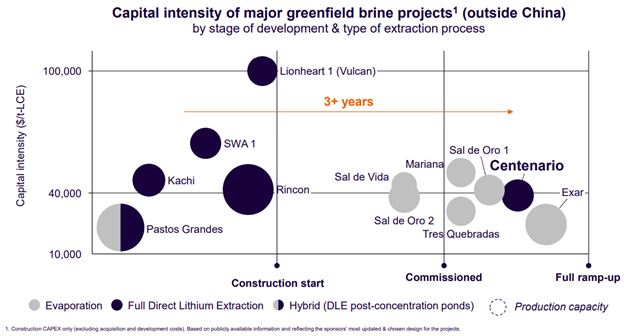

In addition, our tracking of economic studies continues to show persistent escalation in capital intensity – all while hard rock expands market share. Amid rising skepticism, the once-heralded DLE disruption has been largely dismissed from the broader supply outlook by many in the industry.

In this context, Centenario’s technology showcase comes at a uniquely significant moment in the development of the global lithium industry.

We left the Centenario site tour with little doubt that the operation will reach nameplate capacity in 2026, and with it a high-profile validation of the technology. However, this does not promise DLE proliferation.

In our view, successful adoption of DLE poses a steep barrier to entry—one that cannot be overcome by brute funding alone, but requires deep, brine-specific domain expertise developed over years. This is a far cry from the ‘plug and play’ technology models many project developers have adopted. We believe Centenario is a crucial case study in this regard.

Discovered in 2012, the Centenario asset and Eramet’s end-to-end DLE process were developed within Eramet Ideas, the company’s dedicated R&D division. A defining feature of this 13-year journey has been the continuous stewardship of Chief Process Officer Fabien Burdet, who has guided the development and optimization of the proprietary aluminate-based sorbent, overseen lab-scale piloting of various flowsheet configurations, and directed the three-year continuous operation of an on-site demonstration plant prior to construction start in 2022.

During the 3-year construction period, Eramet endured roughly 6-9 months of schedule delays. Setting foot on site and travelling the 320km (150km unsealed) access road to the regional hub of Salta, one develops an appreciation for the reasons behind these delays and a sense of awe for what has been achieved at this remote location 4,000m above sea-level.

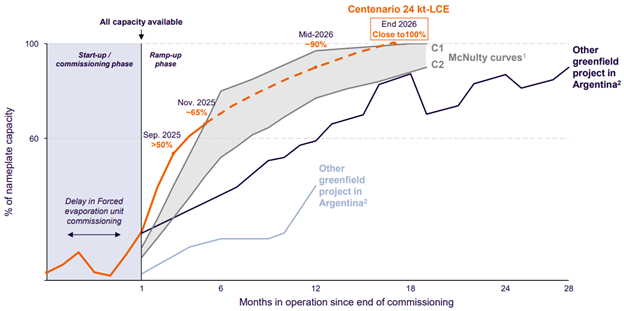

With ramp-up officially commencing 1st July 2025, the plant is now operating at 65% nameplate capacity after just 5 months. Eramet management astutely contextualizes this as tracking between series 1 and series 2 of the McNulty curve – an industry benchmark for ramp up rates of mature and prototype-incorporating technologies, respectively. In fairness, these rates relate to production volumes and not product specification.

Eramet’s plant is designed to produce battery grade lithium carbonate, however it has yet to employ its magnesium and calcium ion exchange polishing units. Consequently, output today is mostly technical grade. However, we observe the product is fetching premium pricing.

For the first 9 months of 2025, Eramet realized an average price of $8,500/t LCE, a modest ~$300/t LCE discount to the prevailing benchmark battery grade price in China. For context, the Cauchari-Olaroz solar evaporation project (operated by Minera Exar, a joint venture between Lithium Argentina and Ganfeng Lithium) realized $7,522/t LCE over the same period, equating to ~$1,300/t discount to battery grade. At an equivalent stage of ramp up as Centenario, the Cauchari-Olaroz product was discounted at an even deeper $2,000/t LCE.

DLE clearly differentiates itself from solar evaporation processes when it comes to ramp up performance, qualities beneficent to net present value and internal rate of return. In our view, the ramp up performance also serves as validation of the company’s methodical approach in project delivery.

Centenario cost $950M to build. For 24,000 tpa LCE production capacity, capital intensity is $39,600/tpa LCE. Although a dynamic metric, this was a highly respectable outcome.

The capital efficiency was evident on site. There was little evidence of excessive spending—just a high-quality stick build featuring standard redundancies for operational flexibility. The unit processes rest on concrete foundations, many sheltered in steel-frame structures, seamlessly blending with the alluvial-covered landscape as opposed to the salt-crust settings common in the Lithium Triangle.

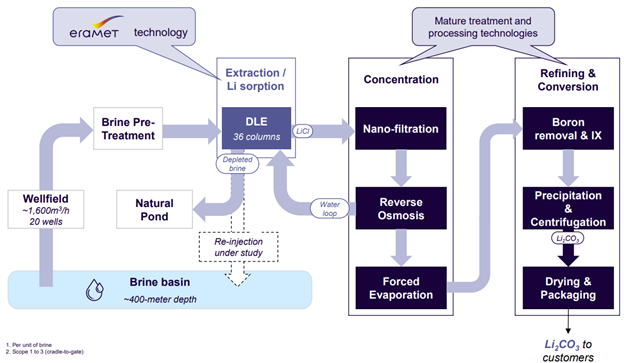

Our impression of the process flowsheet is one which prioritizes simplicity and reliability. The design comprises Eramet’s DLE technology at the front end with industry standard, off-the-shelf purification processes at the back end.

The pumped brine receives a mild pH adjustment with hydrochloric acid to optimize sorbent longevity. Further, Eramet’s third-generation sorbent prioritizes mechanical performance. The company expects negligible replacement over the project’s duration. Furthermore, in contrast to Rio Tinto’s Fénix process, which involves brine heating, Eramet operates at raw brine temperatures. These factors deliver sorbent robustness and ambient processing as core differentiators.

This focus is clearly reflected in the DLE unit’s fixed-bed configuration: twelve parallel trains of three columns each, cycled in a carousel-like sequence through adsorption, polishing, and regeneration stages. By avoiding fluidization, the design minimizes mechanical stress on the sorbent while keeping moving parts to a minimum. Eramet has pilot experience with more advanced simulated moving bed systems and is evaluating them for future expansions.

The resulting plant is remarkably straightforward to operate – comparable in complexity to a small desalination facility. There are only 65 operators on site and primary controls managed from a modern control room with three terminals.

Sustaining capital is targeted at 2–3% of initial capital per annum, equating to roughly $1,000/t LCE at nameplate, while the company’s cash cost guidance of $5,400–5,800/t LCE EXW sits comfortably in the first quartile. It is our understanding this OPEX guidance reflects reagent supply-chain optimizations, lower-than-expected energy use, and global lithium recovery exceeding 80%.

For brine projects overall, we continue to view capital intensity as the more critical driver of returns, given the inherently low operating costs.

Centenario is fulfilling the low-impact promises of DLE technology. The plant’s visual footprint is remarkably modest. Scope 3 carbon footprint is low at 6 t CO₂eq/t LCE. The long-term freshwater consumption target is <50 m³/t LCE, which is comparable to Olaroz, a solar evaporation site operated by Rio Tinto.

We left the tour convinced that Eramet holds a genuine long-term commitment to environmental sustainability and regional social license. A prime example is the company’s proactive investment in demonstrating the viability of spent brine reinjection—a practice currently not permitted under provincial regulation. It is to Eramet’s credit that the primary driver is to minimize physical disturbance to the plateau.

Centenario is shaping up to be a world-class project delivery, pending full achievement of nameplate capacity in 2026. Eramet is demonstrating that commercial-scale DLE on continental brines is not only viable but can be executed with capital discipline, rapid ramp-up and low environmental impact. In an era of widespread DLE skepticism, Centenario offers powerful validation of what patient, methodical development can achieve—setting a benchmark that few competitors are likely to match in the near term.

Incorporating our framework on the rollout of DLE technologies, our incentive models suggest ~1.0 Mtpa of DLE production capacity will be brought to market by 2035, most of which will be continental brines, and only a fraction of which will be greenfield, pure-DLE plants such as Centenario.