Big swing to plug-in hybrids starting to hurt battery nickel demand

One in four

Through the first quarter of 2024 global plug-in hybrid electric vehicle (PHEV) registrations surged by 55% year on year to 1.2m units while full battery electric vehicle (BEV) and conventional hybrid electric vehicle (HEV) sales increased just 13% and 17%, respectively, over the same period.

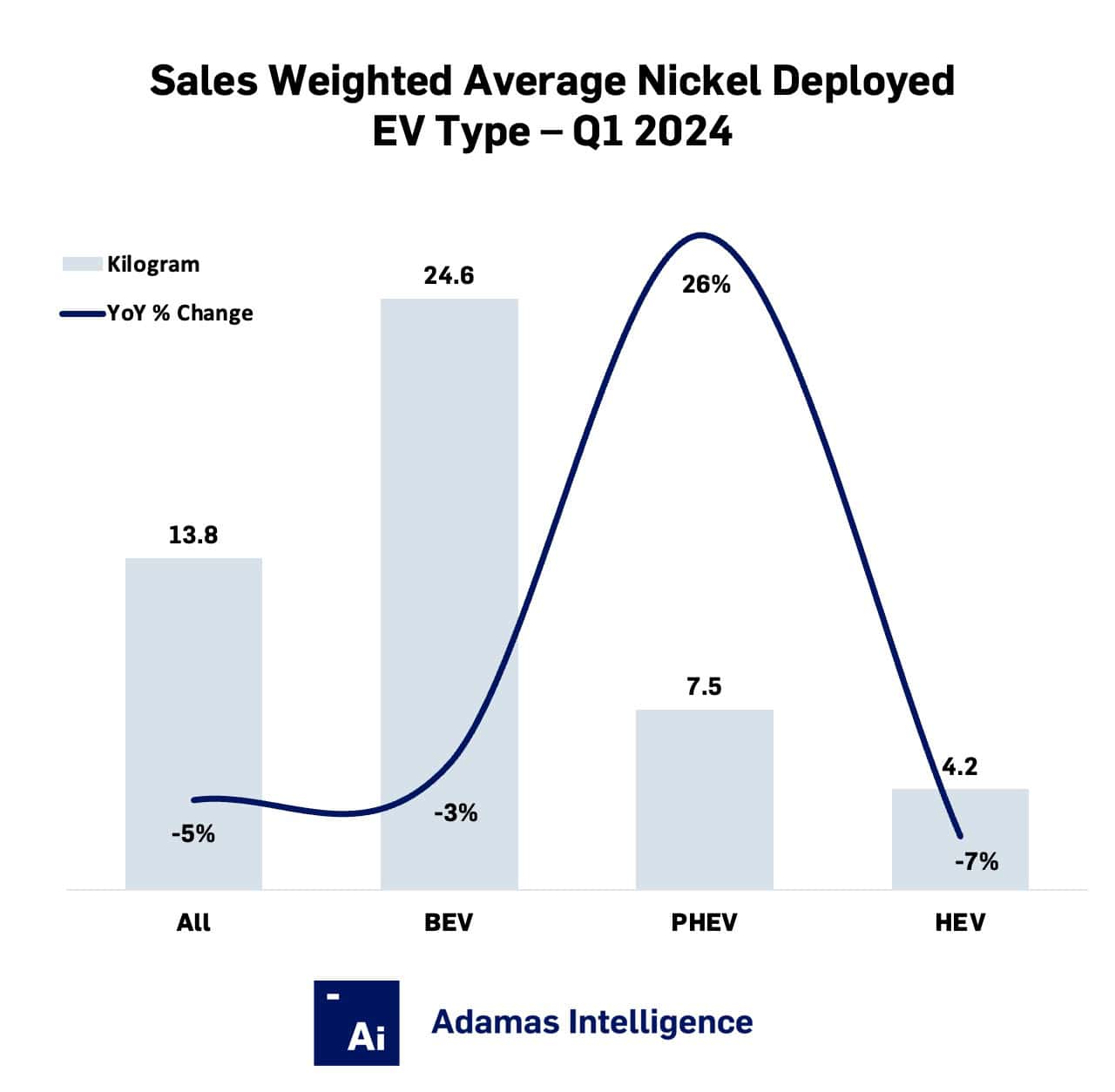

Consequently, the amount of nickel contained in the average electric vehicle (BEV, PHEV and HEV) sold globally during Q1 2024 fell by 5% year on year to 13.8 kilograms as PHEV registrations growth worldwide far outpaced that of full BEVs – the latter of which contains a larger battery and greater nickel loading on average.

PHEVs made up 25% of the global EV sales mix in Q1, up from less than one in five last year and despite seeing a 20% jump in the average PHEV’s battery pack capacity over the same period, the increase was not nearly enough to offset the weakness imparted by BEVs with respect to nickel use.

Through the first quarter of 2024, the average BEV sold globally contained 24.6 kilograms of nickel, down 3% year on year, while the average PHEV and HEV contained 7.5 kilograms and 4.2 kilograms of nickel, up 26% and down 7% year on year, respectively.

Consequently, with PHEV sales surging in Q1, the amount of nickel contained in the average electric vehicle (BEV, PHEV and HEV) sold globally during the same period dropped by 5% to 13.8 kilograms.

High nickel lower

Apart from the growing popularity of PHEVs, a year on year slowdown in the deployment of high nickel cell chemistries compared to last year also contributed to nickel’s underperformance during the quarter.

The combined capacity of high nickel batteries – NCM 6-, 7-, 8-, 9-Series and NCA – in newly sold EVs grew by a pedestrian 9.5% in Q1.

In contrast, the workhorses of the EV battery industry – LFP and NCM 5-Series packs – saw deployment leap by 37% and 36% respectively.

Adamas take:

China’s booming market amid a raging price war, particularly at the lower end of the market, carries most of the blame for a drop in global average EV nickel loadings.

Not only are Chinese buyers increasingly opting for plug-in hybrids (with Q1 PHEV registrations up 78% year on year) but LFP, popular for entry level EVs, now commands 52% of the market in the country.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.