New anti-China rules keep US in electric vehicle slow lane

China-free from mine to megawatt

In a move aimed squarely at China, the US last week issued long-awaited new rules to limit the use of EV batteries and raw materials from so-called foreign entities of concern (FEOC).

The Dept of the Treasury rules define an FEOC as any company that is controlled by or subject to the jurisdiction of China’s government, or any production and processing that takes place inside China. A private company is considered under control of an FEOC if ownership exceeds 25%.

Starting from 2024, EVs that contain any battery components manufactured or assembled by China will not be eligible for the tax credit, currently a maximum of $7,500 per vehicle.

The incentive cut-off date for any lithium, nickel, cobalt and graphite or other battery metals produced by, or which make their way through China, is 2025 (rare earths are already subject to these rules).

FEOC FOMO

A carve out was made for foreign subsidiaries of privately-owned Chinese companies in friendly countries, like Australia and Indonesia, but even these entities may fall foul of the rules if they are deemed to be under the control of the Chinese government.

The new guidelines may allow US automakers to cut licensing and technology deals with Chinese companies, which should give a green light to ventures like Ford’s partnership with CATL for its (now much diminished) LFP plant in Michigan, and Tesla’s venture in Texas with the Chinese behemoth.

Ultimately though, even these arrangements may not pass the US Dept of Energy’s interpretation around FEOCs, which stipulates that technology licensing or off-take arrangements may result in “effective control” of a venture’s production and processing. Appreciate Ford’s careful wording in its February press release when the BlueOval battery park was first announced to see how this particular needle may be threaded.

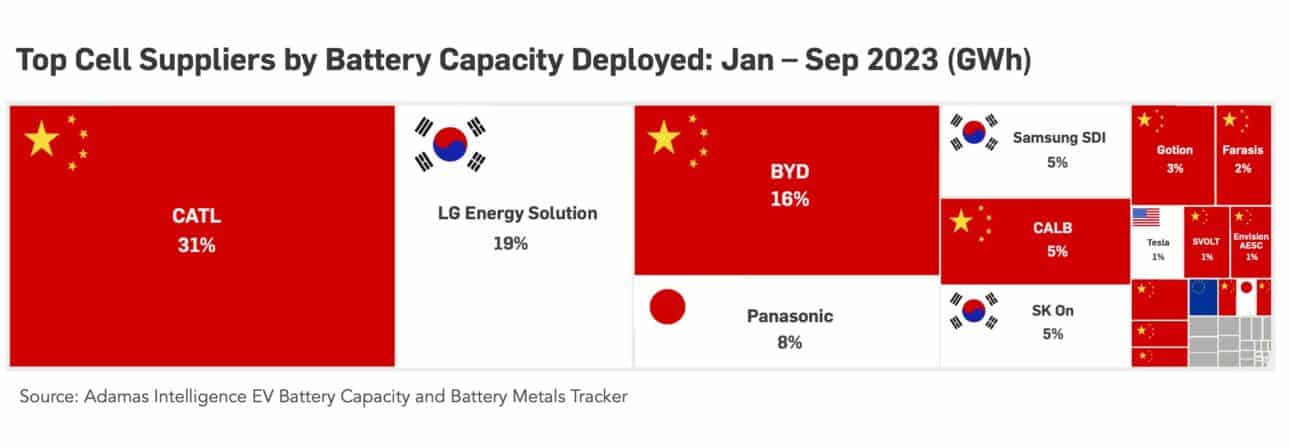

The only US-based cell supplier of any substance – Tesla – has managed 1% global market share in terms of GWh deployed through September of this year and the EV pioneer so far won’t share its cells, which are in the just-launched Cybertruck, the way it does its charging network.

Considering Chinese battery makers will be ineligible a month from now, and the Koreans, who inevitably source material from across the Yellow Sea, potentially a year later, the $7,500 incentive does not look worth the paper it’s written on.

The new EV provisions pitted automakers against mining firms with the former arguing that barring China from directly participating in the US mine-to-megawatt supply chain would be close to impossible given the short timelines, and would delay EV adoption by Americans by pushing up costs.

Miners, justifiably, want rules that speed up and incentivize domestic production, not least because the time from resource discovery to mine production is often counted in decades.

The convoluted US permitting system also provides almost zero certainty that investments, often in the billions of dollars, in new mines will pay off – no matter to what extent miners dot environmental i’s and cross social license to operate t’s.

The FEOC rules are intended to complement the Inflation Reduction Act’s requirement that any EV subsidy is conditional on a percentage of all material inputs being sourced either domestically or from a US free trade partner. Currently the threshold is 30% and will rise to 80% in 2027.

Any EV you want as long as it is a Model Y

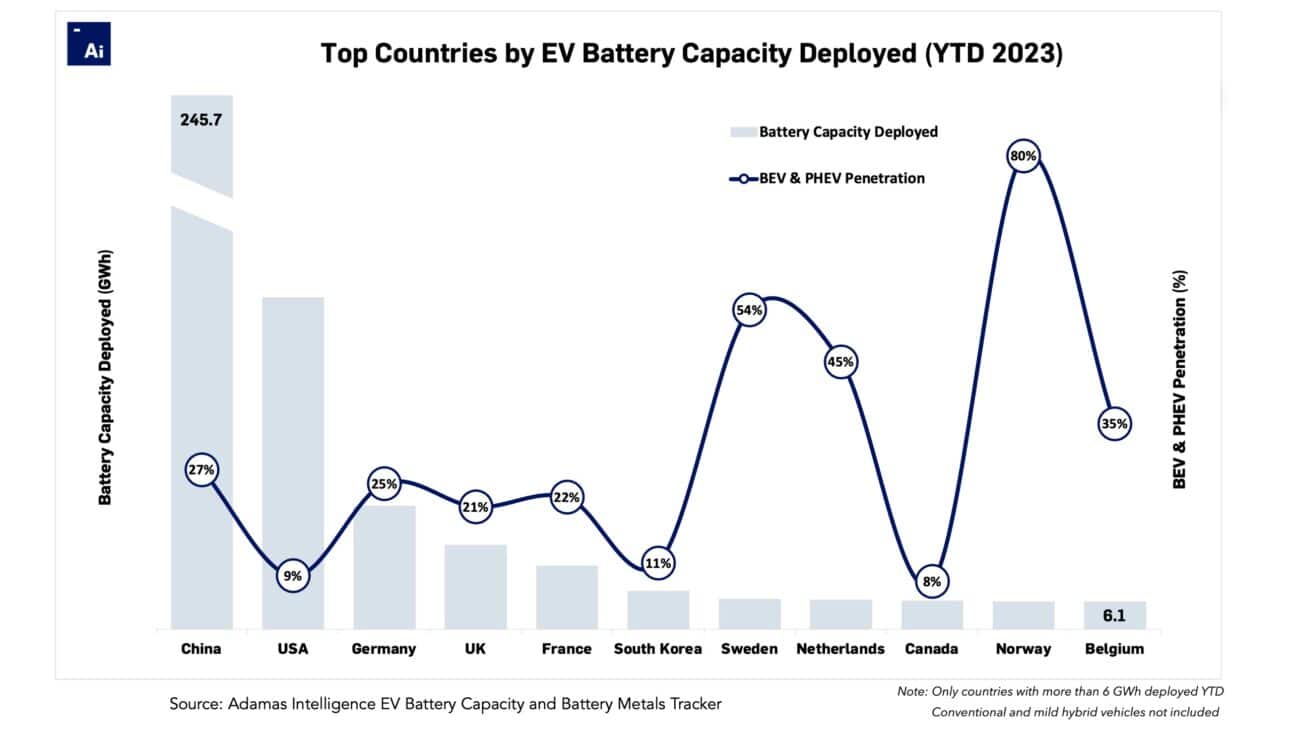

That the US is behind in EV adoption is not in dispute, however. Compared to last year, US sales of full electric and plug-in hybrid passenger cars are up by an impressive 54% and 56%, respectively, to a combined 1.1 million during the first nine months of 2023.

But that translates to a penetration rate of only 9% for the world’s second largest car market, up from 7% during the same period in 2022. That’s a long way away from the US government’s goal of EVs at 50% of overall sales by the start of the next decade.

By contrast, in China, in the month of September alone, 754,000 BEVs and PHEVs left dealership lots. Not counting conventional or mild hybrids, EV registrations in China constituted 27% of total passenger car sales through September, up from 23% last year.

Not only are Chinese EVs much cheaper than in the US – sometimes less than half the price for comparable models – Chinese car shoppers can kick the tires of 110 different brands and more than 300 different electrified models that span all possible vehicle segments and configurations.

Conversely, consumers in the US who are considering putting internal combustion engine-powered vehicles on ice have much slimmer pickings.

In the US, just over 30 marques compete to put drivers into 115 different models. That the ageing Tesla Model Y alone makes up 31% of the overall US electric market in terms of the battery power hitting roads this year describes an industry structure not dissimilar to the early days of the Model T.

High fives for HiPhi and a warm welcome to Weltmeister

Across Europe, more than double the number of BEVs and PHEVs have found new owners this year compared 2022. Every fifth vehicle sold on the continent through September was a full-electric or plug-in hybrid. Adding conventional hybrids (HEVs) to the mix, electrified vehicles make up 30% of the market in Europe, nearly double the US by the same measure.

In Europe’s most electrified car markets – Norway and Sweden – BEV and PHEV penetration rates in 2023 reached 80% and 54% respectively year-to-date, while in the Netherlands this figure went from 36% in 2022 to 45% this year. Add in HEVs and electrified vehicles have captured 85%, 62% and 59% of sales in the three nations, respectively, so far this year.

Europe did not get to these adoption rates by excluding Chinese EV manufacturers (although the EU is now working hard to do so).

Europeans can and often do choose Geometry, HiPhi, Lynk & Co, Ruixing, Seres, Weltmeister, Aeolus, Zeekr, XPeng and others over homegrown automakers like Volkswagen, Peugeot and Fiat. Get behind the wheel of a Tesla, Citroen, BMW, Dacia, Honda, Renault or Smart and there’s also a good chance you’re driving a made-in-China vehicle.

The Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows that so far this year, in terms of battery capacity rolled onto roads, 19% of the EVs bought by Europeans were made in China.

In the US, it’s close to zero. And will now stay that way.

Header image: Mattel Creations – Hot Wheels

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview