CHART: US lawmakers want to raise Trump’s 25% tariff on Chinese EVs

Chinese automakers set to flood export markets with cheap EVs

A bipartisan group of US lawmakers want the Biden administration to hike the current 25% tariff on vehicles made in China and find ways to prevent Chinese automakers from exporting to the US by locating plants in countries with free trade deals such as Mexico.

“It is critical that tariffs on (Chinese) automobiles not only be maintained but also increased to stem the expected surge in (Chinese) imports,” they wrote in the previously unreported letter seen by Reuters.

The letter noted that many of the electric vehicles exported from China are made by Western brands, such as Tesla, and asks for a new so-called Section 301 investigation, which in 2017, with the urging of the Trump White House, led to the imposition of tariffs and trade duties on a range of Chinese goods.

The middle kingdom’s overall vehicle exports surpassed South Korea in 2021, then overtook Germany in 2022, and this year will take top spot from Japan after a 74% jump in volumes so far this year. Trade data indicates that of the 2.8 million vehicles China exported, one million were electrified.

Packed up and ready to go

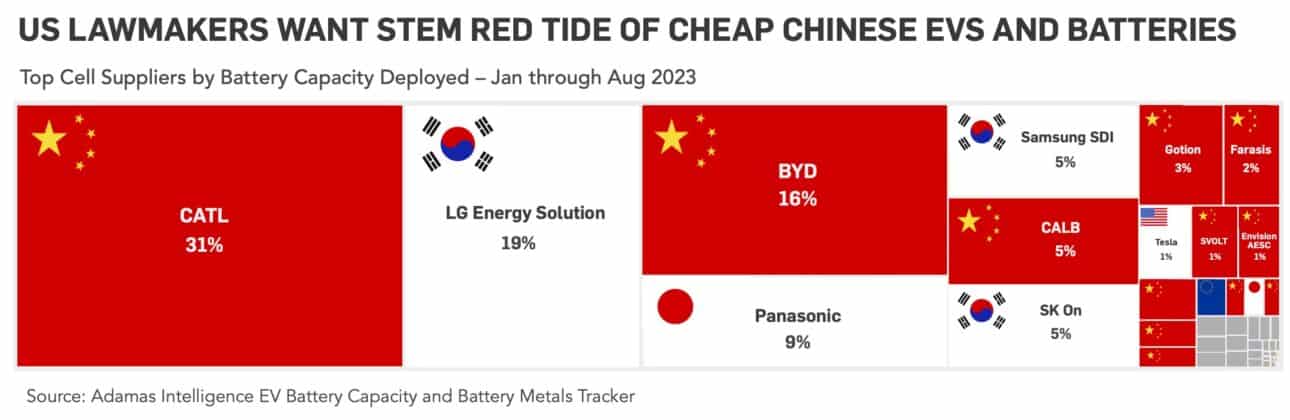

Data from the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker show that the top 5 Chinese cell suppliers by MWhs deployed onto the world’s roads – CATL, BYD, CALB, Gotion and Farasis – together enjoyed 56% global market share in the first eight months of 2023.

In the US, CATL supplied 12% of the cell packs fitted to EVs – including a small number of plug-in hybrids – that hit roads this year, mostly on the back of Tesla’s Model 3. The world’s biggest battery manufacturer also supplies power units for EVs from Mercedes, BMW, Kia, Nissan and others sold in the country this year.

Europe on the road to Sino sanctions

In October, the European Commission formally launched a probe into Chinese government support for its EV industry based on complaints similar to those in the letter from US lawmakers.

The investigation will more than likely result in the imposition of trade sanctions or other punitive measures to block the inroads Chinese OEMs have already made on the continent.

Analysis of data in the Adamas tracker points to a large and growing share for Chinese EV makers in Europe, which has proven an easier market to penetrate than the US so far.

Year to date, around a fifth of all GWhs delivered to EV (and hybrid) buyers in Europe, including Britain and non-EU states, were contained in China-made cells. The majority were non-Chinese brands including Dacia, BMW and of course Tesla.

European countries are already putting up barriers. Before the end of the year France will implement measures that will exclude China-made EVs from its subsidy scheme based on their carbon footprint during manufacture and transport. Italy is expected to follow suit.

China goes from giga to tera

Despite China’s already tight grip on battery manufacture, construction and commissioning of new plants in the nation are only accelerating.

Production capacity in China is expected to reach a towering 1,500 GWh this year according to a recent study, boosted in no small part by subsidies from central and local governments.

To put that in perspective, only 211 GWh were deployed in the battery and hybrid EVs leaving showrooms in China from January through August this year, the AI Tracker shows. And China was responsible for over half the global total.

In September, the average price paid for an EV in the US was $50,683 — down from more than $65,000 one year ago, almost entirely due to Tesla’s series of aggressive price cuts.

The average retail price of an EV in Europe in the first half of 2023 was more than €65,000.

In China you can get behind the wheel of the 110 assorted brands and more than 300 different electrified models available in the country for less than half that price.

Adamas take:

China’s overbuilding and breakneck expansion of its EV industry, particularly battery manufacturing capacity, will inevitably lead to the country exporting its excess electric cars and cells.

Apart from the politicians pursuing mercantile trade policies and the burgeoning bureaucracies implementing them, EV protectionism has few beneficiaries. And when it comes to variety and affordability, electric car shoppers in the US and Europe certainly would not count among them.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview