Italy set to follow French playbook to counter Chinese EV imports

Mooted rules score an EV based on how much energy is used to produce materials, assemble it, and transport it to the market

Italy is looking into a changes to its electric car subsidy rules that would take into account the emissions involved in their production and transportation, according to a Reuters report.

These new rules are based on a similar approach recently adopted by France that will come into effect in December. The French approach assigns a score to each car model based on how much energy is used to make its materials, assemble it, and transport it to the market, as well as the type of battery it has.

This score determines whether the car is eligible for a bonus or a penalty and will likely make EVs and batteries produced in China ineligible, given the country’s reliance on coal for the bulk of its energy generation.

Last week, the European Commission formally launched a probe into Chinese support for its EV industry over complaints that global markets are being flooded with cheaper Chinese electric cars whose prices are kept artificially low by huge state subsidies. As Adamas has long expected, the carbon footprint assessment of EVs could become a template for any EU countermeasures put in place following the investigation.

The Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows that in the first half of 2023, 19% of all GWhs delivered to EV (and hybrid) buyers in Europe, including Britain and non-EU states, were contained in China-made EVs and packs. The majority were non-Chinese brands including Dacia, BMW and Tesla.

Stellantis home performance less than stellar

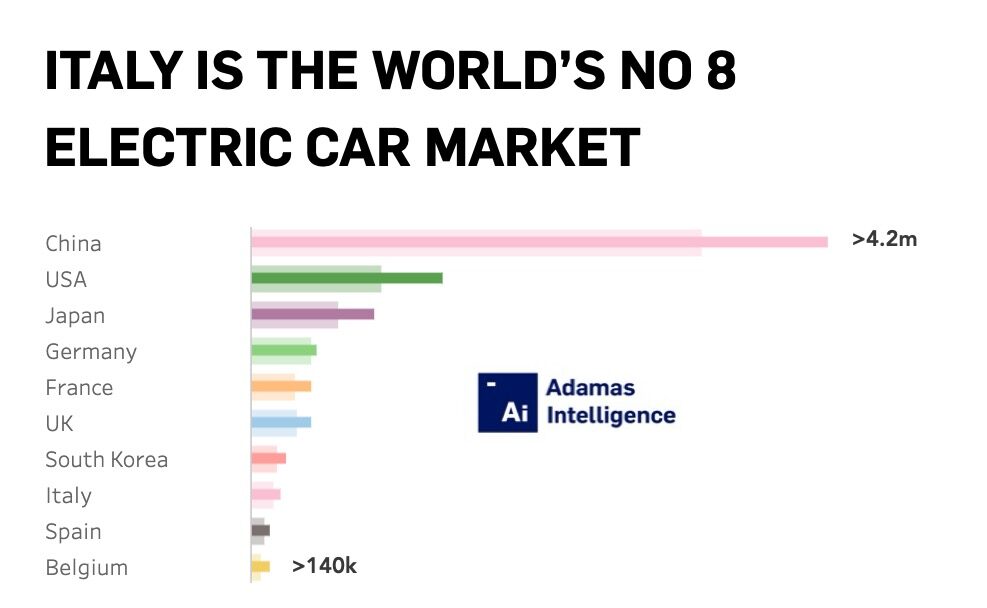

The mooted EV incentive is part of a broader strategy from Rome to revive its car industry and increase annual car production to one million vehicles. Italy is the world’s 8th largest market for full electric (BEV), plug-in hybrid (PHEV) and conventional hybrid (HEV) cars with new registrations in the year to end-July of around 230,000.

Italy’s EV market is relatively underdeveloped compared to its neighbors to the north with BEVs making up fewer than one-in-five light-duty EVs hitting roads there this year. More than 60% of the Italian market is represented by HEVs, with sales growing at a much faster clip than BEVs.

HEV registrations in Italy are up by over 50% this year-to-date, while BEV registrations are up 23%. Italians appear to be not so keen on plug-in hybrids – that segment grew by a mere 2% year-on-year. The Italian market is dominated by Toyota, Renault and Suzuki, with Italy’s only mass-market carmaker, Stellantis, surprisingly underrepresented.

Stellantis marques Jeep and Alfa Romeo make the country’s top ten, but Fiat is in a lowly 17th place after a 15% drop in EV sales year-to-date compared to the same period of 2022.

Adamas take:

Adamas has long expected that the carbon footprint of an EV, battery and associated materials would become a lever in the West for leveling the competitive playing field with foreign manufacturers that benefit from low costs associated with dirty power generation and lax environmental regulations.

Beyond the EV, we expect carbon will also be used in the future as a measure to penalize and reward raw materials imports (and production) in an attempt to level the upstream playing field to the benefit of local and allied producers.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview