Power delay: Volkswagen only building half of promised battery plants

German automaker announced plans for six gigafactories with 240 GWh capacity at its March 2021 Power Day

Volkswagen has postponed a fourth battery factory in Europe indefinitely, the German carmaker’s chairman Oliver Blume said this week.

“Based on market conditions, including the sluggish ramp up of the BEV (battery electric vehicle) market in Europe… there is for the time being no business rationale for deciding on further sites,” Blume said in a statement provided by Volkswagen’s Czech unit Skoda Auto.

Volkswagen’s wholly-owned battery unit Powerco has been scouring Eastern Europe for sites since announcing an ambitious expansion strategy at its “Power Day” in March 2021 when the company said it plans to open six EV battery cell plants with a combined capacity of 240 GWh by 2030.

Only three factories have now been greenlit. The first will be in Salzgitter, Germany, with production at the 40 GWh plant planned for 2025 while the second is located in Valencia, Spain also with 40 GWh capacity (with potential to expand to 60 GWh).

The third factory is destined for St. Thomas, Ontario, which would be the first PowerCo cell plant outside of Europe. VW’s decision to go ahead with the massive 90 GWh facility in Canada was no doubt made possible by eye-watering tax breaks of more than US$10 billion offered by Ottawa. (Something Prague was unable or unwilling to do to the great relief of the European nation’s taxpayers.)

Volkswagen’s decision follows announcements by Ford in October to delay construction of the BlueOval Battery Park in Michigan, and in January by the GM–LG Energy Solution joint venture, Ultium Cells, to nix its fourth planned plant.

Toyota, however, said this week it is more than doubling its investment in North Carolina to $14 billion and will now devote 10 of 14 battery assembly lines to plug-in (PHEV) and conventional hybrid (HEV) models.

Horsepower bolting the VW stable

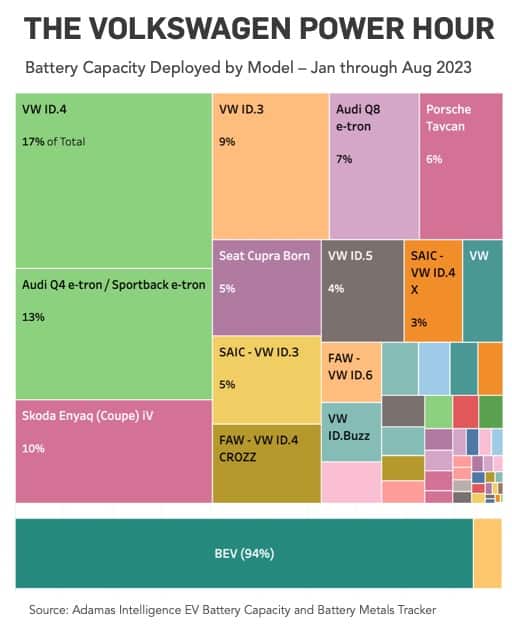

Based on global sales-weighted average battery capacity data derived from the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker, Volkswagen’s three confirmed plants are enough to build more than 2.7 million BEVs.

The AI Tracker indicates that all the Volkswagen-badged EVs sold so far this year (through August) were fitted with batteries with a combined 18.4 GWh, affording the company 4.5% of the global market based on battery capacity deployed.

That includes the Passats, ID.3s, e-Boras, e-Lavidas and Magotans it manufactures through joint ventures in China with SAIC and FAW. Around a third of Volkswagen EV sales of just over 200,000 this year were in China.

Volksies make up just over half the power-hours the group has unleashed onto roads this year. Add Audi, Seat, Porsche, MAN, Bentley and the now sans-plant Skoda, and the numbers begin to look tidier and sees Wolfsburg capture a respectable 8.7% of the global EV market.

Over the first eight months of the year, the battery capacity deployed by marques in the Volkswagen stable is close to 80% of the total for the 2022 calendar year and already exceeds 2021’s GWh tally.

Global capacity

Also working in the German giant’s favor is geographical spread. Volkswagen’s four top markets – Germany, China, US and UK – represent only 62% of its overall battery capacity deployed in 2023.

Fans of the company’s EVs can be found in far flung places like Mauritius and Puerto Rico and the carmakers tireprint extends to undeveloped EV markets like Kazakhstan, Costa Rica, South Africa and Uruguay.

The group’s deliveries are 94% BEVs with the remainder PHEVs compared to a global mix of 50% BEV, 30% HEV and 21% PHEV.

Adamas take:

Since Power Day two-and-a-half years ago Volkswagen AG has managed to move 115 GWh onto the world’s highways and byways. Three operating battery plants with 170 GWh annual production would still give Volkswagen plenty of scope to satisfy its lofty near-term electric car ambitions.

[NOW READ: BlueOval blues: Ford pause further delays more affordable US EVs]

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview