BlueOval blues: Ford pause further delays more affordable US EVs

US LFP penetration is single digits, all thanks to the Model 3; in China it’s 50%

Ford Motor’s decision Monday to halt construction of its massive BlueOval Battery Park in Michigan, barely seven months after announcing the $3.5 billion project, shows us the limitations and unintended consequences of the Inflation Reduction Action (IRA), the most ambitious piece of legislation to revive the industrial economy of the US in decades.

“We are pausing work and limiting spending on construction on the Marshall project until we’re confident about our ability to competitively operate the plant,” Ford said on Monday. The 35 GWh plant was set to start initial production in 2026.

Politics aside, and there is plenty of that swirling around the US auto sector, Dearborn’s decision is also a setback for EV affordability and adoption in the US, which lags the rest of the developed world.

Ford made much of the fact that BlueOval would produce lithium iron phosphate (LFP) batteries, calling it a “key part” of its US EV plans (which now come with a stomach-churning $18 billion price tag) allowing it to “scale more quickly, making EVs more accessible and affordable for customers.”

Ford’s engineers would produce cells using “LFP battery cell knowledge and services provided by CATL.” Note the careful wording in the press release about Chinese firm Contemporary Amperex Technology’s involvement lest Ford falls foul of the IRA, which bars EV tax credits worth $7,500 if any battery components are manufactured or assembled by a “foreign entity of concern.”

It’s not just Ford facing LFP roadblocks. Earlier this month American Battery Factory said it’s postponing the construction start date of its $1.2 billion Arizona plant while another Arizona hopeful, Kore Power (and its $850 million Department of Energy loan), won’t deliver any LFP batteries before 2025 either, the majority of which could ultimately go to its stationary storage customers anyway.

Blade runners

The rise of the cheap and cheerful LFP battery has been one of the biggest factors behind the rapid adoption of EVs around the world.

For EV battery makers deciding on cathode materials, LFP provides the opportunity to eliminate the use of pricey and difficult to source nickel and cobalt used in NCM (nickel cobalt manganese) and NCA (nickel-cobalt-aluminum) EV batteries.

Some EVs use a combination to capitalize on the strengths of the competing technologies – higher energy and power density and better cold weather performance for NCMs versus lower cost, increased thermal stability and longer lifespan for LFPs.

Although the gap has closed as cobalt and nickel prices continue to fall, LFP provides significant cost savings compared to NCM and NCA.

Moreover, more than two thirds of global cobalt and half of nickel is produced in Congo and Indonesia respectively, the latter of which is beset by environmental issues, and exports from there would almost certainly not be IRA-friendly, (Indonesian PM Jokowi’s recent efforts to sign a free trade deal with the US notwithstanding).

BYD – in which legendary investor Warren Buffet famously bought a stake in 2008 for $232 million that is now worth over $5 billion (even after selling off some shares in 2020) – should get credit for much of the popularity of LFP among incumbent carmakers.

In March 2020, BYD revealed its breakthrough Blade battery technology which made up for the inherent energy density limitations of LFP by cramming more cells into battery packs.

The company also said the blade is much less prone to catching fire than NCM batteries which was a concern particularly among Chinese buyers at the time. Today BYD’s all-LFP model range outsells Tesla during good months.

Wrangling CATL

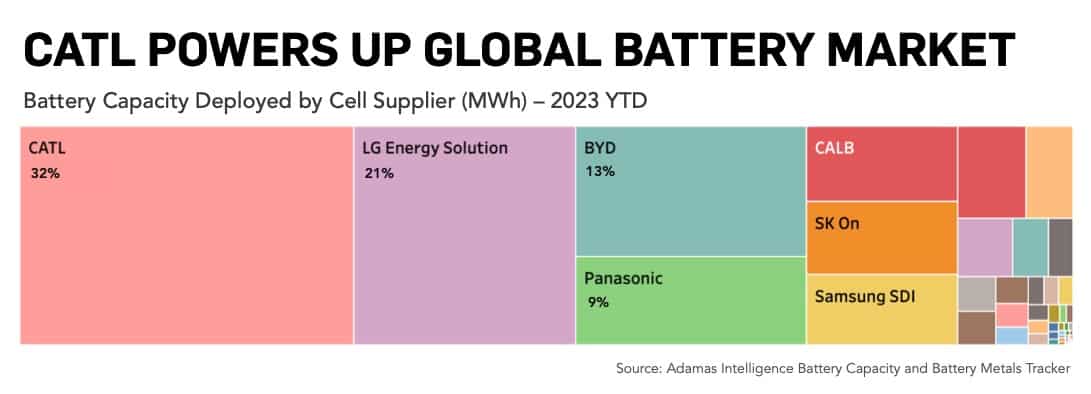

Whatever LFP-related “knowledge and services” CATL was going to impart to Ford, the Chinese firm was the obvious choice for a battery partner in Michigan. In terms of overall battery capacity deployed, CATL can almost lap its nearest competitors.

According to the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker, CATL saw more than 16,000 MWh of its cells roll onto roads worldwide in newly-sold EVs in July alone. BYD and LG Energy Solution shared second place, each just shy of 9,000 MWh in the same month.

Globally, BYD is responsible for 50% of all LFP capacity deployed onto roads in 2023 to-date, but since most of its batteries end up in the Chinese automaker’s own cars, CATL is the natural “knowledge and services” partner for Western OEMs. While other Chinese battery makers such as Gotion are expanding LFP production and BYD is upping supply to other carmakers, Korea’s LGES, SK On and Samsung SDI have not made any inroads into LFP.

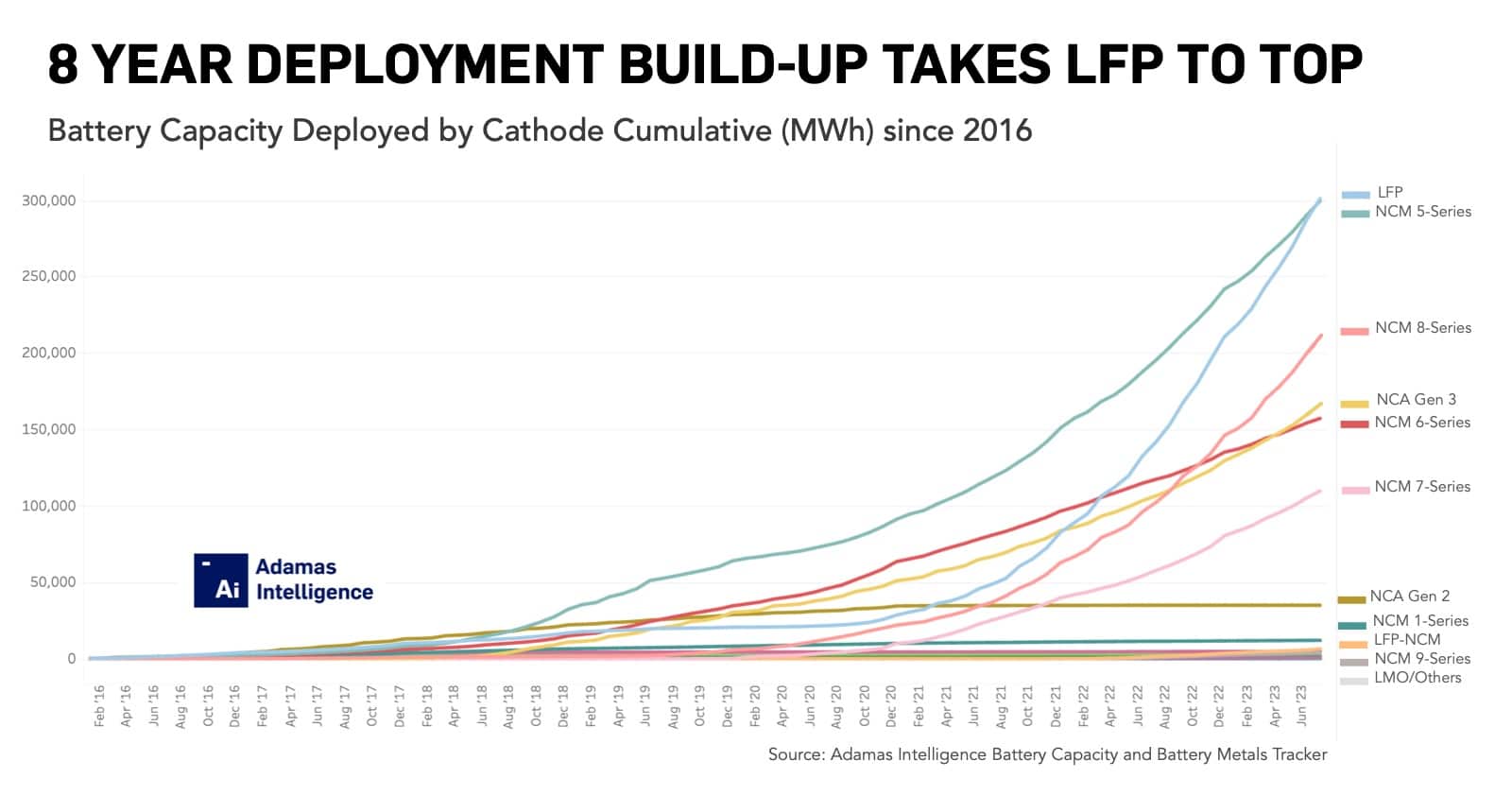

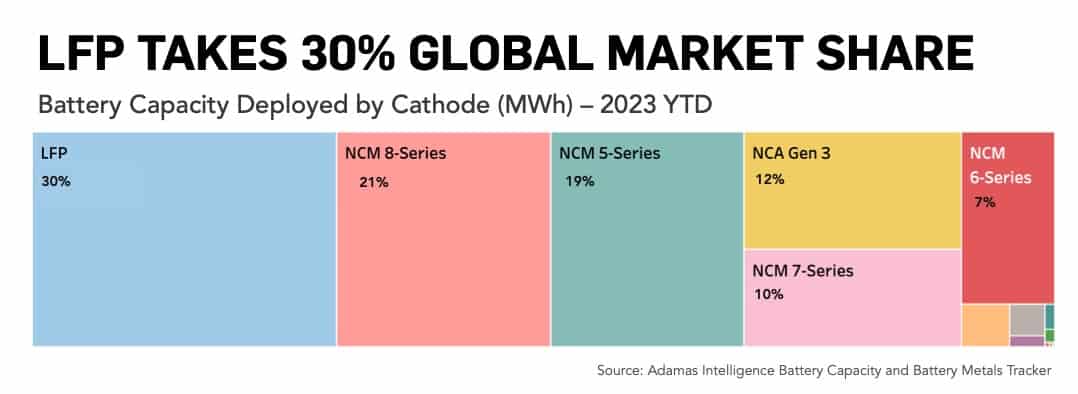

Worldwide, LFP racked up 30% of the battery capacity deployed onto roads through the first seven months of this year, up from just 11% in 2018, according to Adamas data. In China, however, LFP currently owns more than 50% of the market. And to put that in perspective, China deployed more EV battery power in full-electric vehicles (BEVs) so far this year than the next 22 countries combined.

LFP in the USA

At the moment in the US, if you want to drive an LFP-equipped vehicle you need to head to Tesla.com or become an Amazon delivery driver.

Apart from the Model 3, the only other LFP vehicles roaming US streets are Rivian’s delivery vans made for Amazon although the Detroit-based startup could well bring LFP to its popular pickups and SUVs.

LFP penetration is at single digits in the US and that’s thanks almost entirely to CATL-battery containing Model 3s available in the country. Tesla’s LFP Model 3 deliveries in the US so far this year are approaching volumes achieved in China, Adamas data show.

CATL provides batteries for Tesla at its Shanghai factory from where LFP-based entry level versions of the two workhorses are exported to Europe and elsewhere.

The bulk of newly sold Model 3s around the world has been LFP powered this year and the LFP-version of the Model Y occupies the top spot in China (in terms of battery capacity deployed).

Tesla is also expected to produce LFP batteries at its Texas factory, which is currently under construction, with the help of CATL. And depending on how IRA criteria evolves (and billions of dollars of lobbying money will make sure it does), with the help of the US government. Tesla has confirmed it’s switching to LFP for all its standard range cars.

Tesla’s margins are the envy of the automaking world and the Texas-based company’s rising use of LFP means it is likely to stay that way. Tesla also has the maneuvering room to make deep price cuts whenever it needs to move metal. Less and less of that is going to be cobalt or nickel.

Back to overview