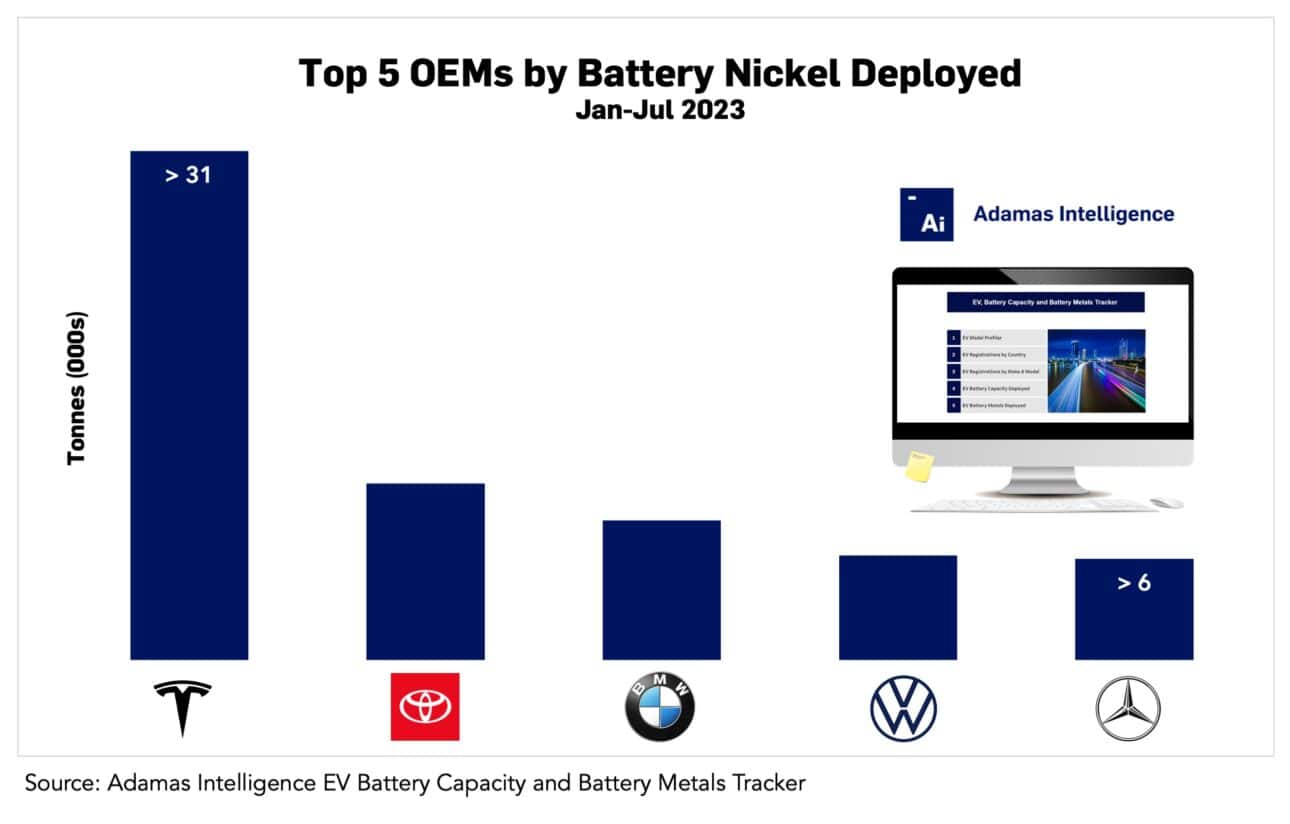

Top 5 EV makers by nickel deployed year-to-date in 2023

Tesla leads in nickel deployed and ups market share

Tesla is the leading carmaker by nickel deployed onto roads year-to-date, with more than 31,800 tonnes of nickel used in its EV batteries from January through July 2023. This is a massive 63% increase from the same period in 2022, when Tesla deployed less than 20,000 tonnes. Tesla also increased its lead on a percentage basis and now accounts for 21% of nickel deployed this year.

Toyota is the second-largest OEM by nickel deployed so far this year, with just over 11,000 tonnes of nickel used in its batteries from January through July, a 28% increase from the same period in 2022.

Number three and four in the ranking, BMW (over 8,700 tonnes year-to-date) and Volkswagen (more than 6,500 tonnes year-to-date) are also two of the fastest-growing OEMs, with 118% and 126% more tonnes of nickel deployed respectively from January through July 2023.

Rounding out the top five is Mercedes-Benz with over 6,300 tonnes of nickel deployed during the first seven month of this year, a robust 76% increase from 2022 for the luxury carmaker.

The law of averages

Booming nickel demand on the global EV market is not just a function of a surge in the volumes of electric cars hitting roads this year but is also being boosted by higher nickel weightings in your average EV.

The Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows average nickel use in EV batteries was up 8% in July 2023 versus the same month the year prior, reaching just over 15 kilograms per vehicle sold.

The bump in average usage is a function of the years-long trend towards high nickel cathode chemistries. The most deployed NCM (nickel-cobalt-manganese) cathode in 2023 has a roughly 8:1:1 split and together with NCM 6-series and higher, and NCA (nickel-cobalt-aluminum) chemistries, captured 47% of the market in July.

For plug-in hybrids (PHEVs), average nickel use was up 11% year-over-year to 6.5 kilograms per vehicle in reflection of the many automakers releasing PHEVs with beefed up batteries.

Adamas take:

Toyota is ranked second despite the fact that more than 94% of the Japanese carmaker’s EV sales this year were conventional hybrids (HEVs). HEVs remain a significant source of nickel demand – not only do almost half the HEVs sold from January through July 2023 come equipped with nickel-metal-hydride (NiMH) batteries, but nickel-containing NCM chemistries also now constitute 20% of the HEV market.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview