Battery nickel use increasing for all EV types

Amount of nickel in average EV battery up 8% year-over-year

Nickel weighting in BEV batteries jumped 8% year on year to average 25.3 kilograms in July as carmakers continue to opt for high-nickel batteries for long-range, performance and even many entry-level new models.

Most of the nickel mined around the world still ends up as stainless steel and soft demand from the construction and manufacturing sector on the all-important Chinese market has seen prices drop precipitously in 2023.

A rapid production ramp up in Indonesia (already responsible for half of global nickel output) only adds to current weak fundamentals, and low level chaos on the London Metal Exchange after a short squeeze and allegations of warehouse fraud have made the situation even worse.

Prices for nickel cathode (minimum 99.96% Ni ex-works China) have been on a steady decline and are now down 33% year-to-date, dropping below $22,000 a tonne for the first time in 2023 last week, according to Asian Metal. Nickel sulfate prices (minimum 22% Ni delivered China) have fared slightly better but are still down 18% year-to-date.

Nickel bulls looking for good news have turned their attention to the electric car market where the use of lithium-ion batteries (and specifically those with nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) cathodes) continues to expand.

Get a load of this

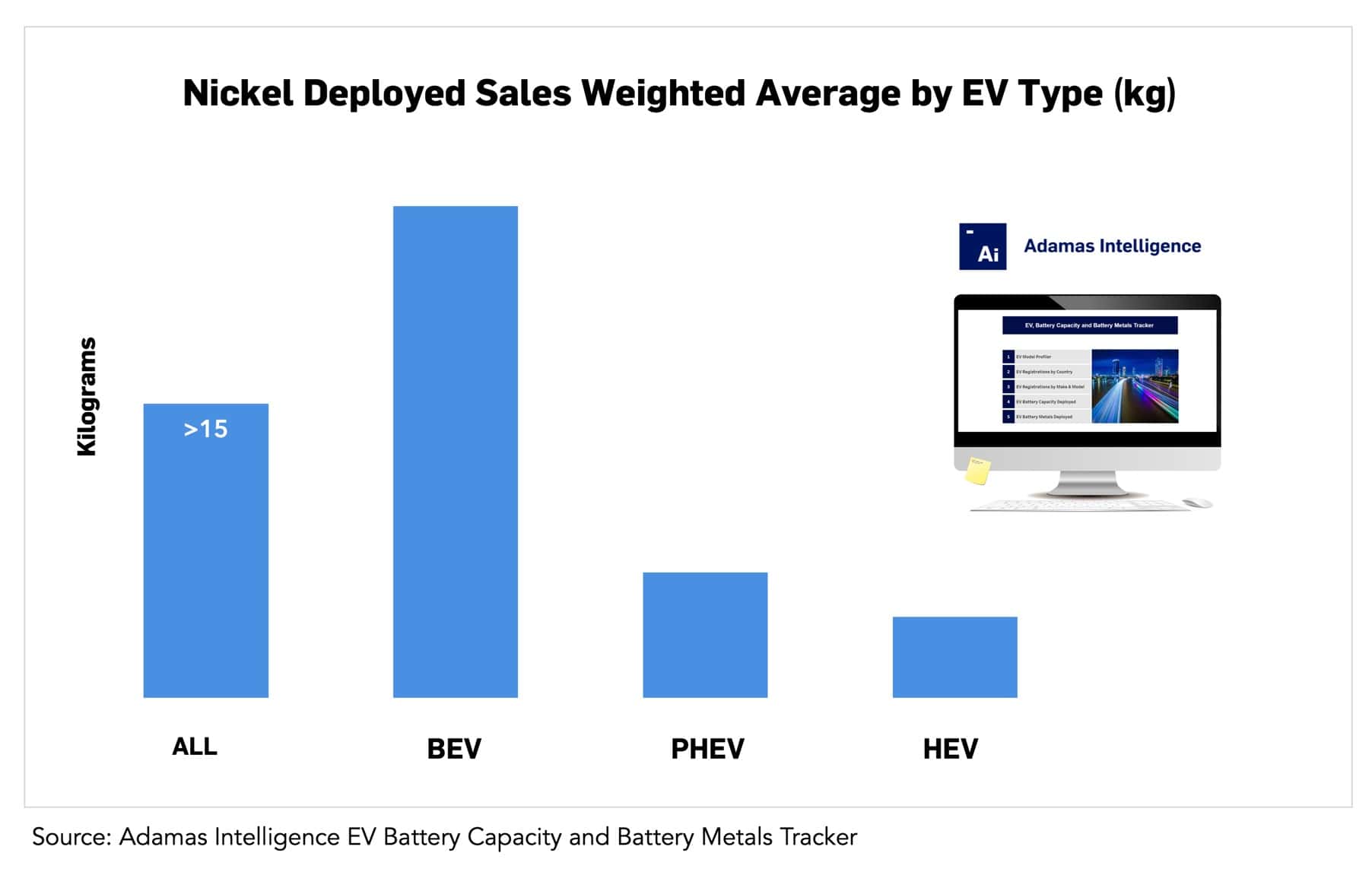

Nickel use is on the rise – and not just in absolute terms, which is to be expected in a booming global EV market, but also on a sales weighted average basis. The Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows average nickel weighting in EV batteries, including plug-in and conventional hybrids, was up 8% in July 2023 versus the same month the year prior, reaching just over 15 kilograms per vehicle sold.

For plug-in hybrids (PHEVs), average nickel use was up 11% year-over-year to 6.5 kilograms per vehicle in reflection of the many automakers releasing PHEVs with beefed up batteries, some sporting a combined ICE-EV range in excess of 1,000 kilometers. Automakers are also upping nickel loads in conventional hybrids (up 6% year-over-year in July).

By nickel tonnes consumed in EV batteries, full electric vehicles (BEVs) currently drive 83% of the global market. In July of this year, the average BEV sold globally contained 25.3 kilograms of nickel in its battery, 8% more than the same month the year prior as carmakers continue to use nickel-rich batteries in new models.

Among nickeliferous cathode options – NCM 8-Series has led the pack globally in 2023, powering 20% of all GWhs deployed onto roads worldwide through the first seven months of the year. NCM 5-Series cells followed closely behind, capturing 19% of the market by GWh deployed. In third place, Tesla-Panasonic’s 3rd Generation NCA cells trailed at a distance with 10% of the market.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview