US car buyers can thank Tesla for making EVs (and luxury cars) affordable

Model Y and Model 3 now much cheaper than average US gas-powered vehicle

The average American paid $47,899 to get behind the wheel of a new car in September.

That’s a full $552 cheaper than August and the lowest in more than a year according to Kelley Blue Book, a California-based vehicle valuation company. Average selling prices peaked at the start of 2023 – just below $50,000.

However, you can now drive away in a brand new base-level Model 3 for just $38,990, a significant discount to the average US sticker price. Model 3 prices are down 24.7% from a year ago according to KBB.

Factor in the US federal tax credit of $7,500 to buy a new EV and even more generous state rebates and cash incentives (Colorado’s adds up to a mouthwatering $13,500) and a new Model 3 begins to look like a steal.

Same goes for the cheapest Model Y which has a recommended retail price in the US of $43,990. Tesla’s aggressive sales tactics have forced EV rivals to compete in this price bracket – the Fisker Ocean starts at $37,499 and the Ford Mustang Mach-E can be had for $42,995.

Cutthroat competition

Tesla’s profit margins are the envy of the automotive industry. At 18% in the June quarter, it’s an order of magnitude fatter than competitors like GM and Ford. Even luxury brands such as Porsche or Mercedes Benz come nowhere near Tesla’s gross margins.

That’s why Tesla has been able to make frequent and deep cuts to prices over the last year, most recently last week.

In September, the average price paid for an EV was $50,683 according to KBB — down from more than $65,000 one year ago, mostly on the back of Tesla’s price cuts.

KBB classifies the Tesla as a luxury vehicle brand and says the Texas-based electric car pioneer was responsible for the biggest fall in average luxury car prices in a decade.

Tesla wears the undisputed EV crown

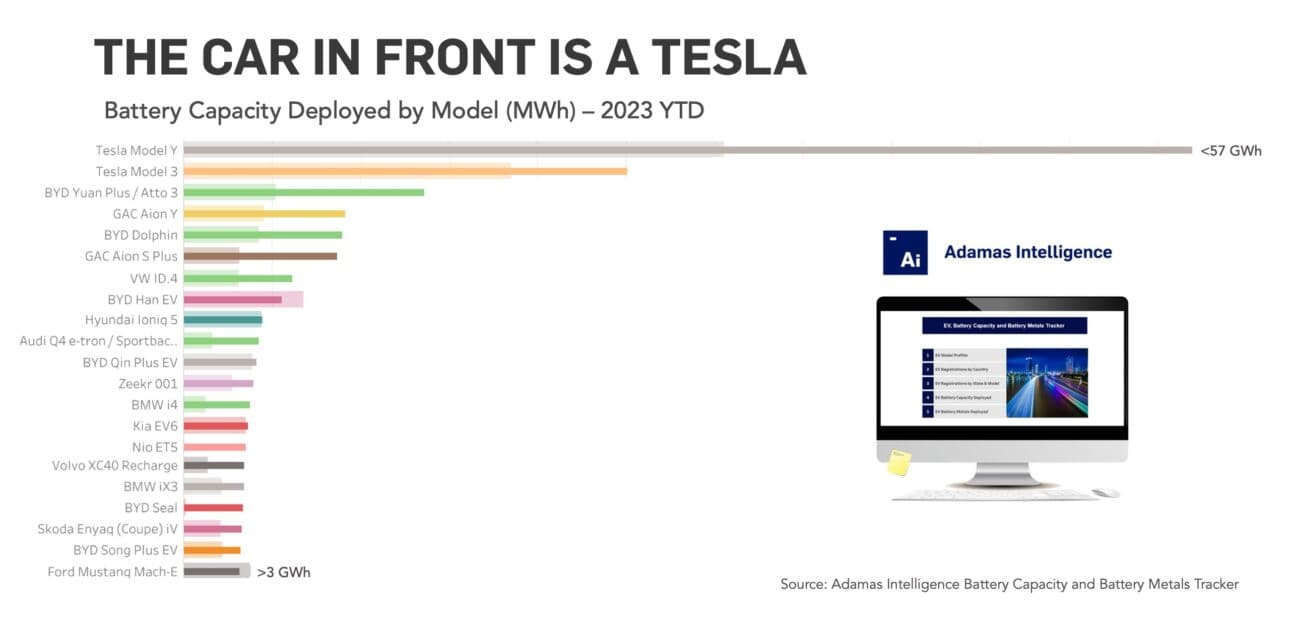

The Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows us that Tesla’s full spectrum dominance of the EV industry is far from over despite the growing army of Musk naysayers.

Through the first eight months of 2023, there were just under 1.2 million new Tesla owners. That’s an almost 350,000 lead on its nearest rival BYD, which is only sniffing around Tesla’s throne as king of the EVs because the Chinese company moves a lot of plug-in hybrids.

Together, the Model Y and Model 3 control just under a fifth of the global market for battery electric vehicles (BEVs) after a 63% and 38% jump in registrations, respectively. In the US, the two Tesla workhorses have an eye-popping 54% market share.

In terms of battery capacity deployed in newly-sold cars, Tesla’s position on the EV market comes up just shy of one out of every four kWhs. According to Adamas Intelligence data, the battery power in Teslas hitting the road year-to-date amounted to 86,197 MWh, while the world’s non-Tesla drivers had to share 273,661 MWh between them.

In terms of battery metals, 165,140 tonnes were inserted into the S,3,X,Y model line-up. The BYDs, GACs, BMWs, VWs, ORAs, SGMWs and MGs of this world had to make do with 712,053 tonnes of lithium, nickel, cobalt, manganese, aluminum and graphite to build their batteries.

Adamas take:

The latest round of price cuts by Tesla may not be the last. There is a well-established pattern on EV markets of a ramp up of sales towards the end of the calendar year which could see the Model Y and Model 3 extend their lead, especially at current price levels. While the new refreshed Model 3 is more expensive than its predecessor, the first significant update to the car since its launch in 2017 will bring new buyers to Tesla.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview