Average amount of manganese in EV batteries is sliding

Manganese weighting in EV batteries declined 7% year-over-year

Manganese is mainly used in alloys for adding hardness, strength and enhancing the corrosion resistance of steel. More than 20 million tonnes of manganese ore are produced globally each year with the bulk originating from South Africa, Gabon and Australia, according to the US Geological Survey.

With these production volumes, the electric car industry is not a major source of demand for manganese like it is for cobalt, lithium and nickel, but there is growing interest from carmakers, including Volkswagen and Tesla, in using manganese-rich batteries for mass market models.

Tesla CEO Elon Musk said as much at the opening ceremony of the Texas-based company’s gigafactory in Berlin last year. Similarly, Volkswagen, the off-and-on biggest carmaker in the world, said in 2021 that it was looking at using high-manganese cathodes for its mid-range EVs when it announced that it’s building six gigafactories in Europe by 2030 with combined capacity to produce 240 gigawatt-hours of cells per annum.

It’s also worth remembering that the first and second generation Nissan Leaf, the world’s best-selling full electric car (BEV) before the arrival of the Tesla Model 3, were equipped with manganese-rich batteries (and were also among the first to use a blend of cathodes in the same cell – in this case combining LMO and LNO).

Manganese malaise

Despite the rosy outlook for manganese use in next generation batteries, including lithium-manganese-iron-phosphate (LMFP), lithium-manganese-nickel-oxide (LMNO) and other nickel-manganese (NMx) based cathodes, prices for manganese sulphate (minimum 22% Mn) entering the EV battery supply chain remain under pressure, with domestic Chinese prices down 26% year-to-date to $700 per tonne, according to Asian Metal.

As is also the case with Chinese nickel sulphate prices, which are down 18% year-to-date. High inventory levels and tepid downstream demand are blamed for nickel’s current weakness.

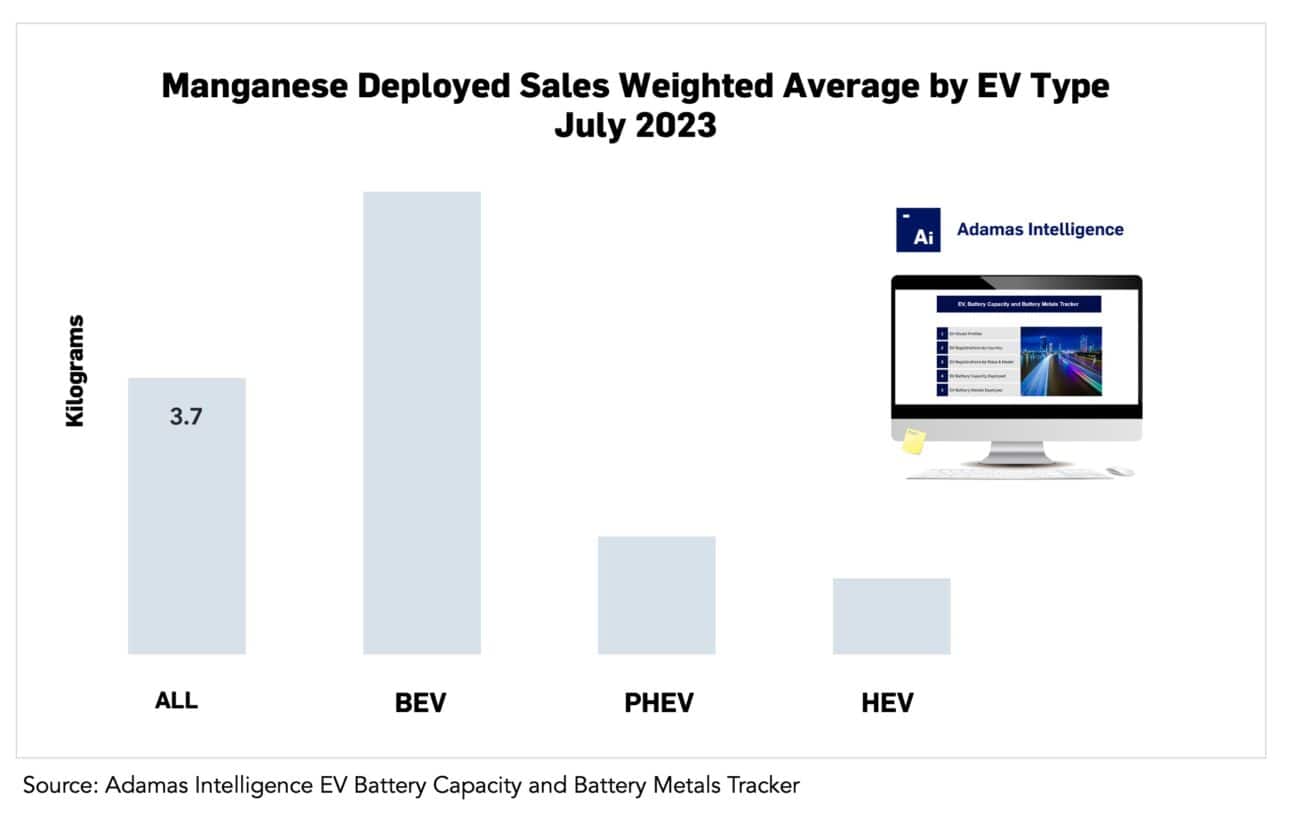

While the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows average nickel weighting in passenger EV batteries, including plug-in and conventional hybrids, was up 8% year-over-year in July 2023, and cobalt use went unchanged, manganese loadings declined 7% over the same period to 3.7 kilograms per EV.

By EV type, the amount of manganese in the average BEV battery dropped 7% year-over-year in July to 6.0 kilograms while that of the average PHEV fell 10% to 2.7 kilograms. This drop in manganese usage comes in the face of a 10% rise in average EV pack capacity over the same period, from 32.4 kWh to 35.6 kWh.

Early NCM cells used nickel-cobalt-manganese in a roughly 1:1:1 ratio, but now this mix only commands 1% of the EV market in terms of GWh deployed globally. The NCM cathode of choice in 2023 has an ~8:1:1 split of these metals and captured nearly 20% of the market (by GWh deployed) through the first seven months of the year, followed by NCM 5-Series, Adamas data shows.

Adamas take

With rising volumes of LMFP expected to hit Chinese roads this year via CATL, and modest prospects for LMNO and NMx looming, we expect that average manganese loadings may rise again in 2024, particularly for BEVs.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview