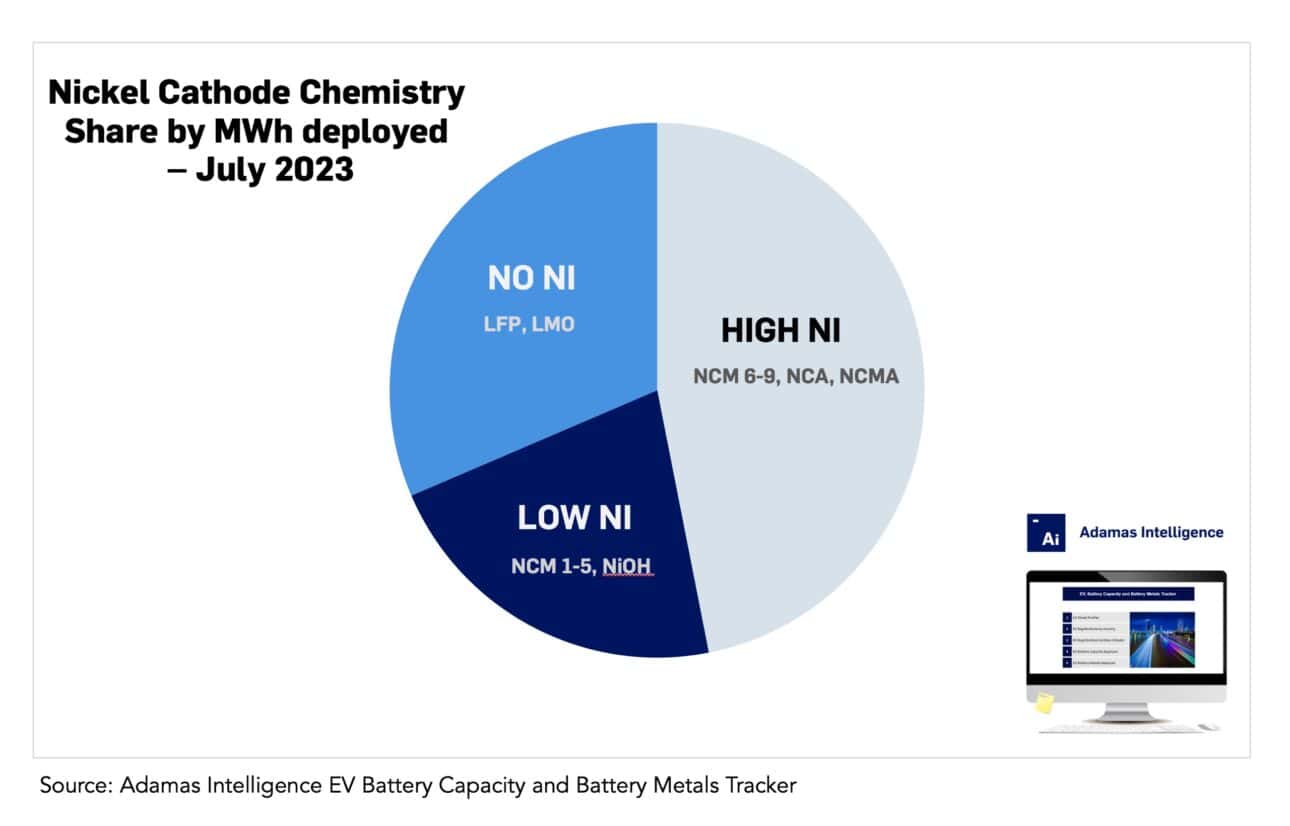

Market share of high-nickel batteries climbed to 47% in July 2023

High on the nickel supply

In July 2023, high-nickel cathode chemistries (including NCM 6-9 series, NCA and NCMA) captured 47% of the passenger EV market by MWh deployed onto roads, up from 45% the same month the year prior data from the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows.

Low-nickel alternatives, including NCM 1-5 series and NiMH batteries, captured a combined 22% of the market in July 2023, pulled down from 25% in July 2022 by rising adoption of both high- and no-nickel incumbents globally.

Moreover, in July 2023, no-nickel cathode chemistries (including LFP and LMO) captured 31% of the passenger EV market by MWh deployed, up from 30% the same month the year prior on the back of strong adoption in China in particular.

While early nickel-cobalt-manganese (NCM) cells used the battery metals in a roughly 1:1:1 ratio, the most widely used NCM cathode in 2023 to-date has an ~8:1:1 split, Adamas data shows.

High-nickel batteries: Not confined to performance and long-range vehicles only, popular with automakers across model versions

Contrary to conventional wisdom, the use of high-nickel cathode chemistries is not confined to performance and long-range vehicles only, it’s increasingly popular with automakers across vehicle segments and geographies.

In July 2023, Adamas data shows the top two drivers of high-nickel cells onto roads globally (via newly sold EVs) were indeed performance and/or long-range models (namely the Tesla Model Y and Model 3) however among the dozens of other users were entry-level and standard range models from all corners of the globe, including the Hyundai Ioniq 5, Kia EV6 and VW ID.4.

Moreover, as the EV landscape continues to expand, the market share of high-nickel cathodes is becoming less and less influenced by industry juggernauts, Tesla and BYD.

Despite Tesla’s rising use of nickel- and cobalt-free LFP (lithium-iron-phosphate) batteries for its Model 3 and Model Y workhorses, and BYD’s use of LFP across its full model line-up, high-nickel cathode chemistries continued to gain market share in July 2023.

Adamas take:

And with the rising market share of high-nickel batteries has come an increase in nickel loading per average EV battery over the same period.

In July 2023, Adamas data shows that the average passenger battery electric vehicle (BEV) sold globally contained 25.3 kilograms of nickel, up 8% year-over-year, while the average PHEV contained 6.5 kilograms, up 11% year-over-year.

Until the LFP talk of Western OEMs turns to LFP walk, we do not expect these trends to see a sharp reversal.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview