What electric car slowdown? Global EV industry is breaking records

Prices as listed

There’s been a steady flow of stories in mainstream and business press over the last couple of months about a reversal in fortunes for the electric car industry in the US and elsewhere.

Decisions by Volkswagen, Ford and others to roll back spending on new battery plants, curb production of some models (notably the F-150 Lightning pickup) and idling workers (as VW did at its largest EV plant in Europe) were taken as signs that major automakers were turning bearish on the longer term prospects of the market.

Rising bankruptcies of EV startups in China – Enovate, Levdeo, Singulato and WM Motor, and that was just in Q4 – did not instill confidence in the market responsible for nearly one out of every two EVs sold worldwide last year. Not that Chinese would miss them – they have 110 other EV brands to kick the tires of.

Outside China declining share prices of electric spinoffs like Volvo’s Polestar and erstwhile highflyers like Vinfast, Lucid, Rivian and Fisker (with the latter is down 90% in value from its 2023 peak) also wreaked havoc on EV portfolios.

Arrival’s bankruptcy this month, before the UK startup sold its first vehicle and after being valued as much as $15 billion, says more about investors chasing shiny new objects than the overall state of the market.

The shelving of Ampere’s IPO was also taken as evidence that the industry as a whole had taken an offramp although Adamas battery capacity data showed that Renault-Dacia EV brands were not even making headway in their home base. Renault’s idea that its EV unit would fetch more than its parent’s $10 billion valuation was always fanciful.

While this year has certainly been tough going, Tesla shares doubled in value in 2023. That did not stop perennial Tesla doomsayers heralding 2023 as the end of an era and not missing an opportunity to rub in that BYD again surpassed the EV pioneer in terms of sales last year (conveniently forgetting that in terms of full electric cars, Tesla remains streets ahead).

Watts really up

Last year was certainly a tumultuous year for EV makers and their investors but looking in the rearview, there’s no question that electrified rubber continues to hit the road.

A slowdown from the breakneck pace of recent years is perfectly expectable given the growing base, both in terms of unit sales and battery capacity contained, of the global EV parc.

Over 19.2 million EVs, including plug-in and conventional hybrids, were registered globally last year, 4.6 million more than in 2022.

Any industry of this size growing at 32% on an annual basis is surely in rude health. From mere single digits only three years earlier, 2023 saw EVs represent 23% of all passenger vehicle sales around the world.

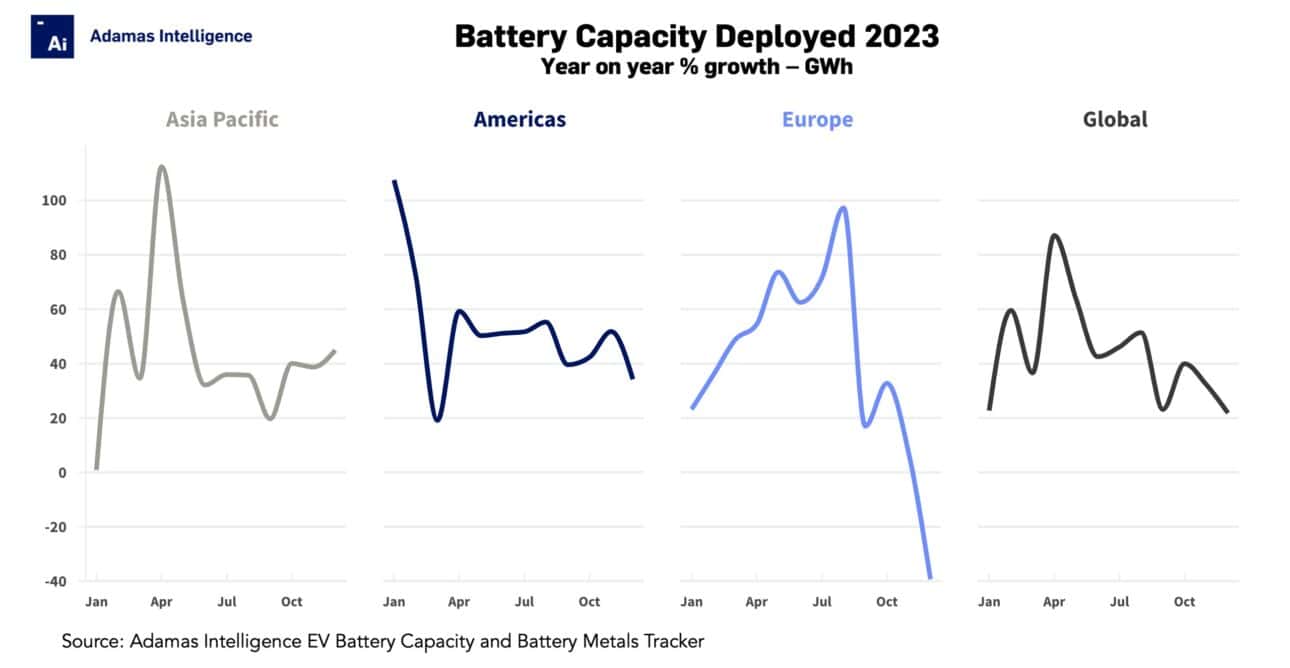

The rollout of battery capacity globally is also happening at a quicker pace than EV unit sales growth alone would suggest.

Adamas data shows December was a record month in terms of total battery capacity (GWh) deployed onto roads globally in newly sold EVs, growing by 12% over the previous record month, which happened to be November.

For the 2023 calendar year, 689.2 GWh was added to the electric car parc, an expansion of just under 200 GWh or 40% compared to 2022.

Some 37% of all power-hours deployed over the past decade were rolled onto roads last year alone. Put another way, more gigawatt-hours were deployed in 2023 than in the eight years from 2014 to 2021 combined.

In fact, the GWhs deployed in December 2023 alone were more than the entire 2018 calendar year.

Autobahn bane

While the global industry remains in good shape, bears can point to Europe and specifically the fourth largest market worldwide – Germany – as proof that car buyers are souring on EVs.

The Asia Pacific region saw combined battery capacity of 48.8 GWh deployed in December, a new record for the region and up 45% over the same month the year before.

In the Americas, 12.6 GWh were deployed onto roads in newly sold passenger EVs in December, a 34% year-over-year gain for a new all-time monthly high. The US and Canada make up more than 96% of the regional market.

In Europe however, growth went into reverse with total battery capacity deployment shrinking by 39% in December 2023 compared to the same month a year earlier.

Historically, December has been the strongest month of the year by a country mile but Europe’s best month of the year came as far back as in March when 16.1 GWh hit roads versus 15.9 GWh in the final month of 2023.

The region’s top market, Germany, cratered in December with passenger EV battery capacity deployment dropping 46% year-over-year in the month, mainly due to the axing of government subsidies a full year early (for reasons that has nothing to do with automaking).

Germany’s poor outcome is also distorted by an exceptional December 2022 when, on the back of buoyant Tesla Model Y and 3 sales, more than 7.3 GWh were added to autobahns.

France leapfrogs

That there is a general EV slump is also belied by how lumpy growth on the continent was at the end of last year.

In France, the third largest EV market in the region in GWh terms, December battery capacity deployment rocketed by 47% smashing all records and surpassing the UK only for the third time ever on a monthly basis.

The widely divergent performance of large markets like France and Germany, two countries with very similar profiles, also give credence to the argument that the EV industry may have fallen prey to larger economic forces at work in the region.

And while December was certainly disappointing for some markets on the continent, on an annual basis, Europe was motoring in 2023.

The region powered ahead 32% year-on-year with 156.2 GWh deployed, compared with 40% growth in Asia Pacific, which saw 405.6 GWh deployed, and 49% growth in the Americas where 117.0 GWh was deployed.

Up for adoption

Across Europe and the UK, December was the 2023 high mark for EV adoption with more than one-third of passenger vehicles leaving showrooms as full electric or hybrid vehicles, showing the appetite to ditch ICE cars was only growing into the new year.

Even in Germany, which accounts for a fifth of the regional market, December was the second best month of the year for EVs relative to gas-powered passenger vehicles.

In many ways Europe is the victim of its own success.

The only market in Europe that contracted on an annual basis in 2023 was Norway, with the country’s EV buyers accumulating 24% less battery power than the year before.

Given that 84% of all vehicles sold in Norway last year were EVs (on par with 2022) it is unsurprising that EV sales should begin to converge with overall growth rates for the automobile sector.

The low countries and the Nordics have been the quickest to electrify autos globally: more than half of cars sold in Finland, Sweden, Denmark and Netherlands in 2023 were EVs, with Belgium reaching a similar level by the end of the year.

And in Iceland, which granted, is a miniscule market, EV penetration rates have run north of 90% since August and hit over 99% of sales in December last year (like it did the year before). Where can you go from there?

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report and data service for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview