Renault unplugs Ampere IPO

Breakeven in 2025

Renault said Monday it will not pursue an initial public offering of its European electric car subsidiary dubbed Ampere.

Ampere’s IPO was expected in the spring of 2024, but the French carmaker said current market conditions are not ideal and would not serve the best interests of the group, its shareholders or the EV unit.

The Boulogne-Billancourt headquartered company said it will continue funding Ampere until it breaks even in 2025.

Last year Renault said Ampere’s target is to sell 300,000 EVs by 2025 and around 1 million by 2031. Plans were to launch seven new models before the start of the next decade, including a small car for €20,000.

Initially, the 124-year old automaker put a market value of between €8 billion to €10 billion on Ampere (Renault itself is currently worth €9.3 billion in Paris), but conditions in the sector have been far from ideal for a long time.

Volvo’s all-electric spin-off Polestar is worth 63% less than this time in 2023, putting a value of $4.7 billion on the stock, while US startup Rivian has lost 20% over the last 12 months, pushing its market worth down to $15.2 billion.

Chinese upmarket all-electric brand Nio’s stock, which were first listed in the US in 2018, is trading down 52% compared to this time last year and is now valued at $10.9 billion.

Zeekr, another luxury Chinese EV company, filed paperwork in New York in December with hopes of raising $1 billion, but the IPO has now been put on hold indefinitely.

Not amping up

In Europe, Renault and Dacia’s combined share of the EV market in sales terms was 8% in 2023, placing the company in second spot, sandwiched between Toyota and Tesla.

The electrified car market in France deployed a total of 18.2 GWh onto roads during the first 11 months of 2023. The country is the fastest growing major market in the region with year-over-year expansion of 56% compared to growth rates of 35% and 36% for Germany and the UK.

Combined, Renault and Dacia, which was acquired in 1999 from the Romanian government, captured 31% of the French EV market through November in terms of the combined battery capacity of the Meganes, Australs, Clios, Springs and Joggers sold during the period.

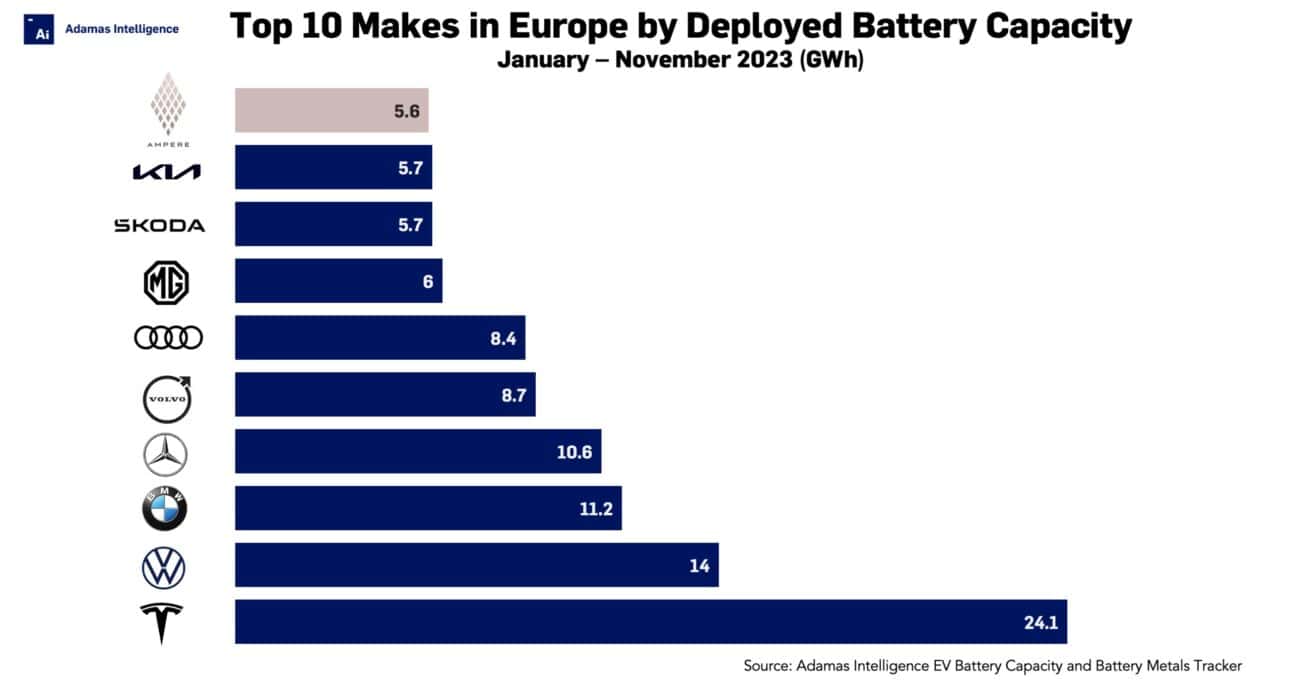

When considering the power-hours new Renault and Dacia owners steered onto European highways and byways – a better indicator of how fast automakers are electrifying their fleets – a would-be Ampere ranks 10th and only commands 4% of the regional GWh market.

Renault and Dacia rely on conventional hybrid vehicles for 61% of overall unit volumes. Plug-in hybrids – the fastest growing segment of the EV market globally – make up only 3% of the brands’ sales mix.

At 21% year-on-year through November 2023, a combined Renault-Dacia is also growing slower than other brands on the continent in terms of GWh hitting roads.

The fastest growing brands in the Europe top 10 are MG, which has placed 111% more power-hours in the hands of the new drivers, Tesla (+85%), Skoda (+60%), Volkswagen (+57%) and BMW (+56%). Only Kia at 15% year-on-year growth, lags Renault and Dacia in Europe.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview